Regulation B Appraisal Rules

Regulation B Appraisal Process

When it comes to applying for a mortgage loan, the Regulation B Appraisal Process plays a crucial role. This set of rules, established by the Consumer Financial Protection Bureau (CFPB), ensures that lenders follow fair and non-discriminatory practices when appraising a property.

Why is the Regulation B Appraisal Process Important?

The Regulation B Appraisal Process is of utmost importance for both the lender and the borrower. It helps maintain transparency and fairness throughout the loan application process. Let's delve deeper into the key aspects of this process.

1. Appraisal Independence

One of the fundamental principles of the Regulation B Appraisal Process is appraisal independence. This means that the lender or any other interested party must not unduly influence the appraiser's assessment of a property's value. By maintaining independence, appraisers can provide an objective evaluation, free from external pressures.

2. Qualitative Evidence in Appraisal

Appendix B of the Regulation B guidelines focuses on the appraisal of qualitative evidence. This section provides valuable insights into how lenders can evaluate and consider subjective factors when determining a property's value. Qualitative evidence takes into account aspects such as market trends, neighborhood characteristics, and overall desirability.

3. Appraisal Review Requirements

An integral part of the Regulation B Appraisal Process is the appraisal review. Lenders must have appropriate procedures in place to review and assess the accuracy and reliability of the appraisals they receive. This ensures that the appraisal report meets the necessary standards and provides an accurate representation of the property's value.

Frequently Asked Questions (FAQs)

Here are some common questions borrowers often have regarding the Regulation B Appraisal Process:

Q: Why is the Regulation B Appraisal Process necessary?

A: The Regulation B Appraisal Process ensures that lenders do not discriminate against borrowers during the appraisal process and that appraisals are accurate representations of a property's value.

Q: Can I choose my own appraiser?

A: While most lenders have their own network of approved appraisers, you have the right to request a specific appraiser. However, the appraiser must still meet certain qualifications and independence criteria.

Q: How long does the appraisal process usually take?

A: The duration of the appraisal process can vary depending on various factors, such as the complexity of the property and the availability of the appraiser. On average, it typically takes around a week to complete.

Q: Are there any fees associated with the appraisal process?

A: Yes, the borrower is usually responsible for covering the cost of the appraisal. The exact amount can vary depending on the property's location and other factors. It is important to discuss the fees with your lender beforehand.

Conclusion

The Regulation B Appraisal Process plays a vital role in ensuring fair and unbiased evaluations of properties during the mortgage loan application process. By adhering to these guidelines, lenders can provide borrowers with a transparent and equitable experience. If you have any further questions or concerns about the appraisal process, don't hesitate to reach out to your lender for clarification.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as legal or financial advice.

Regulation B Appraisal Process

Image Source : mortgageanalyzed.com

Image Source : mortgageanalyzed.com Appendix B Property Regimes

Image Source : www.slideshare.net

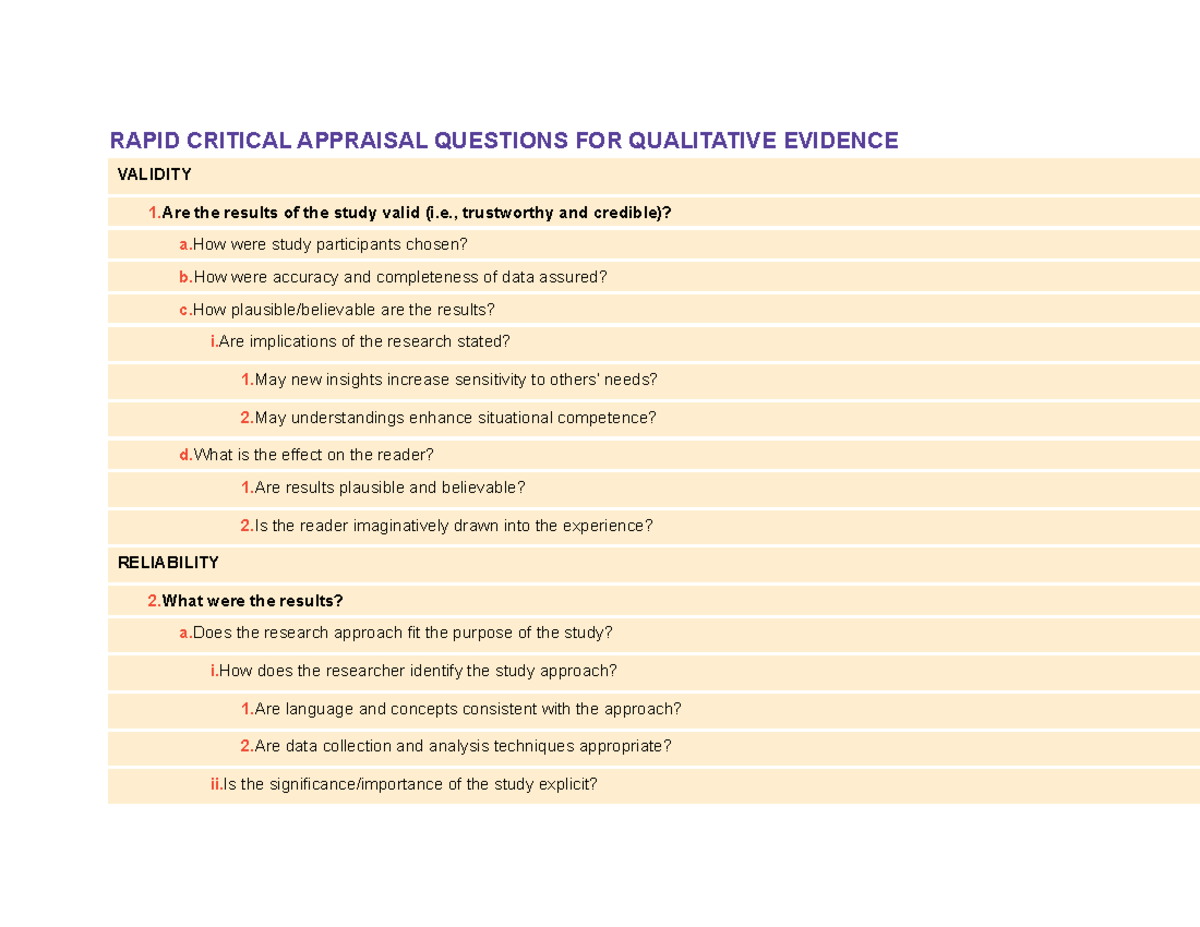

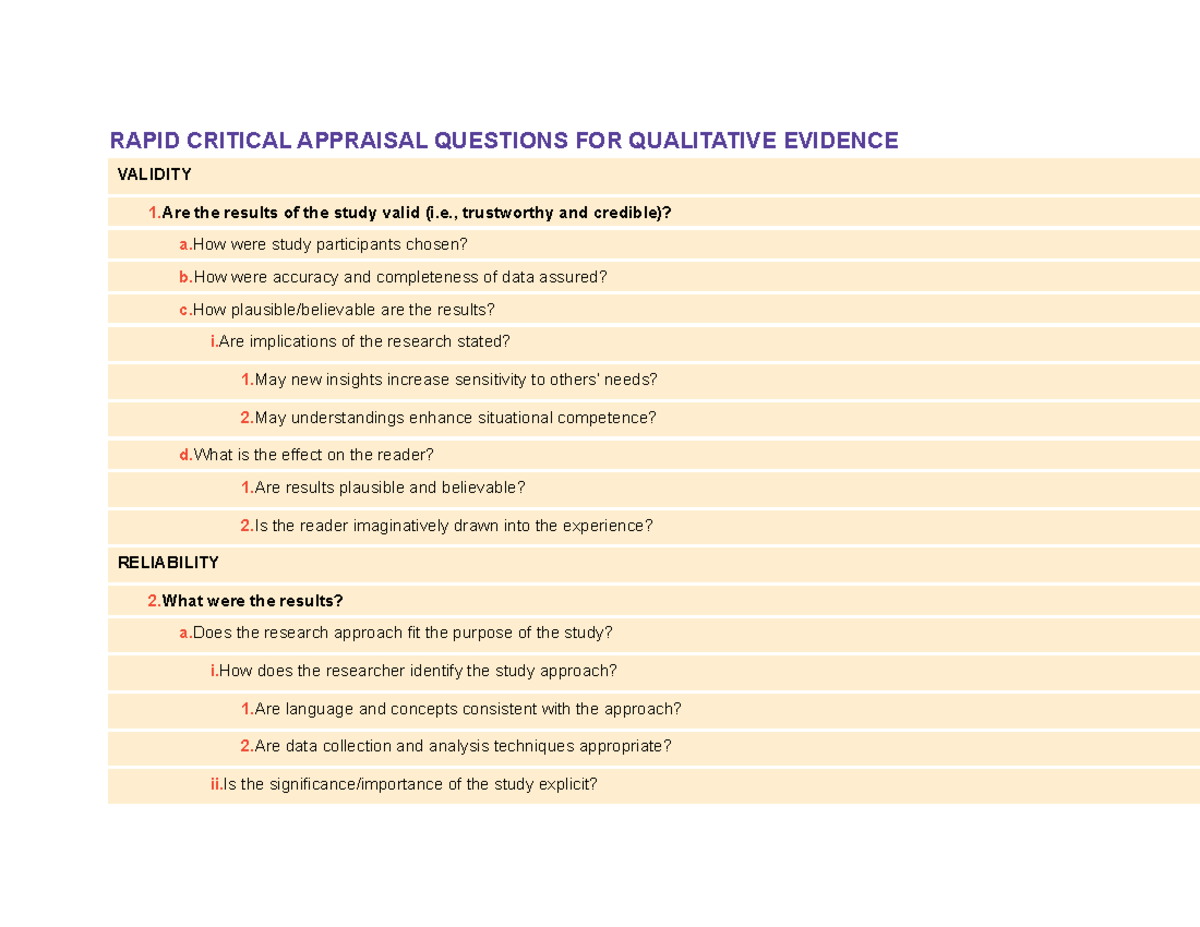

Image Source : www.slideshare.net Appendix B Appraisal Of Qualitative Evidence - RAPID CRITICAL APPRAISAL

Image Source : www.studocu.com

Image Source : www.studocu.com Top Violation: Regulation B Appraisal Notice Online Bankers Training

Image Source : blog.bankerscompliance.com

Image Source : blog.bankerscompliance.com Regulation B: Appraisal Rules Online Course | Vubiz

Image Source : vubiz.com

Image Source : vubiz.com appraisal specific

Online Bankers Training - Regulation B Appraisal Notice For Denials?

Image Source : blog.bankerscompliance.com

Image Source : blog.bankerscompliance.com FHA Appraisal Rules: Heating And Air Conditioning Systems

Image Source : www.fha.com

Image Source : www.fha.com Regulation B: Providing A Copy Of An Appraisal

Image Source : blog.bankerscompliance.com

Image Source : blog.bankerscompliance.com Fha appraisal rules: heating and air conditioning systems. Appraisal specific. Regulation b: providing a copy of an appraisal. Appendix b property regimes. Appendix b appraisal of qualitative evidence