Glba Regulation P : What it is

Gramm-Leach-Bliley Act (GLBA) Compliance: What It Is

The Gramm-Leach-Bliley Act (GLBA), also known as the Financial Modernization Act of 1999, is a United States federal law that aims to protect the privacy and security of consumers' personal financial information. It requires financial institutions to inform individuals about the collection, sharing, and protection of their personal data. In this post, we will explore the key aspects of GLBA regulation and how it affects businesses and consumers.

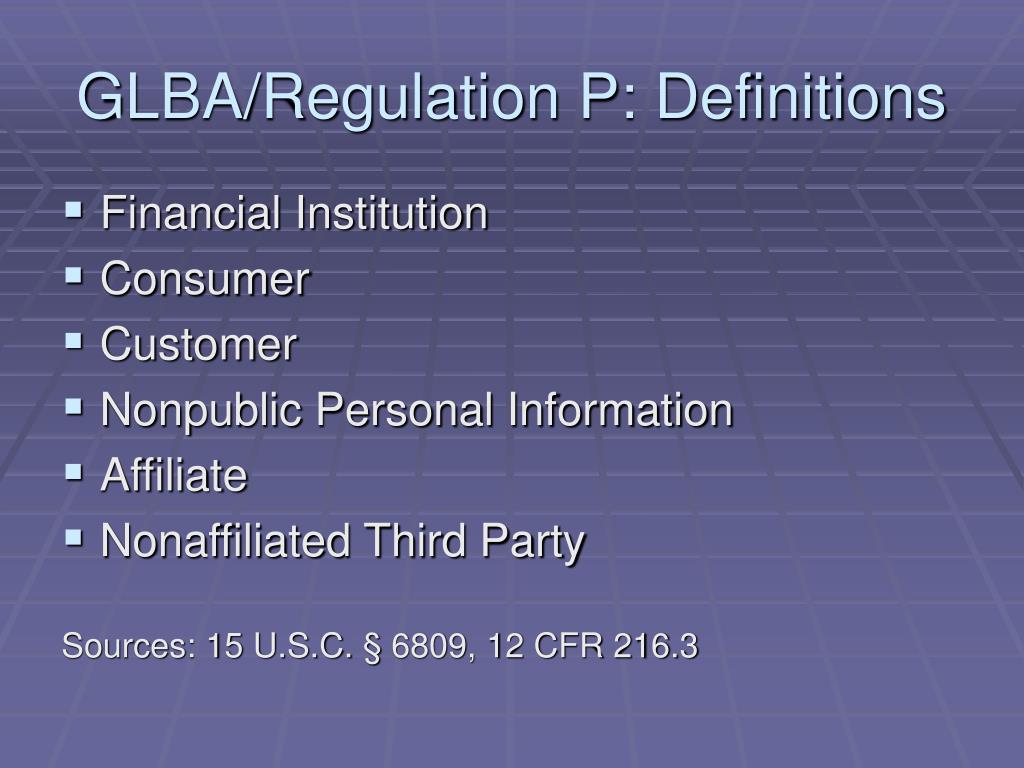

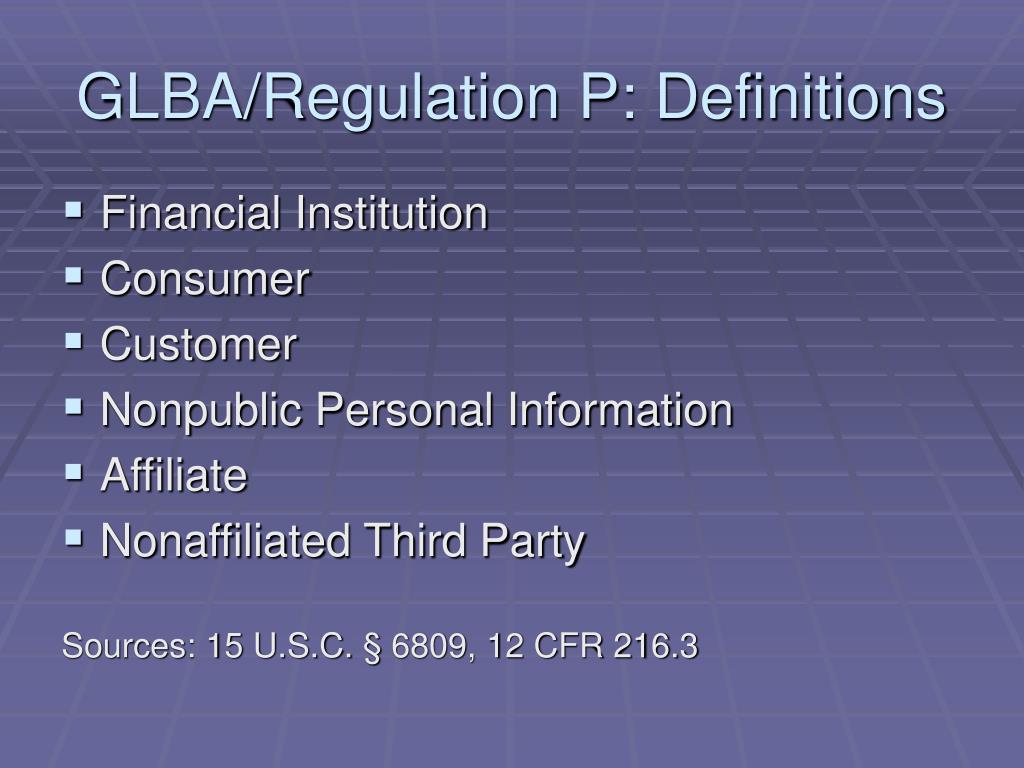

1. Understanding GLBA Regulation

Under GLBA, financial institutions are required to develop and implement comprehensive data privacy and security programs. These programs must include policies and procedures to safeguard the personal information of their customers against unauthorized access, use, or disclosure.

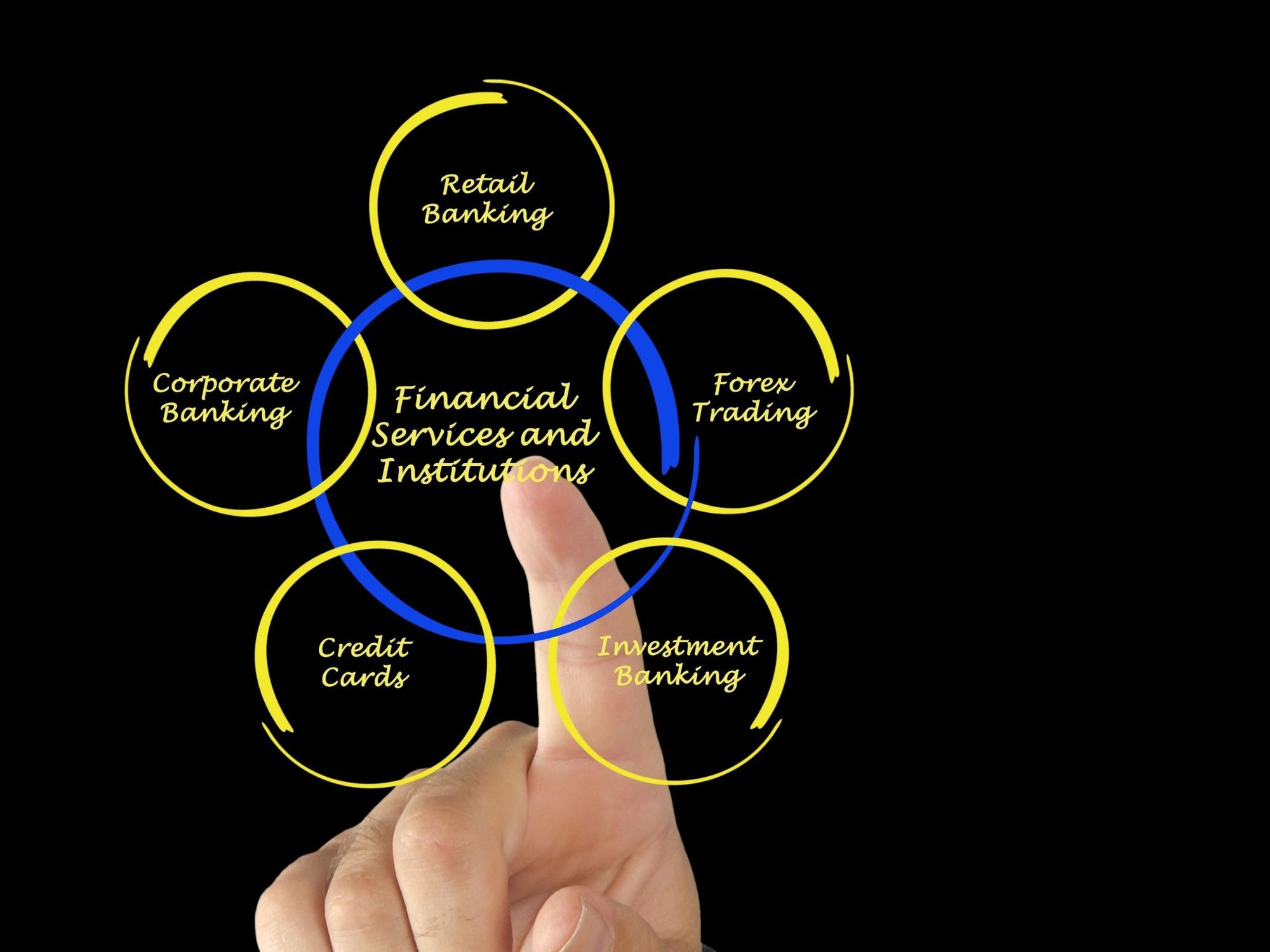

Financial institutions covered by GLBA include banks, credit unions, insurance companies, securities firms, and any other entity that provides financial products or services directly to consumers. The regulation applies to both online and offline data, recognizing the importance of protecting personal information in all channels.

2. GLBA Compliance Challenges

GLBA compliance can be a daunting task for financial institutions due to the complex nature of data privacy and security requirements. Some of the key challenges faced during GLBA compliance implementation include:

- Lack of understanding of privacy and security risks

- Inadequate technical expertise and resources

- Ensuring consistent implementation across multiple locations and departments

- Regularly updating policies and procedures to keep up with changing technologies and practices

- Ensuring compliance with other applicable regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the Payment Card Industry Data Security Standard (PCI DSS)

3. Steps Towards GLBA Compliance

Financial institutions can take several steps to achieve and maintain GLBA compliance:

- Perform a comprehensive risk assessment: Identify and assess potential risks to the security and privacy of customer information.

- Develop and implement data security policies: Establish policies and procedures to protect sensitive data from unauthorized access, use, or disclosure.

- Regularly train employees: Educate employees on data privacy and security best practices to ensure they understand their responsibilities and how to handle customer information.

- Monitor and audit processes: Regularly review and evaluate data protection measures to identify any vulnerabilities or gaps in compliance.

- Assess and update security measures: Stay up to date with emerging technologies and evolving threats to continuously improve data security.

Frequently Asked Questions (FAQ)

Below are some commonly asked questions about GLBA and its compliance:

- Q: What is considered "personal information" under GLBA?

- A: Personal information includes non-public information that can be used to identify an individual, such as their name, address, social security number, account numbers, and financial transactions.

- Q: Are small businesses exempt from GLBA compliance?

- A: Small businesses that are not considered financial institutions themselves may still be subject to GLBA compliance if they provide services to financial institutions or handle their customers' personal information.

- Q: What are the penalties for non-compliance with GLBA?

- A: Non-compliance with GLBA can result in severe penalties, including civil fines, criminal penalties, and reputational damage to the institution.

- Q: Is GLBA compliance a one-time requirement?

- A: No, GLBA compliance is an ongoing requirement. Financial institutions are expected to regularly review and update their data privacy and security programs to address emerging risks and challenges.

In conclusion, GLBA regulation plays a crucial role in safeguarding the privacy and security of consumers' financial information. Financial institutions must comply with GLBA requirements to protect their customers' sensitive data from unauthorized access or misuse. By understanding the regulation, addressing compliance challenges, and implementing robust data security measures, businesses can operate confidently knowing they are protecting their customers' information and maintaining regulatory compliance.

Gramm-Leach-Bliley Act (GLBA) Compliance | Egnyte

Image Source : www.egnyte.com

Image Source : www.egnyte.com How The GLBA Impacts Banks & What You Should Know About The CFPB

Image Source : compliancesavvy.com

Image Source : compliancesavvy.com 377[P]13 - GLBA 0,2/0,4 Ford Tarsnit/Frank-Cars - OSP Racięcice

![377[P]13 - GLBA 0,2/0,4 Ford Tarsnit/Frank-Cars - OSP Racięcice](https://nasygnale.com.pl/data/media/576/dsc_0028.jpg) Image Source : nasygnale.com.pl

Image Source : nasygnale.com.pl Regulation P: GLBA And Non-affiliated Third Party Disclosure

Image Source : baldinilang.com

Image Source : baldinilang.com The Key Principles Of GLBA

Image Source : helpy.io

Image Source : helpy.io glba regulation

GLBA & Regulation P : Webinar | KirkpatrickPrice.com

Image Source : kirkpatrickprice.com

Image Source : kirkpatrickprice.com PPT - Sharing Information With Affiliates And Third Parties PowerPoint

Image Source : www.slideserve.com

Image Source : www.slideserve.com Gramm-Leach-Bliley Act (GLBA) Compliance | Thales

Image Source : cpl.thalesgroup.com

Image Source : cpl.thalesgroup.com glba bliley leach gramm

Glba bliley leach gramm. Gramm-leach-bliley act (glba) compliance. Regulation p: glba and non-affiliated third party disclosure. How the glba impacts banks & what you should know about the cfpb. Glba regulation