Legislation And Regulation

Legislation And Regulation in the Financial Services Industry: A Comprehensive Guide

1. Maltese Financial Services: Regulation, Standards, and Direction

In the ever-evolving landscape of the financial services industry, legislation and regulation play a pivotal role in ensuring stability, protecting investors, and fostering economic growth. One jurisdiction that has gained international recognition for its robust regulatory framework is Malta. With its strategic location, attractive tax incentives, and well-established financial services infrastructure, Malta has emerged as a preferred destination for businesses seeking regulatory clarity and investor confidence.

The Maltese financial services sector operates under the supervision of the Malta Financial Services Authority (MFSA), which is responsible for regulating and supervising various financial activities, including banking, insurance, investment services, and trust management. The comprehensive set of laws and regulations enforced by the MFSA ensures that entities operating within the Maltese financial services industry adhere to stringent standards of conduct, safeguarding the interests of all stakeholders involved.

2. The Impact of Legislation and Regulation on Property/Casualty Insurance

Property/casualty insurance is a critical component of the financial services industry, providing protection against various risks faced by businesses and individuals. The effectiveness of this insurance sector relies heavily on robust legislative and regulatory frameworks that ensure the solvency of insurers, protect policyholders, and maintain market stability.

The impact of legislation and regulation on property/casualty insurance is multifaceted. Through the establishment of minimum capital requirements, regulators ensure that insurance companies maintain sufficient financial resources to honor policyholders' claims. Additionally, regulations govern the underwriting process, ensuring fair pricing and preventing discriminatory practices. The regulatory authorities also monitor the claims settlement process to guarantee that policyholders receive prompt and fair compensation for covered losses.

Furthermore, legislation plays a crucial role in shaping the liabilities and responsibilities of insurers in cases of catastrophic events or natural disasters. By defining insurers' obligations and ensuring the availability of coverage, legislation enables the insurance industry to play a fundamental role in post-disaster recovery efforts.

3. The Future of Legislation and Regulation in the Financial Services Industry

As the financial services industry continues to evolve, legislation and regulation must adapt to address emerging challenges and risks. Several key trends are expected to shape the future of regulatory frameworks and their impact on the industry:

a) Technological Advancements: The proliferation of technology has revolutionized financial services, giving rise to innovative products and service delivery models. However, this disruption has also presented regulators with the challenge of supervising complex and rapidly evolving technologies like blockchain, robo-advisors, and cryptocurrency. The future regulatory landscape will likely focus on striking a balance between facilitating innovation while ensuring adequate consumer protection and market integrity.

b) Enhanced Cross-Border Cooperation: With the increasing globalization of financial markets, regulators are recognizing the need for enhanced cross-border cooperation to effectively address regulatory arbitrage and systemic risks. Collaborative efforts among regulatory authorities from different jurisdictions will enable the harmonization of standards and facilitate the sharing of information, ultimately fostering a more resilient and globally integrated financial system.

c) Sustainability and Climate Change: Heightened awareness surrounding climate change and its potential impact on financial stability has prompted regulators to incorporate sustainability factors within their remit. The integration of Environmental, Social, and Governance (ESG) considerations into the regulatory framework will encourage financial institutions to adopt sustainable practices, promoting a more resilient and environmentally conscious financial services industry.

FAQs - Frequently Asked Questions

Q1. How does regulation protect investors in the financial services industry?

A1. Regulation in the financial services industry aims to protect investors by ensuring transparent and fair practices, such as accurate disclosure of financial information, preventing fraudulent activities, and maintaining adequate levels of capital and liquidity within financial institutions.

Q2. What are the key challenges faced by regulators in overseeing technological advancements?

A2. The rapid pace of technological advancements poses challenges for regulators in keeping up with evolving business models and potential risks associated with new technologies. Regulators need to strike a balance between fostering innovation and safeguarding consumer protection and market integrity.

Q3. How will sustainable practices shape the future of regulation in the financial services industry?

A3. Growing concerns about climate change and the environment are driving regulators to incorporate sustainability factors into the regulatory framework. This will encourage financial institutions to adopt sustainable practices and contribute to a more resilient and environmentally conscious financial services industry.

In conclusion, legislation and regulation form the backbone of the financial services industry, ensuring stability, protecting investors, and fostering trust. Jurisdictions like Malta have established comprehensive regulatory frameworks, attracting businesses with their commitment to maintaining high standards and investor confidence. As the industry continues to evolve, regulators face the challenge of effectively overseeing technological advancements, fostering cross-border cooperation, and incorporating sustainability considerations. By addressing these challenges proactively, regulatory authorities can ensure a robust and resilient financial services industry that meets the needs of a rapidly changing world.

Drug Legislation And Regulation As Part Of The Health

Image Source : studylib.net

Image Source : studylib.net WHS Legislation & Regulation Pyramid Australia - Safe Design Australia

Image Source : www.safedesignaustralia.com.au

Image Source : www.safedesignaustralia.com.au Sustainability Update – Legislation & Regulation – KSN Horizon

Image Source : ksnhorizon.com

Image Source : ksnhorizon.com PPT - Maltese Financial Services: Regulation, Standards, Direction

Image Source : www.slideserve.com

Image Source : www.slideserve.com regulation maltese standards legislation framework

Legislation And Regulation Updates

PERSPECTIVES: Affects Of Legislation, Regulation On Property/casualty

Petition · Immediate Legislation & Regulation Of RFIDs Existing In

Image Source : www.change.org

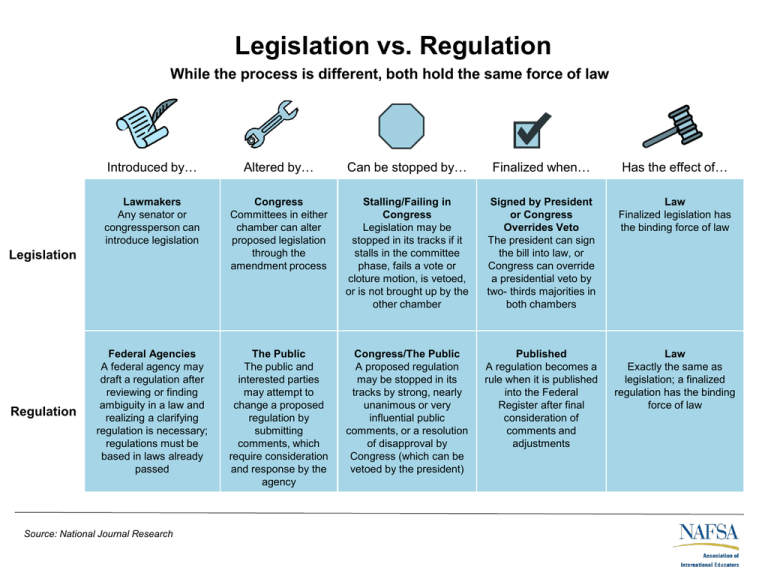

Image Source : www.change.org Legislation Vs. Regulation

Image Source : studylib.net

Image Source : studylib.net legislation

Legislation vs. regulation. Regulation maltese standards legislation framework. Perspectives: affects of legislation, regulation on property/casualty. Legislation and regulation updates. Petition · immediate legislation & regulation of rfids existing in