Sftr Regulation : What it is

SFTR Regulation: What It Is and How to Prepare Introduction: The Securities Financing Transactions Regulation (SFTR) is a European Union regulation designed to increase transparency and reduce risks in the securities financing markets. It aims to address potential vulnerabilities in these markets through the reporting of transactions to trade repositories. SFTR became effective in 2016, with phased implementation beginning in 2019. With the increasing complexities in financial markets and the need for greater regulatory oversight, SFTR has become a critical regulation that financial institutions and market participants must comply with. In this article, we will explore what SFTR is, its implications, and how you can prepare for its requirements. Understanding SFTR: SFTR stands for Securities Financing Transactions Regulation. It is a regulatory framework introduced by the European Union to bring transparency to the securities financing market. These markets involve transactions such as securities lending, repurchase agreements (repos), and margin lending. Under SFTR, these transactions are subject to reporting obligations aimed at enhancing market stability and investor protection. 1. The Scope and Reporting Obligations: SFTR applies to a wide range of market participants involved in securities financing transactions. This includes banks, investment firms, asset managers, central counterparties, and non-financial counterparties with significant securities financing activity. The regulation requires these entities to report detailed information about their transactions to trade repositories. The reporting obligations include capturing information such as the economic terms of the transaction, the identification of the securities involved, and the parties to the transaction. It also covers collateral details, reuse of collateral, and any associated risks. The reporting must be done in a standardized format and submitted to an approved trade repository within specific time frames. 2. Implications and Benefits of SFTR: SFTR brings several important implications for market participants. By mandating reporting requirements, it aims to improve transparency in securities financing transactions. This transparency helps regulators, investors, and other stakeholders understand the potential risks and assess the stability of the financial system. The regulation also aims to address concerns related to shadow banking, where certain financial activities take place outside the traditional banking sector. SFTR helps shed light on these activities and ensures that appropriate risk mitigation measures are in place. Additionally, SFTR enhances investor protection by providing more information about the securities loans and other transactions they are exposed to. This allows investors to make better-informed decisions and assess the risks associated with their investments. 3. Preparation and Compliance: Compliance with SFTR requires careful preparation and implementation of necessary measures. Market participants need to establish robust reporting systems, ensure data accuracy, and align their operations with the regulatory requirements. Here are some key steps you can take to ensure compliance: a. Assess Applicability: Determine whether your organization falls within the scope of SFTR. Consider the nature and volume of your securities financing activities to identify any reporting obligations. b. Data Management: Establish data management processes to ensure accurate and timely reporting. This includes capturing relevant transaction details, maintaining data integrity, and validating the information before submission. c. Technology Solutions: Explore technology solutions that can help automate the reporting process and ensure data consistency. Work with vendors and internal IT teams to implement solutions that align with your specific requirements. d. Internal Controls: Implement robust internal controls to monitor and oversee SFTR compliance. This includes establishing policies, procedures, and governance frameworks to ensure accurate reporting and adherence to the regulation. e. Training and Awareness: Educate your staff about SFTR requirements and provide training on reporting obligations. Foster a culture of compliance within your organization to ensure everyone understands the importance of meeting regulatory obligations. FAQ Section: Q1. Who needs to comply with SFTR? A1. SFTR applies to a wide range of market participants involved in securities financing transactions. This includes banks, investment firms, asset managers, central counterparties, and non-financial counterparties with significant securities financing activity. Q2. What are the reporting obligations under SFTR? A2. SFTR requires entities to report detailed information about their securities financing transactions to approved trade repositories. This includes capturing transaction details, identifying the securities involved, providing collateral details, and reporting associated risks. Q3. What are the benefits of SFTR? A3. SFTR brings transparency to securities financing markets, enhances investor protection, and addresses concerns related to shadow banking activities. It provides regulators, investors, and other stakeholders with better insights into potential risks and helps assess the stability of the financial system. Conclusion: SFTR is a vital regulation that promotes transparency and reduces risks in securities financing transactions. Market participants need to understand the implications and ensure compliance with the reporting obligations. By following the necessary steps and implementing robust systems and controls, organizations can meet the requirements of SFTR and contribute to the overall stability of the financial system. Please note that the information presented in this article is for educational purposes only and should not be considered as legal or financial advice. It is important to consult with professionals and regulatory authorities to ensure compliance with SFTR and other applicable regulations.  Image Source : www.lei-worldwide.com

Image Source : www.lei-worldwide.com  Image Source : www.sionic.com

Image Source : www.sionic.com  Image Source : info.cappitech.com

Image Source : info.cappitech.com  Image Source : deltaconx.com

Image Source : deltaconx.com  Image Source : www.slideshare.net

Image Source : www.slideshare.net  Image Source : www.slideshare.net

Image Source : www.slideshare.net  Image Source : theindustryspread.com

Image Source : theindustryspread.com  Image Source : www.dnb.no

Image Source : www.dnb.no

LEIs For SFTR - LEI Worldwide

Image Source : www.lei-worldwide.com

Image Source : www.lei-worldwide.com sftr srd worldwide leis securities transactions financing

How To Prepare For SFTR

Image Source : www.sionic.com

Image Source : www.sionic.com sftr regulation prepare securities financing transaction whitepaper

SFTR FAQ

Image Source : info.cappitech.com

Image Source : info.cappitech.com sftr regulation

SFTR – Challenging Regulation Or Welcome Opportunity? | DeltaconX

Image Source : deltaconx.com

Image Source : deltaconx.com challenging regulation

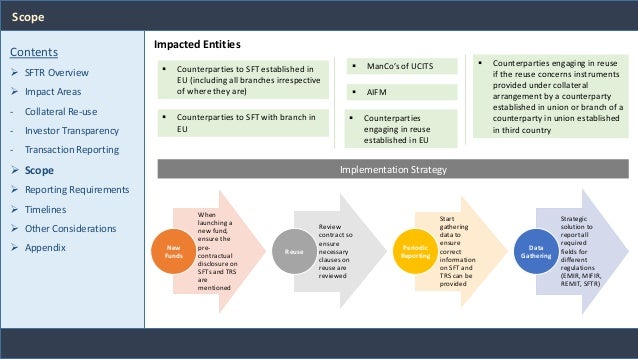

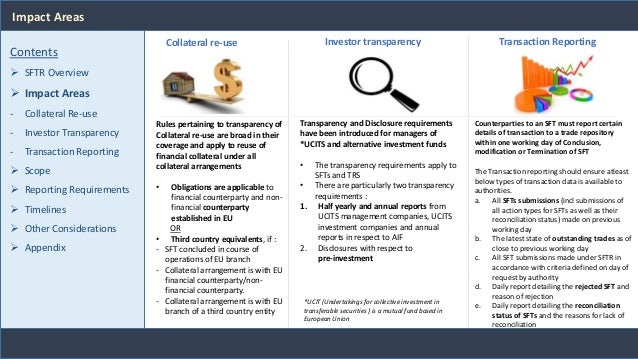

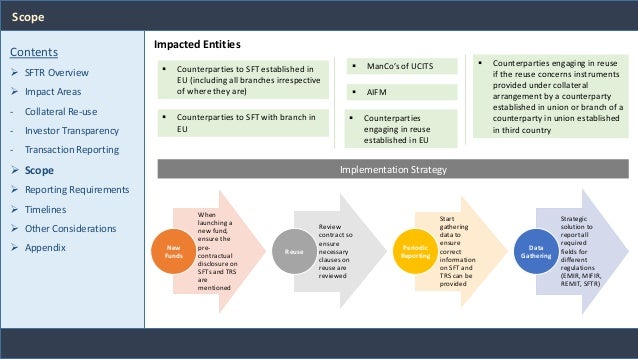

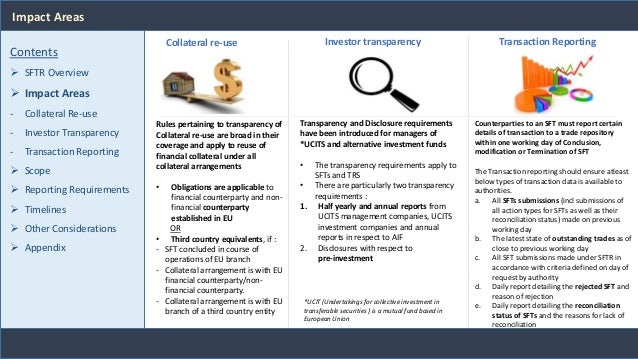

Securities Financing Transactions Regulation

Image Source : www.slideshare.net

Image Source : www.slideshare.net financing securities transactions sftr

Securities Financing Transactions Regulation

Image Source : www.slideshare.net

Image Source : www.slideshare.net regulation transactions securities

Broadridge Launches Service To Address European Securities Financing

Image Source : theindustryspread.com

Image Source : theindustryspread.com sftr regulation european broadridge securities transactions financing collateral management launches address service role

SFTR - Securities Financing Transactin Regulation | Prices, Terms And

Image Source : www.dnb.no

Image Source : www.dnb.no Sftr srd worldwide leis securities transactions financing. Sftr regulation european broadridge securities transactions financing collateral management launches address service role. Sftr regulation. Regulation transactions securities. Leis for sftr