What Is The Most Important Reason For Insurance Regulation

Insurance regulation is essential in ensuring that the insurance industry operates in a fair and transparent manner, while also protecting the interests of policyholders and maintaining stability in the financial market. There are multiple reasons why insurance regulation is crucial, but one reason stands out as the most important. Let's explore this significant reason and its impact on the insurance industry and consumers.

Reason 1: Consumer Protection and Confidence

One of the most important reasons for insurance regulation is to protect consumers and enhance their confidence in the insurance market. Insurance plays a vital role in providing financial protection to individuals, families, and businesses in times of need. Whether it's auto insurance, health insurance, or life insurance, people rely on insurance policies to safeguard their assets and loved ones.

Insurance regulation ensures that insurance companies follow ethical practices and operate in a manner that prioritizes the interests of policyholders. It sets standards for how insurance policies are marketed, sold, and serviced. Regulatory bodies enforce rules that prevent unfair practices, such as misleading advertising, hidden fees, or unjust claim denials.

Furthermore, insurance regulation requires insurance companies to maintain sufficient financial reserves to meet their obligations to policyholders. This ensures that they have the capacity to pay claims, even during challenging economic conditions. For consumers, this provides peace of mind, knowing that their insurer has the financial stability to fulfill its promises.

Reason 2: Maintaining Stability in the Financial Market

The stability of the overall financial market is closely tied to the insurance industry. Insurance regulators play a crucial role in mitigating risks and preventing the occurrence of systemic failures that could have far-reaching consequences.

Insurance companies invest the premiums they collect from policyholders to generate income and build reserves. These investments play a vital role in the economy. Insurance regulators monitor and regulate the investment activities of insurance companies to ensure they stay within acceptable risk limits. This safeguards the solvency and stability of the insurance industry and prevents excessive risk-taking that could destabilize the financial system.

In addition, insurance regulation requires insurance companies to maintain sufficient capital and reserves to absorb unexpected losses. This safeguards the industry from insolvency and minimizes the risks of policyholders not receiving the benefits they are entitled to.

Reason 3: Promoting Fair Competition and Innovation

Insurance regulation fosters fair competition among insurance companies, benefiting consumers through greater choice and improved services. Regulators enforce antitrust laws to prevent anti-competitive practices, such as price fixing or monopolistic behavior.

Furthermore, insurance regulation also encourages innovation within the insurance industry. Regulators work closely with insurance companies to develop new products and services that meet evolving consumer needs. They create an environment that encourages insurers to explore innovative ways of underwriting risks and adapting to changing market dynamics.

Frequently Asked Questions

Q: How does insurance regulation differ between countries?

A: Insurance regulation can vary significantly between countries. Each jurisdiction may have its own regulatory framework and requirements. Some countries have a more centralized regulatory approach, with a single regulatory authority overseeing the entire insurance industry. Others may have a more decentralized structure, with multiple regulatory bodies responsible for different aspects of insurance regulation.

Q: What are the penalties for insurance companies that violate regulations?

A: Penalties for insurance companies that violate regulations can vary depending on the severity of the violation and jurisdiction. Common penalties include fines, license revocation, and legal action. Repeat or egregious offenders may face more severe consequences, such as criminal charges and substantial financial penalties.

Q: How can consumers ensure they are dealing with a regulated insurance company?

A: Consumers can verify the regulatory status of an insurance company by checking with the relevant regulatory authority in their country or region. Most regulatory bodies maintain public databases or websites where consumers can search for licensed insurers. It's always recommended to deal with reputable insurance companies that are authorized and regulated by the appropriate authorities.

In conclusion, insurance regulation is of utmost importance for consumer protection, maintaining stability in the financial market, and promoting fair competition and innovation. By implementing and enforcing regulations, governments and regulatory bodies strive to create an insurance industry that is trustworthy, reliable, and responsive to the needs of policyholders. Whether it's safeguarding consumers' interests or mitigating systemic risks, insurance regulation plays a vital role in shaping the insurance landscape for the benefit of all stakeholders.

The Most Valuable And The Second-most Valuable Asset For Firms

Image Source : www.researchgate.net

Image Source : www.researchgate.net Florida Office Of Insurance Regulation Highlights 2021 Leadership

Image Source : capitalsoup.com

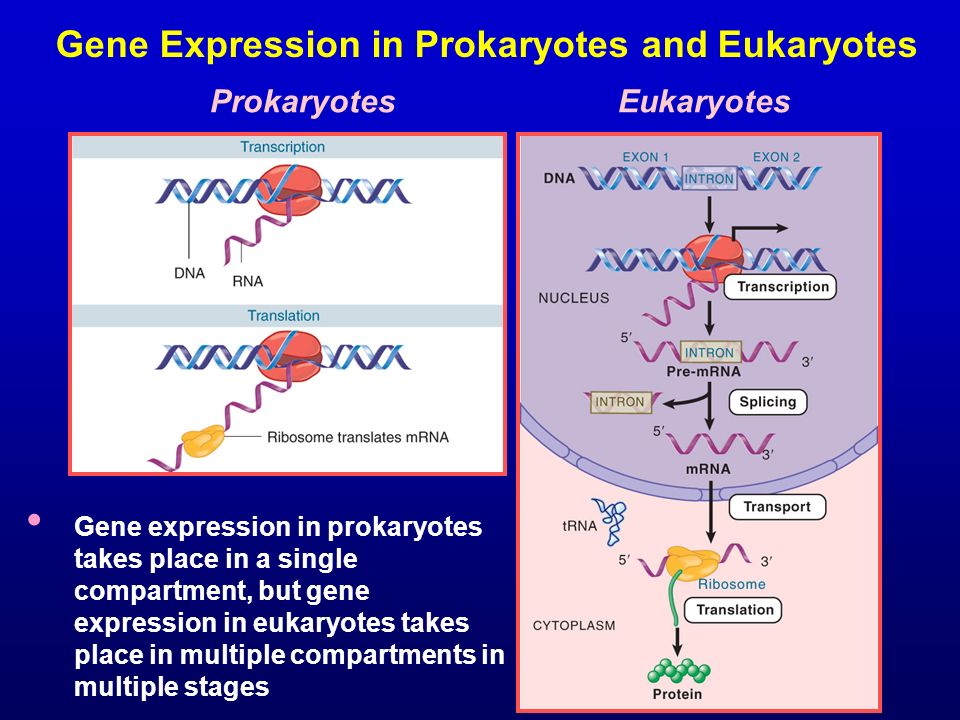

Image Source : capitalsoup.com How Do Prokaryotic Cells Differ From Eukaryotic Cells

Image Source : knowledge-builders.org

Image Source : knowledge-builders.org APCIA Adopts Principles Of Good Insurance Regulation - Financial

Image Source : financialregnews.com

Image Source : financialregnews.com adopts principles

Most Important Reason Why - YouTube

Image Source : www.youtube.com

Image Source : www.youtube.com The Most Important Reason We Ensure The Safety And Chemical Balance Of

Image Source : www.pinterest.com

Image Source : www.pinterest.com The Single Most Important Reason We Get Cancer - PositiveMed

Image Source : www.positivemed.com

Image Source : www.positivemed.com positivemed

The Most Important Reason For Trials That Mormons Almost Always Forget

Image Source : www.mormonlight.org

Image Source : www.mormonlight.org mormons gospel

The most valuable and the second-most valuable asset for firms. The most important reason we ensure the safety and chemical balance of. Apcia adopts principles of good insurance regulation. Florida office of insurance regulation highlights 2021 leadership. How do prokaryotic cells differ from eukaryotic cells