Credit Card Regulation : What it is

Credit Card Regulation: An Essential Guide for Consumers Introduction Credit cards have become an integral part of our daily lives, enabling us to effortlessly make purchases and manage our finances. However, with the incredible convenience comes the need for regulation to protect consumers from fraudulent practices and ensure fair treatment by financial institutions. In this article, we'll explore the credit card regulation, its impact on consumers, and what you need to know to navigate this ever-evolving landscape. 1. Why is Credit Card Regulation Important? Credit card regulation serves as a safeguard against unfair practices, ensuring transparency, and promoting healthy competition among financial institutions. It is designed to protect consumers from predatory lending practices, hidden fees, and unauthorized charges. Without these regulations, consumers would be at higher risk of falling into debt traps and experiencing financial hardship. 2. Understanding the Credit Card Regulation Landscape The credit card industry is regulated by various authorities, both at national and international levels. In the United States, the main governing body overseeing credit card regulations is the Consumer Financial Protection Bureau (CFPB). Additionally, international bodies such as the European Union (EU) and its Multi-interchange Fee (MIF) Regulation have a significant impact on credit card regulations globally. 2.1 The Consumer Financial Protection Bureau (CFPB) The CFPB is an independent agency of the United States government responsible for consumer protection in the financial sector. Their mission is to ensure fair treatment of consumers and promote transparency in financial transactions. The CFPB has introduced several regulations to protect credit cardholders, including: - Limiting penalty fees: The CFPB has imposed restrictions on excessive penalty fees that credit card issuers can charge. This ensures that consumers are not burdened with exorbitant charges for late payments or exceeding credit limits. - Simplified terms and conditions: To make credit card agreements more accessible and understandable for consumers, the CFPB has enforced regulations that require credit card issuers to present terms and conditions in a clear and concise manner. This helps consumers make informed decisions and avoid hidden charges. 2.2 The European Union Multi-interchange Fee (MIF) Regulation The MIF Regulation is a legislative measure implemented by the EU to regulate fees charged by banks and other financial institutions for credit card transactions. The regulation aims to promote fair competition, transparency, and lower costs for consumers. Key provisions of the MIF Regulation include: - Capping interchange fees: Interchange fees charged to merchants for accepting credit card payments are limited to a certain percentage of the transaction value. This prevents cardholders from indirectly covering excessive fees through higher product prices. - Encouraging new payment solutions: The MIF Regulation also promotes the development of innovative payment solutions, ensuring a level playing field for new players in the market and fostering competition. 3. How Credit Card Regulation Benefits Consumers Credit card regulation brings several benefits for consumers, enhancing their rights and minimizing risks associated with credit card usage. Here are some of the key advantages: 3.1 Protection against fraudulent practices By setting clear guidelines and imposing penalties for fraudulent practices, credit card regulation provides a safety net for consumers. It ensures that they are not held liable for unauthorized charges made on their credit cards and establishes procedures for reporting and resolving such issues. 3.2 Transparent fee structures Credit card regulation requires financial institutions to present a clear breakdown of fees and charges associated with credit card usage. This transparency enables consumers to make informed decisions, avoid hidden costs, and budget their finances more effectively. 3.3 Fair treatment and dispute resolution In cases of disputes or disagreements with credit card issuers, credit card regulation offers mechanisms for fair resolution. Consumers can file complaints, and financial institutions are obliged to address them promptly, ensuring a fair outcome for both parties. 4. Frequently Asked Questions (FAQ) Q1: Are all credit card regulations the same worldwide? A1: No, credit card regulations vary across countries. Each jurisdiction has its own set of rules and legislation governing credit card practices. Q2: Can credit card issuers change the terms and conditions without notice? A2: In most cases, credit card issuers are required to provide notice before making any significant changes to terms and conditions. However, it is essential to carefully review the agreements to understand the specific terms regarding modifications. Q3: How can I file a complaint against a credit card issuer? A3: If you have a grievance against a credit card issuer, you can start by contacting their customer service department. If the issue remains unresolved, you can escalate the complaint to the regulatory authority overseeing credit card regulation in your country. Conclusion Credit card regulation plays a vital role in protecting consumers and ensuring fair practices within the industry. By promoting transparency, preventing fraudulent practices, and encouraging healthy competition, these regulations empower consumers to use credit cards confidently. As a responsible credit card user, it's crucial to stay informed about the regulations governing your credit card usage to make the most of this financial tool while safeguarding your interests.  Image Source : sample.gelorailmu.com

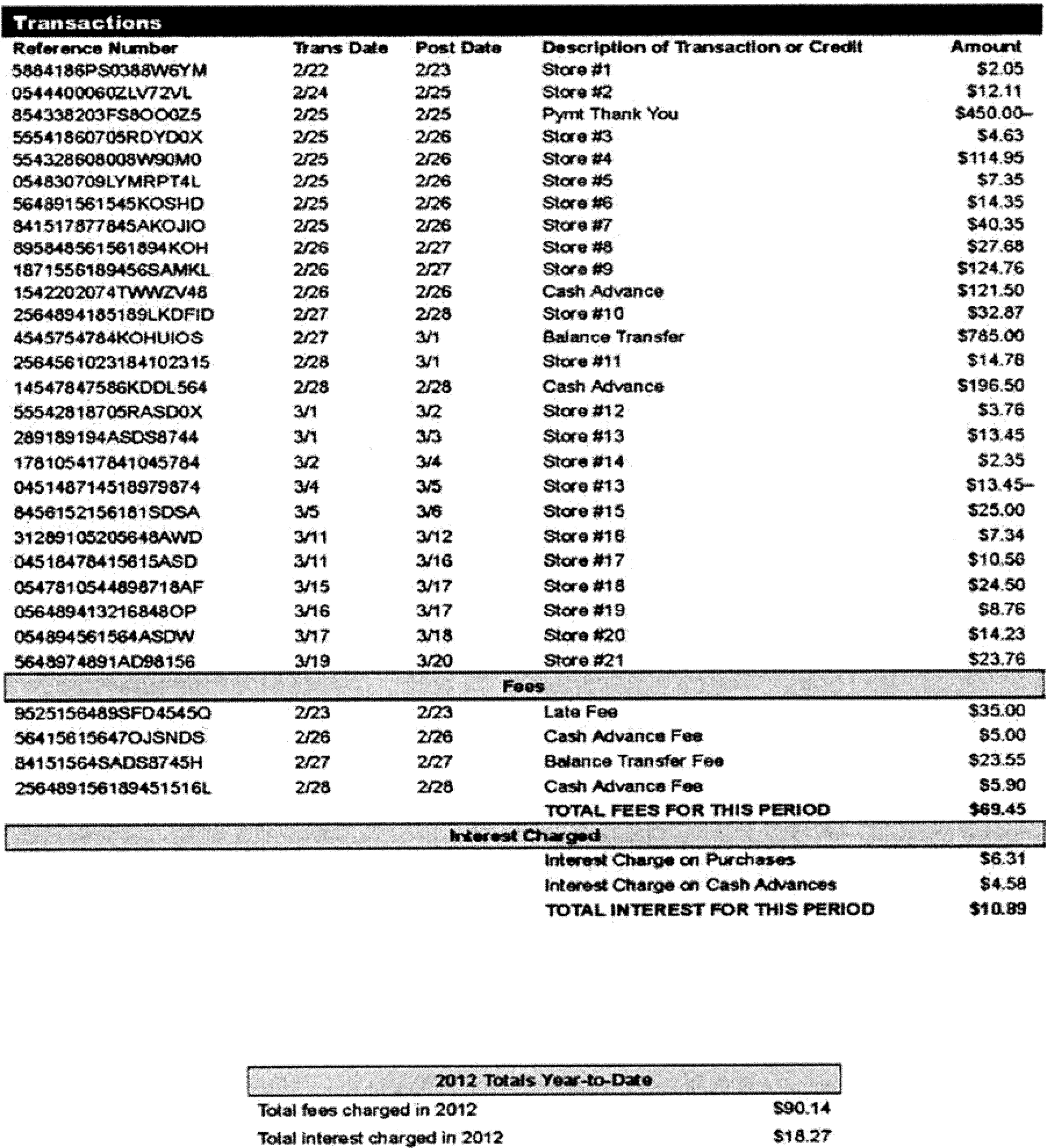

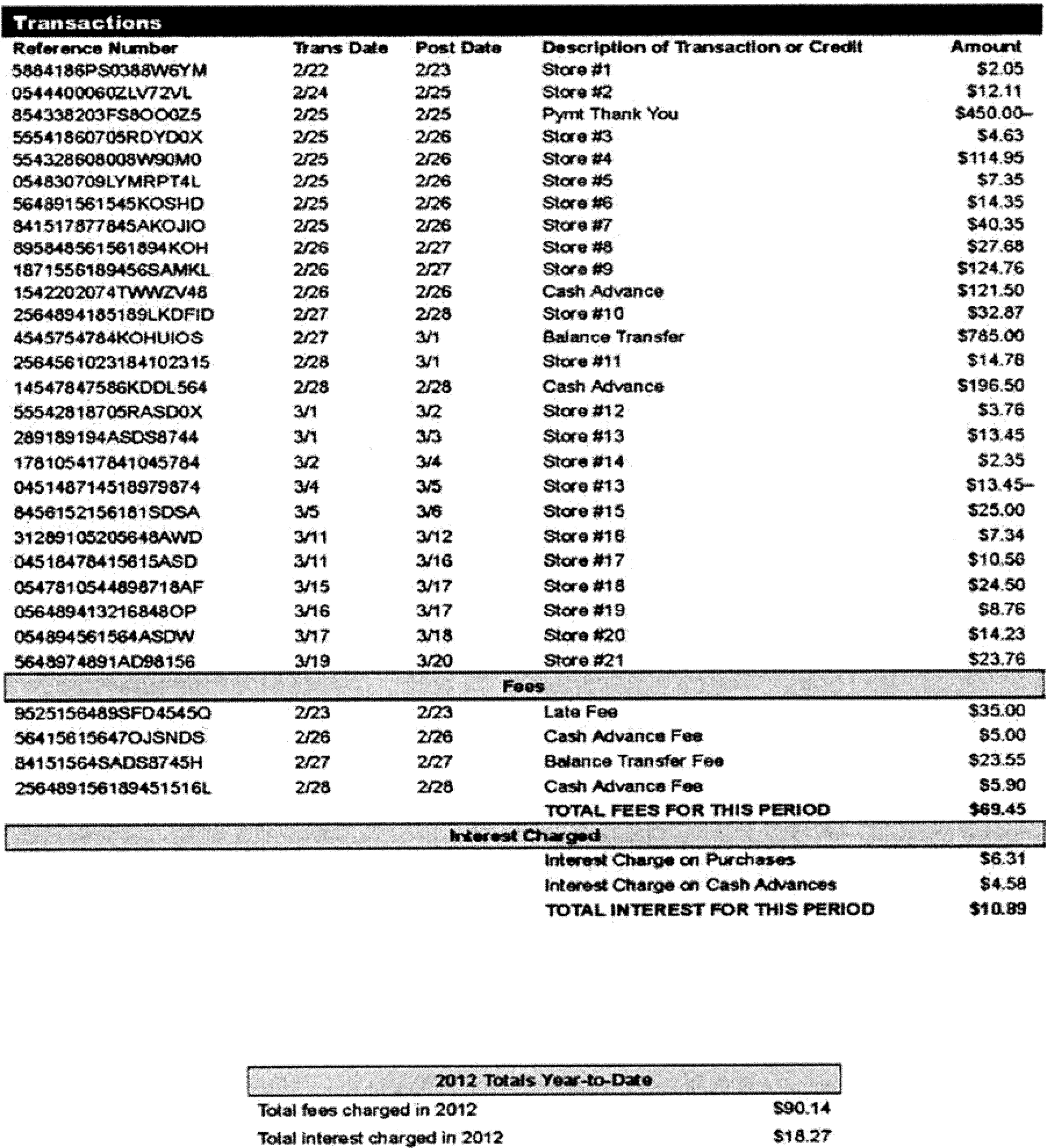

Image Source : sample.gelorailmu.com  Image Source : www.academia.edu

Image Source : www.academia.edu  Image Source : net63.blogspot.com

Image Source : net63.blogspot.com  Image Source : www.academia.edu

Image Source : www.academia.edu  Image Source : alabamaretail.org

Image Source : alabamaretail.org  Image Source : www.readkong.com

Image Source : www.readkong.com  Image Source : www.researchgate.net

Image Source : www.researchgate.net  Image Source : emoneyadvice.com

Image Source : emoneyadvice.com

12 Cfr Part 1026 – Truth In Lending (Regulation Z In Credit Card

Image Source : sample.gelorailmu.com

Image Source : sample.gelorailmu.com regulation 1026 lending cfr

(PDF) The Effectiveness Of Credit-card Regulation For Vulnerable

Image Source : www.academia.edu

Image Source : www.academia.edu Bank Indonesia Issues New Credit Card Regulation, How...? - Googling News

Image Source : net63.blogspot.com

Image Source : net63.blogspot.com (PDF) A Theoretical Analysis Of Credit Card Regulation | Joshua Gans

Image Source : www.academia.edu

Image Source : www.academia.edu Credit/Debit Card Liability Rules | Alabama Retail Association

Image Source : alabamaretail.org

Image Source : alabamaretail.org liability card rules fraud credit debit cards chart shift terminals visa emv chip mastercard accept merchants avoid payment need oct

Proposed Credit Card Regulation ANZ Banking Group Ltd Response To

Image Source : www.readkong.com

Image Source : www.readkong.com (PDF) Evaluating The Efficacy Of Credit Card Regulation

Image Source : www.researchgate.net

Image Source : www.researchgate.net EU Multi-interchange Fee (MIF) Regulation - EmoneyAdvice

regulation mif interchange fee ifr card multi payment

12 cfr part 1026 – truth in lending (regulation z in credit card. Eu multi-interchange fee (mif) regulation. Regulation mif interchange fee ifr card multi payment. Credit/debit card liability rules. Liability card rules fraud credit debit cards chart shift terminals visa emv chip mastercard accept merchants avoid payment need oct