Regulation D Rule 506 C : What it is

Regulation D Rule 506(c) is an important provision in the Securities Act of 1933 that allows companies to raise capital through the sale of securities to accredited investors. It has opened up new avenues for businesses to obtain funding from high-net-worth individuals and institutions, without the need for extensive disclosures and regulatory requirements. In this post, we will explore the key aspects of Regulation D Rule 506(c) and its impact on the fundraising landscape. Let's dive in!

1. What is Regulation D Rule 506(c)?

Regulation D Rule 506(c) is an exemption provided by the Securities and Exchange Commission (SEC) that allows companies to offer and sell securities to accredited investors through a private placement offering. Unlike the previous Rule 506(b), which restricted the public solicitation and advertising of securities, Rule 506(c) allows issuers to publicly promote their securities offerings, provided that all investors are verified as accredited.

Image Source: PPM Fast

2. Key Advantages of Rule 506(c)

Rule 506(c) offers several advantages to companies looking to raise capital:

- Access to a larger pool of potential investors: By allowing public solicitation, Rule 506(c) enables issuers to reach a wider audience of accredited investors who may not be directly connected to their network. This increases the chances of attracting more capital for their business.

- Efficient fundraising process: The streamlined fundraising process under Rule 506(c) reduces the administrative burden and time involved in securing investments. Companies can focus on promoting their offering and evaluating potential investors, rather than navigating complex disclosure requirements.

- Flexibility in marketing strategies: Rule 506(c) allows issuers to use various marketing channels and strategies to reach potential investors, including social media, online platforms, and traditional advertising mediums. This flexibility enables companies to tailor their marketing approach based on their target audience.

3. Key Requirements for Rule 506(c) Offerings

While Rule 506(c) offers more flexibility compared to its predecessor, issuers must adhere to certain requirements to qualify for this exemption:

- Verification of accredited investors: Issuers must take reasonable steps to verify that all investors in a Rule 506(c) offering are accredited individuals or entities. This involves obtaining specific information and documentation from investors to prove their accreditation status.

- File Form D with the SEC: Issuers must file a Form D with the SEC within 15 days of the first sale of securities in the offering. This form provides relevant information about the offering and the issuer to ensure regulatory compliance.

- No false or misleading statements: Issuers must exercise caution in their promotional activities and ensure that all statements made in connection with the offering are accurate and not misleading. This includes providing adequate disclosures about the risks and terms of the investment.

Image Source: MW Law

FAQs About Regulation D Rule 506(c)

Q1: Can issuers advertise their securities offering to the general public under Rule 506(c)?

A1: Yes, Rule 506(c) allows issuers to publicly promote their securities offering to the general public, as long as all investors are verified as accredited individuals or entities.

Q2: How does the verification process work for Rule 506(c) offerings?

A2: The verification process involves obtaining specific information and documentation from investors, such as tax returns, bank statements, or certifications from a qualified third party, to prove their accredited status.

Q3: Are there any restrictions on the types of securities that can be offered under Rule 506(c)?

A3: No, Rule 506(c) allows the offering of any type of securities, including equity, debt, convertible notes, or other investment instruments, as long as all applicable regulations are followed.

Q4: Are there any limitations on the number of investors or the amount of capital that can be raised under Rule 506(c)?

A4: There are no specific limitations on the number of accredited investors or the amount of capital that can be raised under Rule 506(c). However, issuers must comply with all other regulatory requirements and anti-fraud provisions.

Q5: Can an issuer switch from Rule 506(b) to Rule 506(c) during an ongoing offering?

A5: No, once an issuer has commenced a securities offering under Rule 506(b), they cannot switch to Rule 506(c) for the same offering. However, they can subsequently initiate a new offering under Rule 506(c) if desired.

With the flexibility and advantages it offers, Regulation D Rule 506(c) has become a popular choice for companies seeking capital. By simplifying the fundraising process and expanding the reach of issuers, this exemption has paved the way for innovative projects and business ventures that may have otherwise struggled to secure funding. However, it is crucial for issuers to carefully navigate the requirements and obligations associated with Rule 506(c) to ensure compliance and build investor trust.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as legal or financial advice. It is always advisable to consult with a qualified professional before making any investment or legal decisions.

Reg. D Rule 506(b-c) Quick Comparison Chart — MW Law

Rule 506(b) Vs. Rule 506(c) For New Fund Launches

Image Source : richeymay.com

Image Source : richeymay.com Regulation D, Rule 506(c) Private Placements - Carofin - An Alternative

Image Source : carofin.com

Image Source : carofin.com Regulation D, Rule 506(b) Verification | Verify Investor, LLC

Regulation D Offerings | AccreditedInvestors.net

Image Source : www.accreditedinvestors.net

Image Source : www.accreditedinvestors.net bridge structure

Regulation D Rule 506(c) Vs. Regulation A+: Differences Explained

PPM Template For LP Equity Offering – Rule 506(c) - Private Placement

Image Source : ppmfast.com

Image Source : ppmfast.com ppm equity estate real template lp offering debt llc corp fund 506 rule templates convertible corporation investment comb private 506b

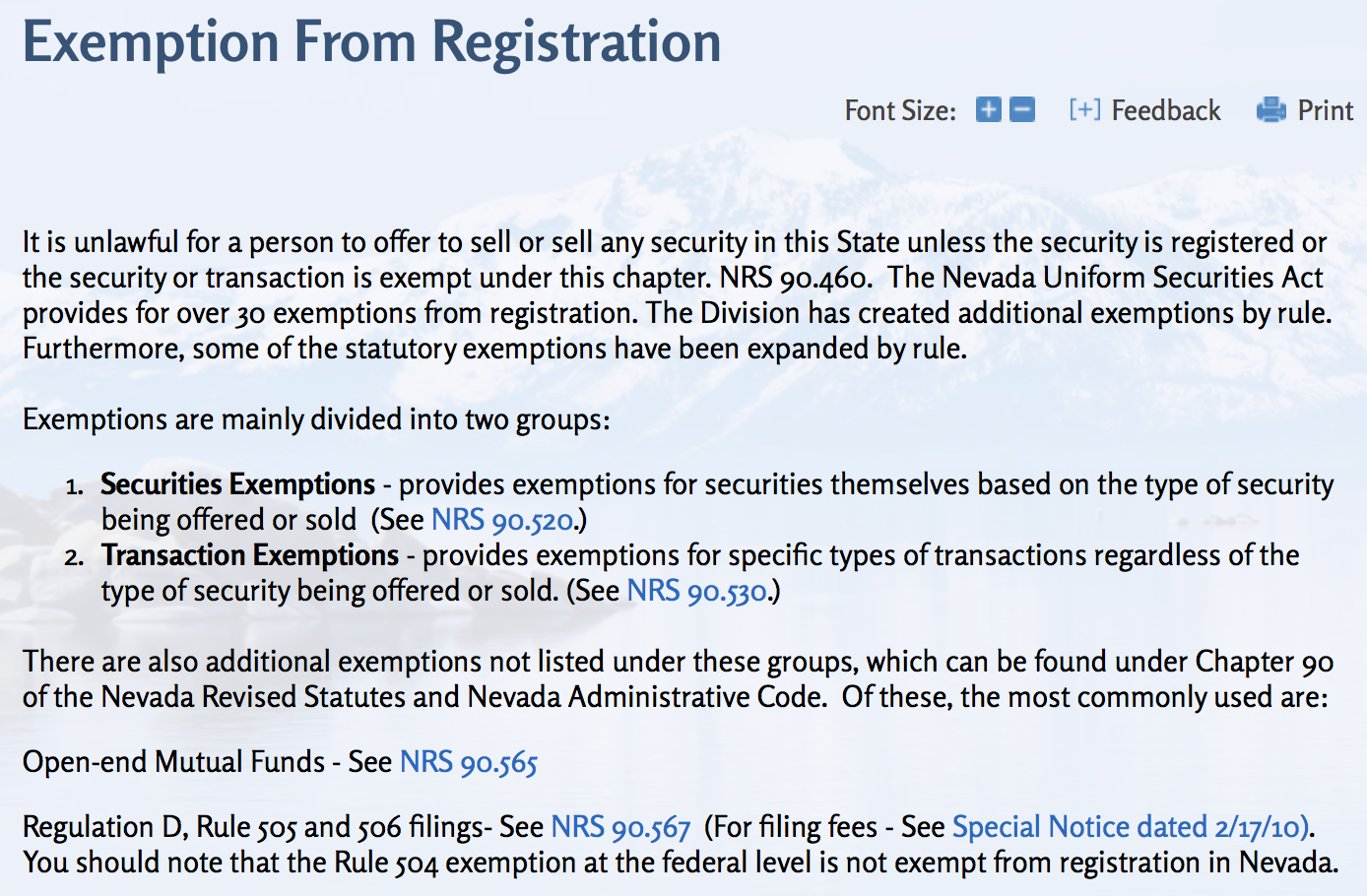

SEC Regulation D, Rule 506(c) + Nevada State Exemption Filing For

Image Source : medium.com

Image Source : medium.com regulation nevada rule exemption security state sec filing token registration exemptions honored noting rules only

Regulation nevada rule exemption security state sec filing token registration exemptions honored noting rules only. Ppm equity estate real template lp offering debt llc corp fund 506 rule templates convertible corporation investment comb private 506b. Ppm template for lp equity offering – rule 506(c). Bridge structure. Regulation d, rule 506(b) verification