Asset Management Regulation

Asset management regulation is a crucial aspect of the financial industry. It provides guidelines and frameworks for overseeing and managing various types of assets, ensuring their effective utilization, and minimizing risks. In this article, we will explore the latest developments in asset management regulation, its impact on the financial sector, and how it influences the planning and operation of power and gas assets.

Power and Gas Asset Management: Regulation, Planning, and Operation

Power and gas assets play a vital role in meeting the energy demands of various industries and consumers. To ensure efficient operation and maintenance of these assets, asset management regulation becomes essential.

Asset management regulations provide guidelines for the planning, monitoring, and operation of power and gas assets. These regulations cover areas such as safety standards, environmental considerations, asset performance monitoring, and risk management.

Evolving Asset Management Regulation 2018

The evolving landscape of asset management regulation is captured in the book "Evolving Asset Management Regulation 2018." This resource highlights the key regulatory changes and their implications for the asset management industry.

Asset managers need to stay up-to-date with evolving regulations to effectively navigate the changing landscape. The book covers topics such as regulatory compliance, risk assessment, and the impact of technological advancements on asset management practices.

Impact of Asset Management Regulation

Asset management regulation has a profound impact on various stakeholders, including asset managers, financial institutions, and investors. Let's explore some key areas where asset management regulation plays a significant role:

1. Investor Protection

Asset management regulation aims to protect investors by ensuring transparency, fair practices, and accurate reporting by asset managers. These regulations require asset managers to disclose relevant information about the risks associated with investments and provide clear, accurate, and timely reports.

Investors can make informed decisions based on the information provided by asset managers who comply with these regulations. This not only safeguards their interests but also promotes trust and confidence in the financial markets.

2. Risk Management

Asset management regulation places emphasis on risk management practices to minimize the potential threats to asset performance and investor returns. Asset managers are required to implement robust risk management frameworks, assess potential risks, and develop mitigation strategies.

By effectively managing risks, asset managers can protect investor capital and optimize asset performance. This, in turn, contributes to the stability and sustainability of the financial industry.

3. Compliance and Governance

Asset managers must comply with regulatory requirements to maintain operational efficiency, trustworthiness, and good governance practices. These regulations define the responsibilities and obligations of asset managers, ensuring proper oversight and accountability.

By adhering to asset management regulations, asset managers can streamline their operations, mitigate reputational risks, and enhance investor confidence.

The Future of Asset Management Regulation

The asset management industry is undergoing significant transformations driven by regulatory changes and advancements in technology. Here are some aspects that will shape the future of asset management regulation:

1. Embracing Technology

Asset management regulation will need to adapt to the advancements in technology, such as artificial intelligence, big data, and automation. These technologies have the potential to enhance operational efficiency, improve risk management, and optimize asset performance.

Regulators will need to monitor and regulate the use of technology in asset management to ensure fair practices, data privacy, and security. The integration of technology in asset management processes will require collaboration between regulators and industry participants.

2. Sustainable Investment Practices

As environmental, social, and governance (ESG) considerations gain prominence, asset management regulation is likely to incorporate guidelines for sustainable investment practices. Regulations may require asset managers to assess and report on the ESG impact of their investments.

This shift towards sustainable investing aligns with the growing demand for responsible investment choices, considering both financial returns and societal benefits.

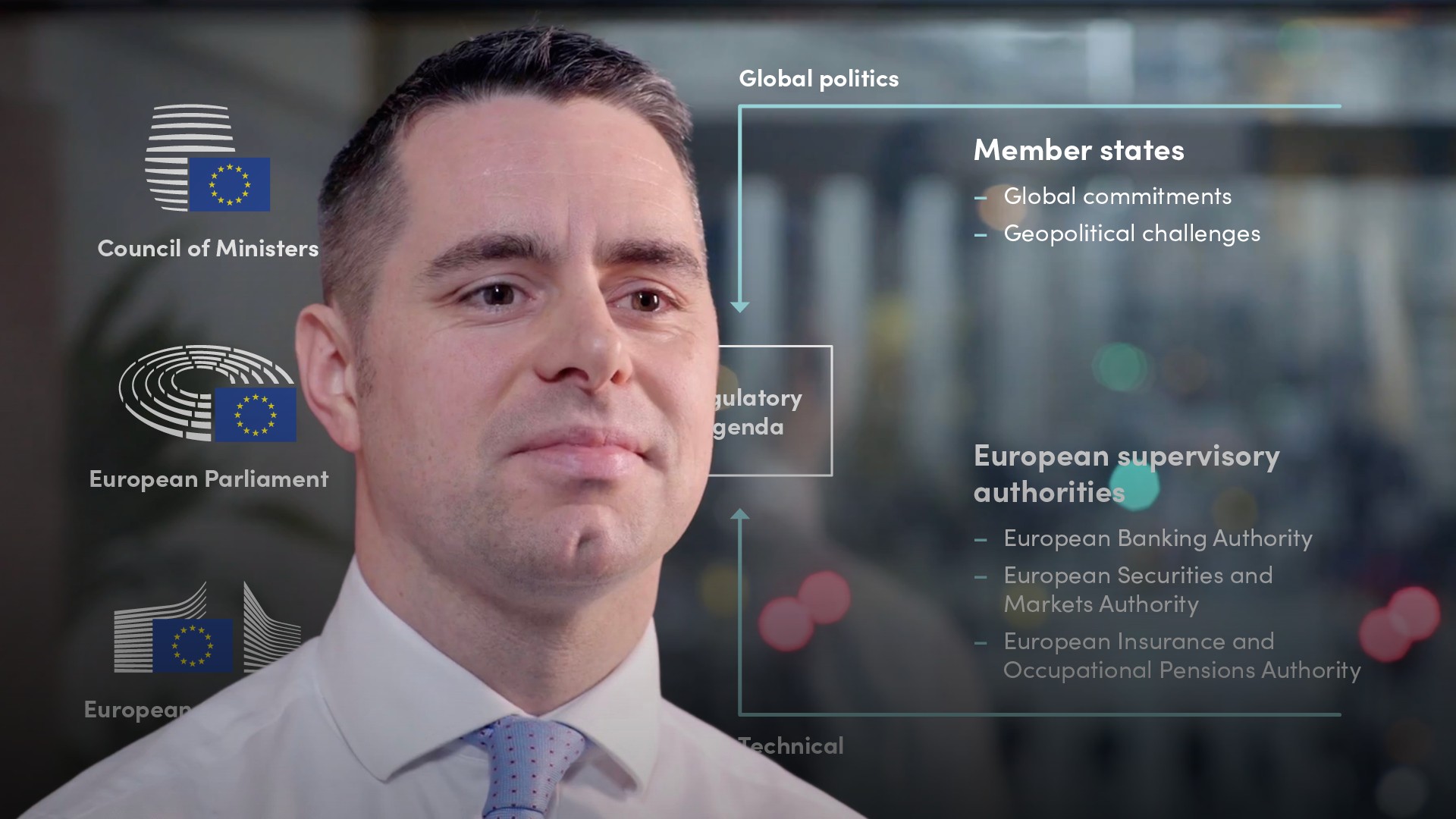

3. Enhancing Cross-Border Cooperation

The global nature of asset management necessitates cross-border cooperation and harmonization of regulations. Regulators worldwide need to collaborate to create consistent standards, share information, and facilitate the smooth functioning of the global asset management industry.

Collaborative efforts will ensure that asset managers can operate across borders without facing significant regulatory hurdles, promoting the growth and efficiency of the global financial markets.

Frequently Asked Questions (FAQ)

To provide further clarity on asset management regulation, here are some frequently asked questions:

Q: What is asset management regulation?

A: Asset management regulation encompasses the rules and guidelines that govern the management, operation, and oversight of various types of assets, including financial instruments, power and gas assets, and real estate. These regulations aim to ensure investor protection, risk management, and compliance with legal and ethical standards.

Q: Why is asset management regulation important?

A: Asset management regulation is important for various reasons:

- It protects investors by ensuring transparency and fair practices.

- It minimizes risks associated with asset management.

- It promotes compliance with legal and ethical standards.

- It enhances accountability and governance practices.

Q: How can asset managers stay compliant with changing regulations?

A: Asset managers can stay compliant with changing regulations by:

- Staying informed and up-to-date with the latest regulatory developments.

- Establishing robust risk management frameworks.

- Conducting regular internal audits and assessments.

- Engaging with regulatory authorities and industry associations.

Q: What are the potential challenges in asset management regulation?

A: Some potential challenges in asset management regulation include:

- Keeping pace with rapidly evolving technology.

- Addressing the complexities of cross-border regulations.

- Balancing investor protection with the need for innovation and growth.

- Harmonizing regulations across different jurisdictions.

Q: How is asset management regulation likely to evolve in the future?

A: Asset management regulation is likely to evolve in response to technological advancements and changing market dynamics. The future of asset management regulation may involve:

- Greater integration of technology, such as AI and automation.

- Incorporation of sustainable investment practices, focusing on ESG considerations.

- Enhanced cross-border cooperation and harmonization of regulations.

Asset management regulation is a critical pillar in maintaining the integrity and stability of the financial industry. By adhering to these regulations, asset managers can provide investors with reliable and transparent investment opportunities while effectively managing risks. Stay informed and compliant to ensure the success and sustainability of asset management practices.

Asset Management Regulation - Euromoney Learning On-Demand Powered By

Image Source : ondemand.euromoney.com

Image Source : ondemand.euromoney.com EU Asset Management Regulation Introduction - Finance Unlocked

Image Source : financeunlocked.com

Image Source : financeunlocked.com Evolving Asset Management Regulation - KPMG Global

Image Source : home.kpmg

Image Source : home.kpmg Evolving Asset Management Regulation 2018 (PDF)

Image Source : pdfroom.com

Image Source : pdfroom.com Evolving Asset Management Regulation 2018 (PDF)

Image Source : pdfroom.com

Image Source : pdfroom.com Evolving Asset Management Regulation - KPMG Cayman Islands

Image Source : home.kpmg

Image Source : home.kpmg Evolving Asset Management Regulation - KPMG Cayman Islands

Image Source : home.kpmg

Image Source : home.kpmg Power And Gas Asset Management: Regulation, Planning And Operation Of

Image Source : b-ok.lat

Image Source : b-ok.lat Evolving asset management regulation 2018 (pdf). Evolving asset management regulation. Evolving asset management regulation. Asset management regulation. Evolving asset management regulation 2018 (pdf)