Csdr Regulation 2022 : What it is

Csdr Regulation 2022: What It Is and How It Impacts Financial Markets Introduction: The Central Securities Depositories Regulation (CSDR) is a regulatory framework introduced by the European Union to enhance the safety and efficiency of securities settlement and reduce systematic risks in financial markets. The regulation aims to establish common rules for central securities depositories (CSDs) and improve post-trading activities. As we delve into the details of the CSDR regulation in 2022, it's important to understand its impact on market participants, the measures implemented, and the challenges faced. Let's explore further. 1. Understanding the Central Securities Depositories Regulation (CSDR): The CSDR regulation was adopted by the European Parliament and Council in 2014 and has been gradually implemented since then. Its main objectives include: 1.1 Enhancing the safety and stability of the financial system: The CSDR aims to mitigate operational, legal, and financial risks associated with securities settlement by imposing stringent requirements on CSDs. These requirements include the provision of essential services, such as authorizations, supervision, and settlement discipline. 1.2 Harmonizing securities settlement across the EU: The CSDR seeks to establish a consistent regulatory framework for securities settlement, custody, and collateral management within the European Union. This harmonization promotes cross-border activities, reduces fragmentation, and increases efficiency in the European market. 1.3 Introducing settlement discipline measures: One of the key provisions of the CSDR is the introduction of a robust framework for settlement discipline. This includes the obligation to have buy-ins, cash penalties, and measures to prevent settlement fails. These measures aim to incentivize timely settlement, reduce counterparty risks, and enhance market integrity. 2. CSDR Regulation and Its Impact on Market Participants: The implementation of the CSDR regulation has significant implications for various market participants, including CSDs, investment firms, banks, and institutional investors. Let's explore how each of these stakeholders is affected: 2.1 Central Securities Depositories (CSDs): CSDs play a crucial role in the post-trading process, providing services like settlement, safekeeping, and asset servicing. Under the CSDR, CSDs are required to obtain authorization from their national supervisor and adhere to strict operational and governance standards. These standards include segregation of assets, risk mitigation, and robust cybersecurity measures. 2.2 Investment Firms and Banks: Investment firms and banks that rely on CSDs for securities settlement and custody services are also impacted by the CSDR regulation. They need to align their processes with the new requirements, such as reporting transparency, liquidity risks, and collateral management. This ensures that they comply with the regulation and fulfill their obligations to clients and regulators. 2.3 Institutional Investors: Institutional investors, including pension funds, asset managers, and insurance companies, are affected by the CSDR through the introduction of settlement discipline measures. These measures require timely settlement and impose penalties on failing parties. Institutional investors need to adjust their strategies and operational processes to comply with these provisions and minimize potential risks. 3. Measures Implemented to Ensure Compliance with CSDR: To ensure compliance with the CSDR regulation, market participants have implemented a range of measures. These include: 3.1 Technology Upgrades: Market participants have invested in advanced technological solutions to improve settlement efficiency, enhance risk management capabilities, and meet reporting requirements. This includes the adoption of distributed ledger technology, automation tools, and data analytics to streamline operations and reduce settlement fails. 3.2 Process Enhancements: Firms have reviewed and updated their internal processes and procedures to align with the CSDR requirements. This includes enhancing collateral management frameworks, improving liquidity management practices, and implementing robust risk control mechanisms. These process enhancements aim to minimize operational risks and ensure compliance. 3.3 Collaboration and Knowledge-Sharing: Market participants have actively collaborated and shared knowledge through industry forums, working groups, and regulatory bodies. This collective effort has facilitated the exchange of best practices, interpretation of regulatory guidelines, and implementation strategies. It has also enabled the identification of common challenges and the development of standardized approaches. 4. Challenges Faced in Implementing the CSDR Regulation: The implementation of the CSDR regulation has posed several challenges for market participants. Let's explore these challenges and their potential solutions: 4.1 Cross-Border Coordination: The CSDR aims to harmonize settlement practices across EU member states. However, achieving seamless coordination among different regulatory regimes, legal systems, and market infrastructures remains a challenge. Greater cross-border cooperation, interoperability, and alignment of standards are necessary to overcome these hurdles. 4.2 Regulatory Reporting Requirements: The CSDR introduces enhanced reporting obligations for market participants. Meeting these requirements necessitates robust data management capabilities, standardized reporting formats, and efficient data collection mechanisms. Firms have to invest in technology and develop scalable systems to address these reporting challenges effectively. 4.3 Market Liquidity and Funding: The settlement discipline measures implemented under the CSDR have the potential to impact market liquidity and funding. Stringent penalties and buy-in mechanisms may lead to increased costs and potential liquidity shortages. Market participants need to carefully manage their liquidity positions and explore alternative funding options to mitigate these risks. FAQ Section: Q1. How does the CSDR promote market efficiency? A1. The CSDR promotes market efficiency by harmonizing securities settlement practices, reducing settlement fails, and enhancing risk management capabilities. It ensures transparent reporting, timely settlement, and robust settlement discipline measures to maintain market integrity. Q2. What are the penalties for settlement fails under the CSDR? A2. The CSDR imposes cash penalties on failing parties, requiring them to cover the costs incurred by the non-defaulting party due to the settlement fail. Additionally, it introduces buy-in mechanisms, allowing the non-defaulting party to purchase the securities on the failing party's behalf. Q3. How can investment firms align with the CSDR requirements? A3. Investment firms can align with the CSDR requirements by enhancing their operational processes, improving risk management capabilities, and adopting advanced technology solutions. They need to ensure transparency in reporting, manage liquidity risks effectively, and comply with settlement discipline measures. Conclusion: The Central Securities Depositories Regulation (CSDR) is a game-changer in the post-trading landscape, bringing new standards for market participants and strengthening the safety and efficiency of securities settlement. By harmonizing settlement practices, promoting transparency, and introducing robust settlement discipline measures, the CSDR aims to foster a thriving and resilient financial market in the European Union. While the implementation of the regulation may present challenges for market participants, proactive measures, collaboration, and technology adoption can help ensure compliance and unlock the benefits it brings. As the market adapts to the CSDR, it is essential for participants to stay updated, share knowledge, and actively engage with regulators to shape an optimal framework for the future.  Image Source : www.pershing.com

Image Source : www.pershing.com  Image Source : www.cva-services.eu

Image Source : www.cva-services.eu  Image Source : equilend.com

Image Source : equilend.com  Image Source : www.euroclear.com

Image Source : www.euroclear.com  Image Source : jump-technology.com

Image Source : jump-technology.com  Image Source : www.dwpbank.de

Image Source : www.dwpbank.de  Image Source : www.sc.com

Image Source : www.sc.com  Image Source : clercclassic.com

Image Source : clercclassic.com

Central Securities Depositories Regulation (CSDR) Overview

Image Source : www.pershing.com

Image Source : www.pershing.com csdr regulation securities central depositories pershing

Was Ist CSDR? Central Securities Depositories Regulation - CVA Services

Image Source : www.cva-services.eu

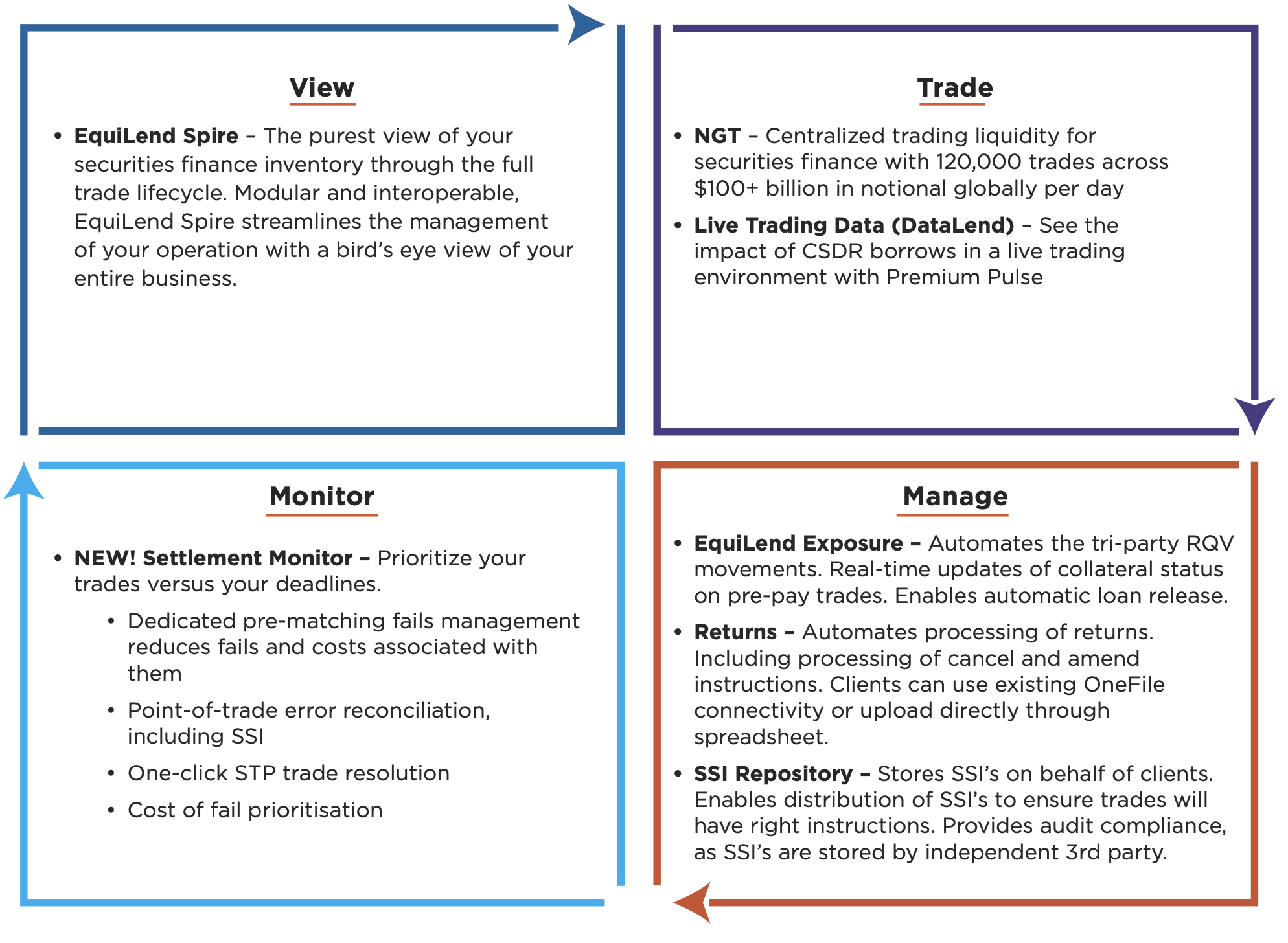

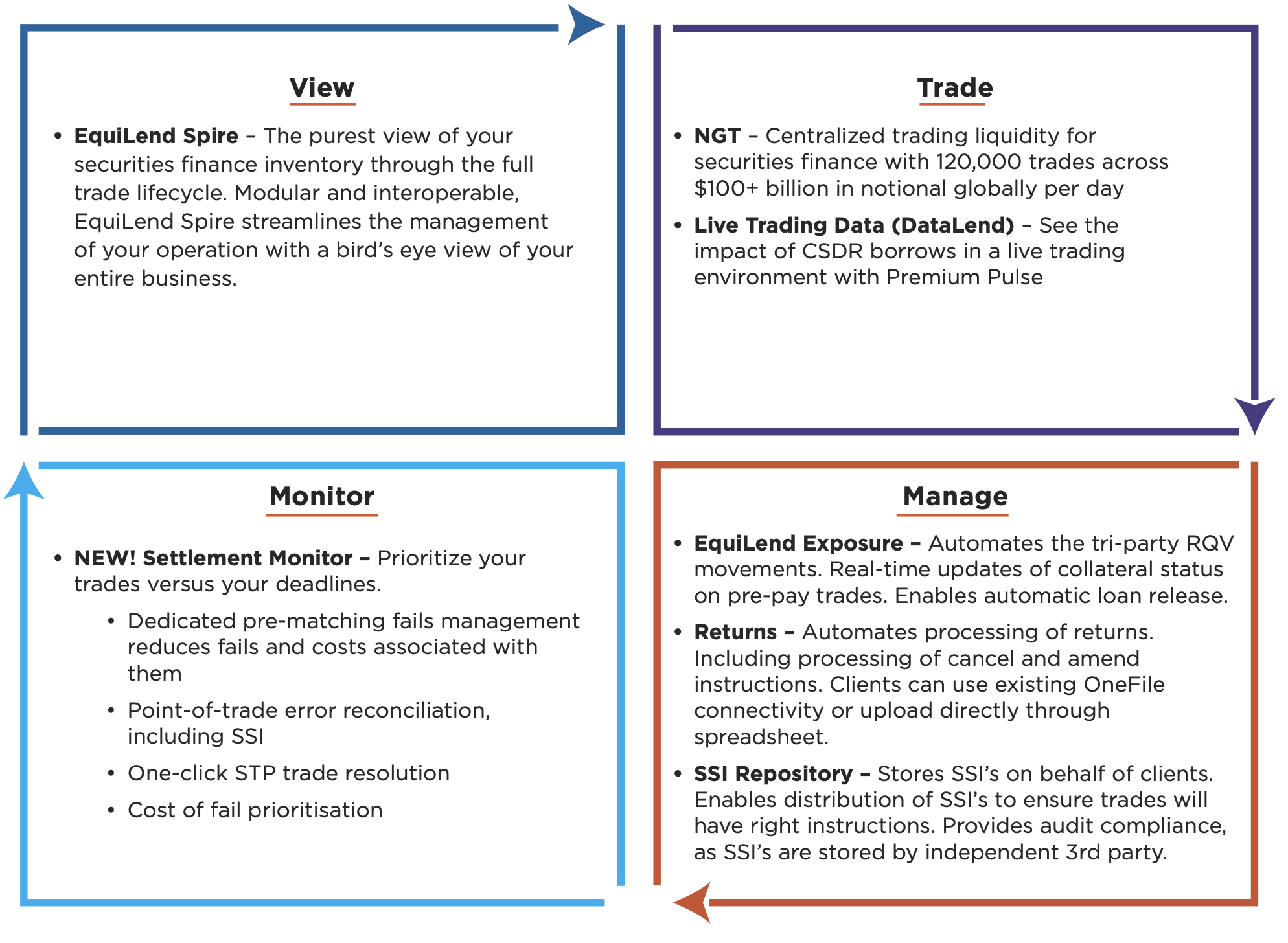

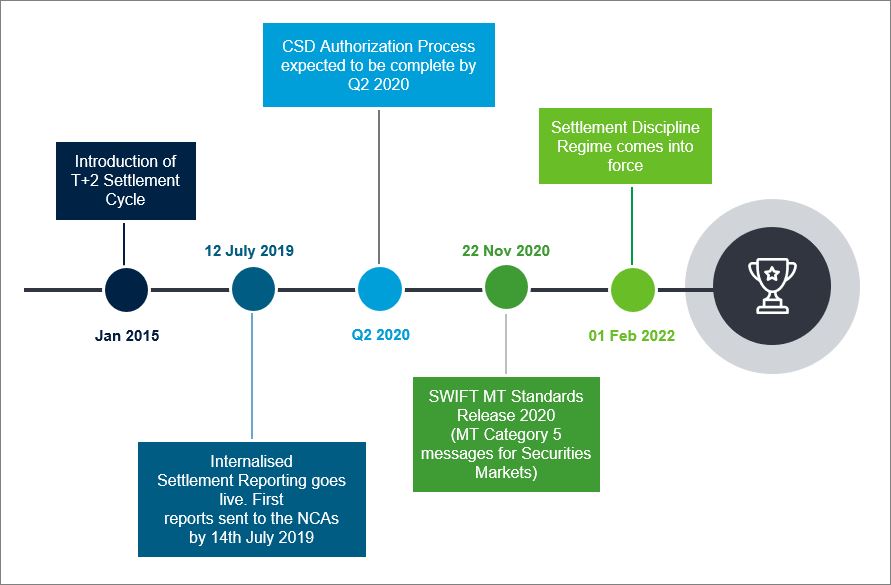

Image Source : www.cva-services.eu CSDR - EquiLend

Image Source : equilend.com

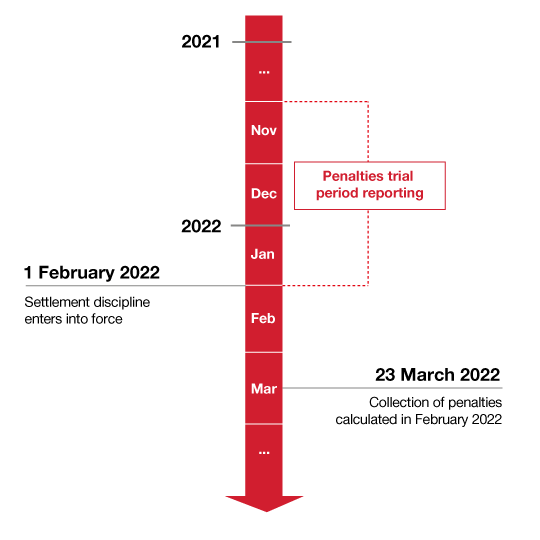

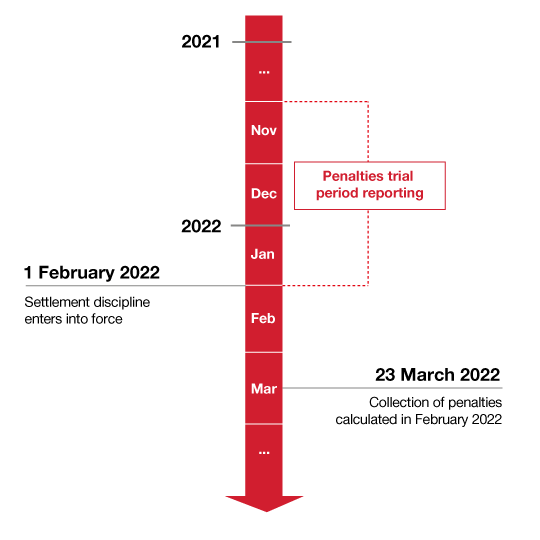

Image Source : equilend.com CSDR Settlement Discipline - Euroclear

Image Source : www.euroclear.com

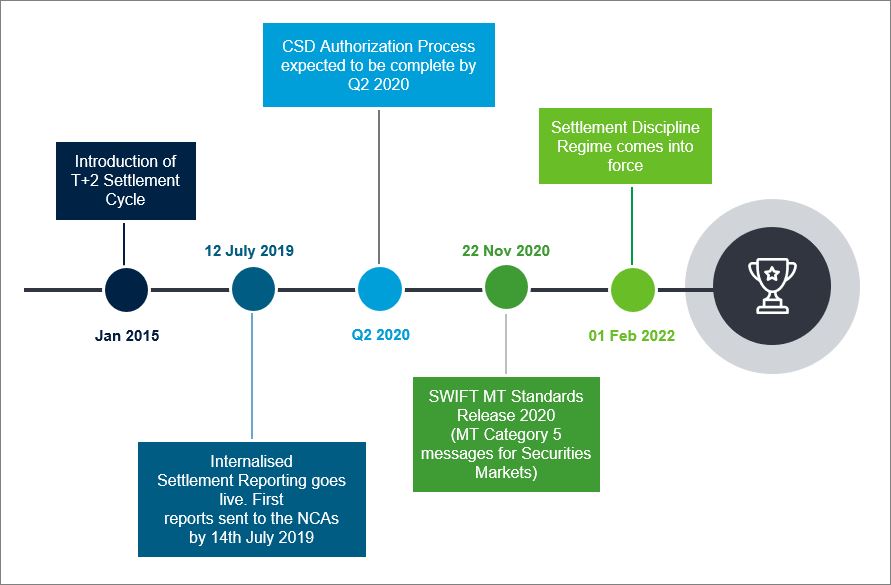

Image Source : www.euroclear.com JUMP Club U' CSDR Regulation

Image Source : jump-technology.com

Image Source : jump-technology.com Die CSDR-Services Der Dwpbank – Abwicklungsdisziplin Automatisiert

Image Source : www.dwpbank.de

Image Source : www.dwpbank.de CSDR Settlement Discipline Regime | Standard Chartered

Image Source : www.sc.com

Image Source : www.sc.com csdr regime settlement discipline regulation

California School For The Deaf Riverside Cheerleading - Clerc Classic XXI

Image Source : clercclassic.com

Image Source : clercclassic.com Csdr settlement discipline regime. Was ist csdr? central securities depositories regulation. Die csdr-services der dwpbank – abwicklungsdisziplin automatisiert. Central securities depositories regulation (csdr) overview. Csdr settlement discipline