Sustainable Finance Regulation

Understanding the EU Sustainable Finance Disclosure Regulation

The EU Sustainable Finance Disclosure Regulation (SFDR) is a regulatory framework aimed at promoting sustainable investments and providing transparency to investors. It introduces a set of disclosure requirements for financial market participants and financial advisers regarding the integration of sustainability risks into their investment decision-making process. This regulation plays a crucial role in the transition towards a more sustainable financial sector.

The Importance of the SFDR

The SFDR is a response to the growing recognition of the urgent need to align financial activities with sustainable objectives, such as addressing climate change and promoting social and environmental responsibility. It aims to tackle greenwashing and promote the flow of capital towards sustainable investments. By providing clear and comparable information to investors, the SFDR encourages informed decision-making and drives the shift towards a greener and more sustainable economy.

The Key Provisions of the SFDR

The SFDR consists of three main pillars: transparency, adverse sustainability impacts, and sustainability preferences. Let's delve into each of these pillars.

Transparency

Under the transparency pillar, financial market participants and financial advisers are required to disclose certain information to investors. This includes information about the integration of sustainability risks into their investment decisions and the consideration of adverse sustainability impacts.

Adverse Sustainability Impacts

Financial market participants are required to assess and disclose the adverse impacts of their investments on sustainability factors. This involves considering the environmental, social, and governance (ESG) aspects of their investments and identifying any negative impacts they may have. By shedding light on the adverse sustainability impacts of investments, investors can make more informed decisions and encourage companies to adopt sustainable business practices.

Sustainability Preferences

Financial advisers are required to take into account the sustainability preferences of their clients, providing appropriate recommendations that align with these preferences. This pillar aims to ensure that investors' sustainability preferences are integrated into their investment strategies, promoting greater alignment between financial products and investors' values.

How the SFDR Affects Investors

The SFDR empowers investors by providing them with clear and comparable information about the sustainability profile of financial products. This allows investors to make informed decisions that align with their sustainability preferences and values. By demanding greater transparency from financial market participants, the SFDR enhances accountability and promotes the flow of capital towards sustainable investments. Investors can play a significant role in driving the transition to a sustainable financial sector through their investment choices.

FAQs

-

What is the purpose of the SFDR?

The SFDR aims to promote sustainable investments and provide transparency to investors by introducing disclosure requirements for financial market participants and financial advisers.

-

What are the key pillars of the SFDR?

The SFDR consists of three main pillars: transparency, adverse sustainability impacts, and sustainability preferences.

-

How does the SFDR affect investors?

The SFDR empowers investors by providing them with clear and comparable information about the sustainability profile of financial products, allowing them to make informed decisions that align with their sustainability preferences and values.

Conclusion

The EU Sustainable Finance Disclosure Regulation (SFDR) is a crucial regulatory framework that promotes sustainable investments and provides transparency to investors. By requiring financial market participants and financial advisers to disclose information about sustainability risks and adverse impacts, the SFDR creates a more informed and accountable financial sector. It empowers investors to make choices that align with their sustainability preferences and contributes to the transition towards a greener and more sustainable economy.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. Please consult with a professional advisor before making any investment decisions.

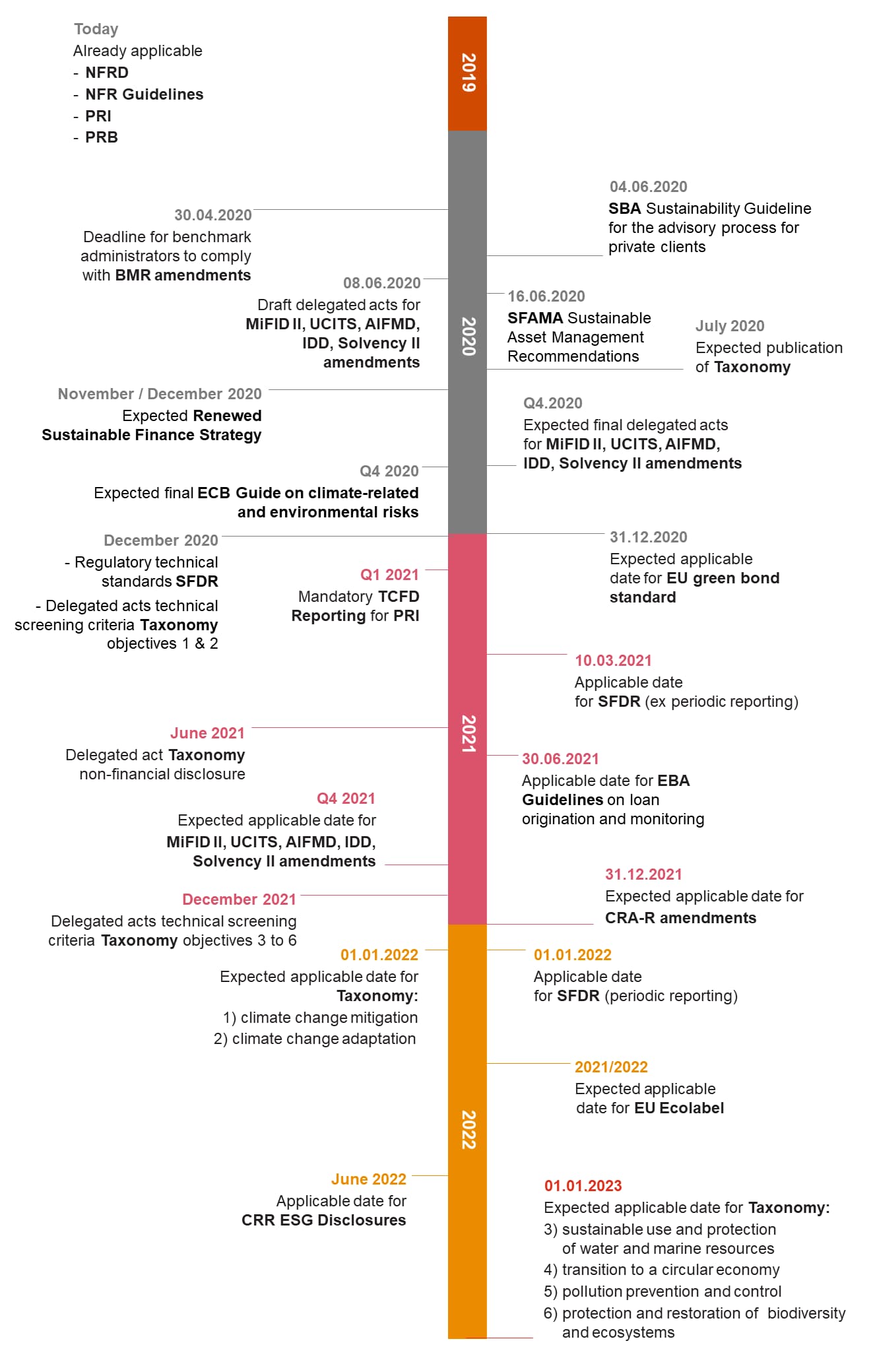

Analysing The EU Sustainable Finance Regulation: Expectations

Image Source : lsfi.lu

Image Source : lsfi.lu Sustainable Finance Regulation | PwC Switzerland

Image Source : www.pwc.ch

Image Source : www.pwc.ch sustainable finance regulation services pwc timeline industry financial market ch

SI Dilemmas: Is EU Sustainable Finance Regulation Helping Or Hurting?

Image Source : www.robeco.com

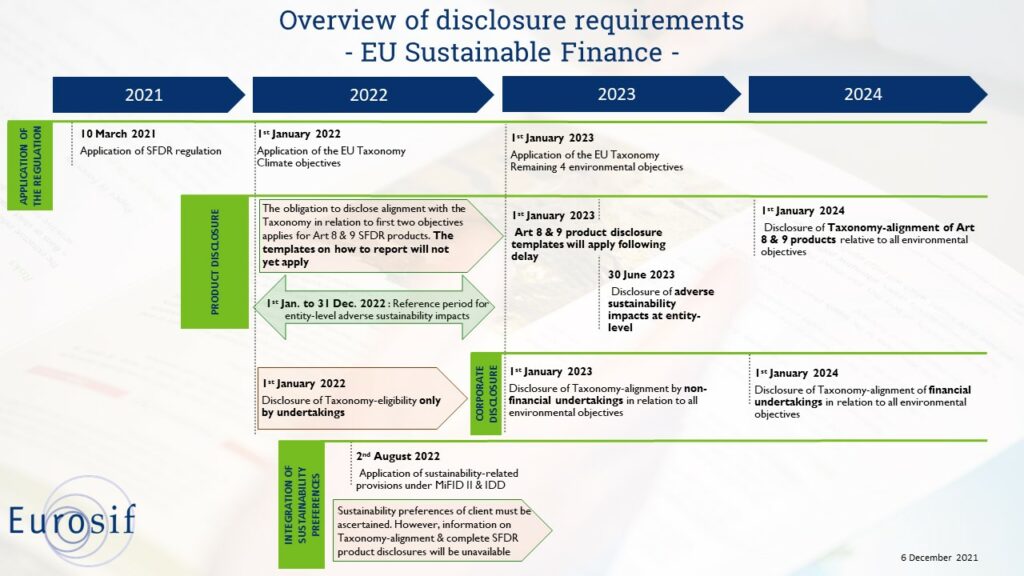

Image Source : www.robeco.com Infographic On Sustainable Finance Disclosure Requirements - EUROSIF

Image Source : www.eurosif.org

Image Source : www.eurosif.org Sustainable Finance Disclosure Regulation - Carne

Image Source : www.carnegroup.com

Image Source : www.carnegroup.com The Sustainable Finance Disclosure Regulation (SFDR - Issuu

Image Source : issuu.com

Image Source : issuu.com Sustainable Finance Regulation | Refinitiv

Image Source : www.refinitiv.com

Image Source : www.refinitiv.com Understanding The EU Sustainable Finance Disclosure Regulation | Sphera

Sustainable finance disclosure regulation. The sustainable finance disclosure regulation (sfdr. Understanding the eu sustainable finance disclosure regulation. Analysing the eu sustainable finance regulation: expectations. Sustainable finance regulation services pwc timeline industry financial market ch