Regulation Cc Funds Availability Chart 2021

Regulation CC Funds Availability Chart 2021

When it comes to managing funds, financial institutions and consumers must abide by the rules and regulations set forth by governing bodies. One such regulation that affects the availability of funds is Regulation CC. This regulation, also known as the Funds Availability Rule, ensures that consumers have access to their deposited funds within a reasonable amount of time.

Understanding Regulation CC

Regulation CC sets the standards for deposit holds and the availability of funds at banks and credit unions in the United States. It provides guidelines for how long financial institutions can hold deposited funds before making them available to customers.

The purpose of this regulation is to protect consumers and ensure that they have timely access to their funds. By having clear rules in place, it helps prevent unnecessary delays and provides transparency in the banking system.

How Regulation CC Affects Consumers

Regulation CC directly impacts consumers by detailing when their deposited funds will become available. Below are some key points to understand:

- Local Checks: Typically, funds from local checks must be made available to consumers within two business days from the date of deposit.

- Non-Local Checks: Funds from non-local checks are subject to longer hold periods. Financial institutions may hold these funds for up to five business days.

- Large Deposits: If a consumer makes a deposit exceeding $5,000, banks may place an extended hold on the funds. This is to ensure the validity of the deposit and protect against potential fraud.

What Trade Groups Say About Reg CC Proposal

Recently, there has been a proposal to amend Regulation CC. Various trade groups have voiced their opinions on the matter. Let's take a look at some of their views:

1. American Bankers Association (ABA)

The ABA supports the proposed changes to Regulation CC as it believes it will simplify and streamline the funds availability process. They argue that the revision will align the regulation with the current technological advancements and banking practices.

2. National Credit Union Administration (NCUA)

The NCUA also supports the proposed changes and highlights that it will benefit credit unions and their members. They state that the amendments will foster efficiency in the funds availability process while ensuring consumer protection.

3. Consumer Bankers Association (CBA)

The CBA expresses concerns regarding the proposed changes to Regulation CC. They believe that certain modifications may introduce new complexities and increase regulatory burdens for financial institutions. They suggest further examination and addressing potential challenges before implementing the amendments.

Frequently Asked Questions (FAQ)

Q: What is the purpose of Regulation CC?

A: Regulation CC aims to ensure that consumers have timely access to their deposited funds by setting rules and guidelines for deposit holds.

Q: Are there any exceptions to the funds availability rules?

A: Yes, there are exceptions. In certain cases, financial institutions may extend hold periods or place longer holds on certain types of deposits to mitigate risks or validate funds' legitimacy.

Q: How can consumers minimize delays in accessing their funds?

A: One way consumers can expedite funds availability is by depositing funds through electronic means, such as direct deposit or mobile check deposit. These methods often result in quicker access to funds compared to traditional paper checks.

As consumers, it is essential to familiarize ourselves with Regulation CC and its implications on our finances. By understanding the regulations and requirements, we can make informed decisions and effectively manage our funds.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial or legal advice. Please consult with a professional for personalized guidance.

Online Bankers Training - Regulation CC Changes Effective 7-1-20

Image Source : www.bankerscompliance.com

Image Source : www.bankerscompliance.com PPT - Regulation CC PowerPoint Presentation - ID:249204

cc regulation powerpoint hold ppt presentation slideserve

Here’s What Trade Groups Say About Reg CC Proposal

cc reg regulation proposal trade groups say working funds availability amendments implements bureau would which make

Regulation Cc Funds Availability Applies To

Image Source : regulationlatest.blogspot.com

Image Source : regulationlatest.blogspot.com availability regulation schedule

Reg CC Funds Availability Chart | Money Order | Cheque

Image Source : es.scribd.com

Image Source : es.scribd.com availability

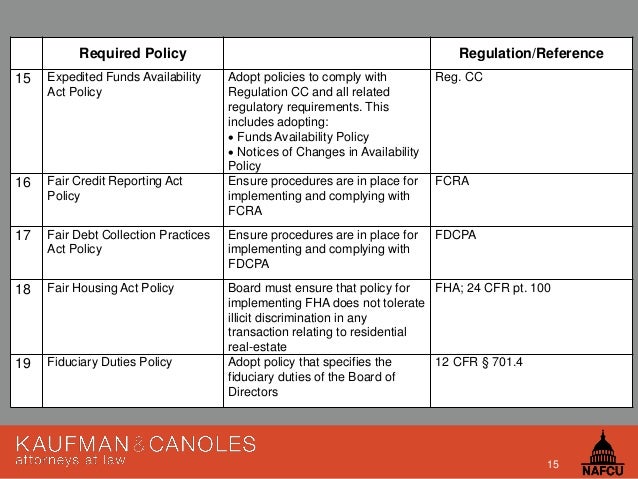

NCUA Board Of Directors Policies

Image Source : www.slideshare.net

Image Source : www.slideshare.net ncua directors

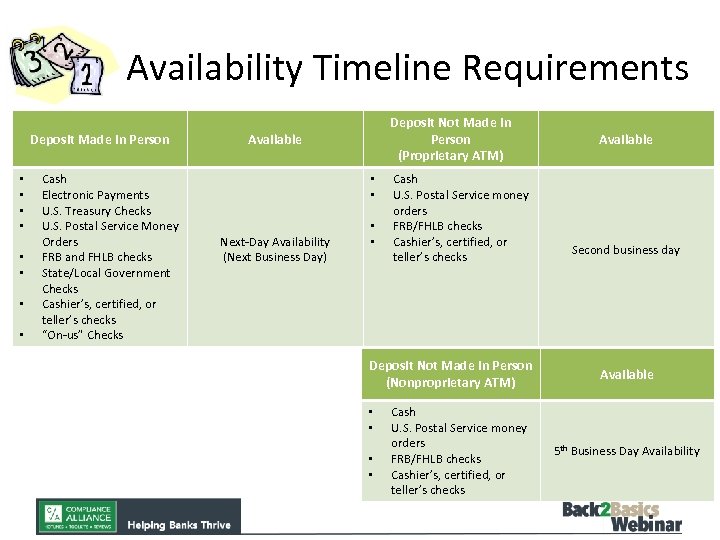

Regulation CC Funds Availability BY ELIZABETH MADLEM ASSOCIATE

Image Source : present5.com

Image Source : present5.com Regulation Cc Banking

regulation funds

Regulation funds. Cc regulation powerpoint hold ppt presentation slideserve. Regulation cc funds availability applies to. Ncua board of directors policies. Here’s what trade groups say about reg cc proposal