Rule 105 Regulation M : What it is

Rule 105 of Regulation M is an essential regulation designed to prevent manipulative short selling practices in the securities market. This rule specifically addresses short selling activities that occur prior to the pricing of offering securities in specific circumstances. Let's dive deeper into what this regulation entails and why it is important in maintaining fair and transparent markets.

The Basics of Rule 105

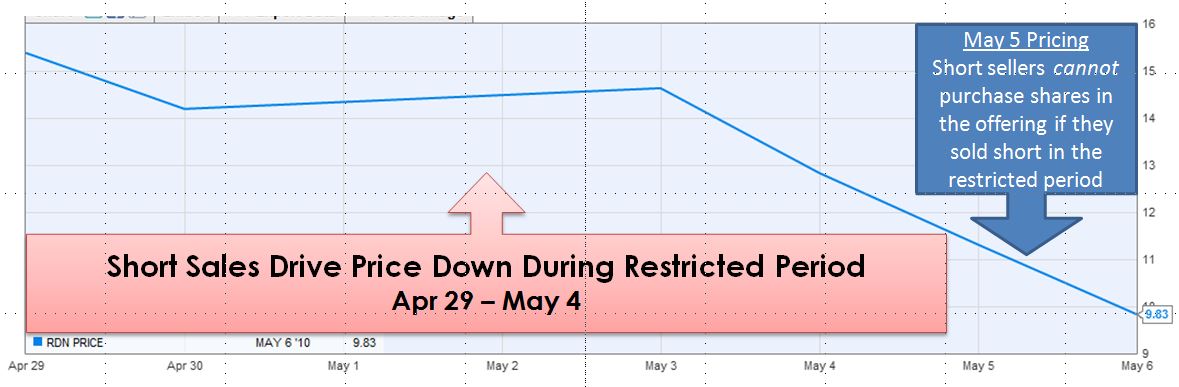

Rule 105 of Regulation M was introduced by the U.S. Securities and Exchange Commission (SEC) to combat potential market manipulation by restricting short selling activities leading up to the pricing of offerings. It aims to prevent short sellers from driving down the stock price and profiting from participating in a subsequent offering transaction at a lower price.

Short selling involves borrowing shares and selling them with the intention of buying them back at a lower price in the future. The process typically involves betting against a stock or security, speculating on a potential price decline. Rule 105 establishes guidelines to prevent short sellers from manipulating the market and profiting unfairly from offerings.

How Rule 105 Works

Under Rule 105, if an investor has shorted a security and has a "covered" position (generally defined as a short position that is equal to or greater than its offering allocation) within a restricted period leading up to an offering, they are prohibited from participating in that offering. This restricted period usually spans the five trading days prior to the pricing of the offering.

The rationale behind Rule 105 is to maintain a level playing field for all investors participating in an offering. By disallowing short sellers from participating in the offering, the SEC aims to prevent artificial price depreciation caused by those looking to profit unfairly by shorting the security prior to the offering.

Nautical Slide Rule 105: Weems & Plath Annapolis Vintage

While Rule 105 of Regulation M is primarily concerned with short-selling activities related to securities offerings, the term "Rule 105" is also associated with a nautical slide rule called the "Weems & Plath Annapolis Vintage." This vintage slide rule, manufactured by Weems & Plath, is a classic piece of navigational equipment used for celestial navigation.

The Nautical Slide Rule 105, also referred to as the "Weems & Plath Rule 105," is a practical tool that aids mariners in solving navigational problems related to time, speed, and distance. It is particularly useful in determining the time of sunrise and sunset, as well as celestial fixes. This vintage slide rule has gained popularity among collectors and maritime enthusiasts due to its historical significance and reliability in navigation.

FAQs about Rule 105 of Regulation M

1. What types of securities offerings does Rule 105 apply to?

Rule 105 of Regulation M applies to any securities offerings conducted under the Securities Act of 1933, including initial public offerings (IPOs) and secondary offerings.

2. Can short sellers participate in the offering after the restricted period?

Yes, short sellers who have violated Rule 105 can participate in the offering after the restricted period. However, they must first cover their short position, ensuring a fair market and preventing manipulation during the offering process.

3. Are there any exceptions to Rule 105?

There are certain exceptions to Rule 105, such as de minimis exemption, passive market making activities, and bona fide merger arbitrage. These exceptions allow for specific activities that do not pose a threat to fair market pricing.

By understanding Rule 105 of Regulation M and its implications, investors can gain better insight into the regulations that govern the securities market. This rule serves as a crucial safeguard against manipulative short selling practices, ensuring fair and transparent markets for everyone involved.

Rule 105 Of Regulation M (Short Selling Prior To Pricing Of Certain

Image Source : knopman.com

Image Source : knopman.com rule securities prior regulation offerings certain pricing selling short notes

Rule 105 Brewing - Visit Greeley

Image Source : www.visitgreeley.org

Image Source : www.visitgreeley.org Rule#105 #shorts #youtubeshorts #rules - YouTube

Image Source : www.youtube.com

Image Source : www.youtube.com One Year Later: SEC Sanctions Under Rule 105 Of Regulation M | Subject

Image Source : www.subjecttoinquiry.com

Image Source : www.subjecttoinquiry.com Rule 105 Brewing - Greeley, CO

Image Source : rule105brewing.com

Image Source : rule105brewing.com Nautical Slide Rule 105 Weems & Plath Annapolis Vintage | Slide Rule

Image Source : www.pinterest.com

Image Source : www.pinterest.com Buy Nautical Slide Rule 105 Weem&plath In La Quinta, California, US

Image Source : www.2040-parts.com

Image Source : www.2040-parts.com L'ORÉAL PARIS Lippenstift Infaillible Rouge Signature I Rule 105, 7 Ml

Image Source : www.dm.de

Image Source : www.dm.de Rule#105 #shorts #youtubeshorts #rules. Rule securities prior regulation offerings certain pricing selling short notes. Rule 105 brewing. Nautical slide rule 105 weems & plath annapolis vintage. Rule 105 brewing