Regulation X Mortgage : What it is

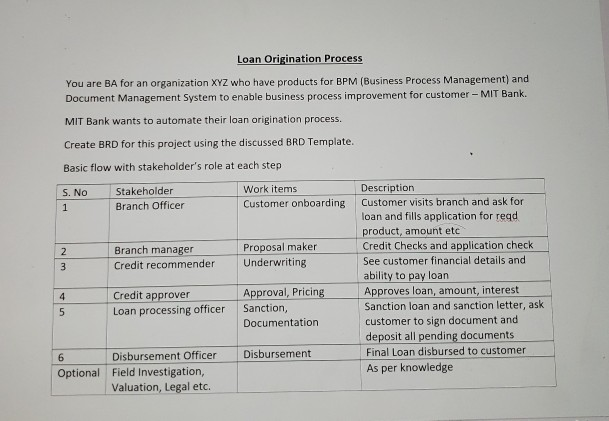

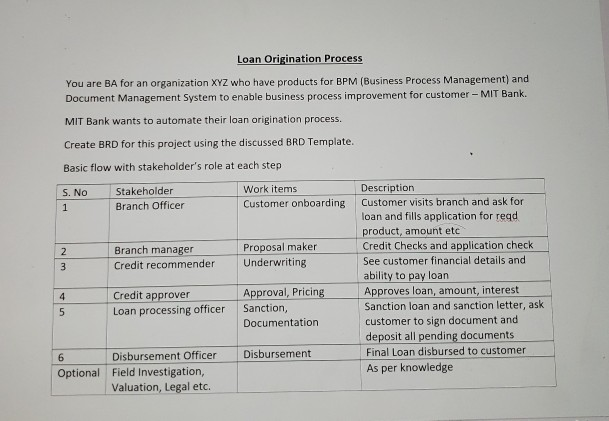

Regulation X Mortgage: What You Need to Know Are you considering applying for a mortgage loan? If so, it's important to familiarize yourself with the many regulations that govern this process. One such regulation you should be aware of is Regulation X Mortgage. In this post, we will delve into the details of Regulation X Mortgage, breaking down its significance, requirements, and implications. So, let's get started! Subheading 1: Understanding Regulation X Mortgage To kick off our exploration of Regulation X Mortgage, let's first understand what it is and why it matters. This regulation, also known as the Real Estate Settlement Procedures Act (RESPA), is a federal law that aims to protect consumers during the mortgage loan process. It addresses various aspects involved in mortgage transactions, covering everything from disclosures and settlements to loan modifications and foreclosures. Subheading 2: The Requirements and Scope of Regulation X Mortgage Now that we have a basic understanding of Regulation X Mortgage's purpose, let's delve into its requirements. This regulation applies to most mortgage loans secured by residential real estate, including primary residences, second homes, and investment properties. It focuses on providing borrowers with accurate and timely information related to their mortgage loans, encouraging transparency and fairness in the lending process. Under Regulation X Mortgage, lenders are obligated to provide borrowers with several key disclosures, including the Loan Estimate and Closing Disclosure. These documents outline the terms, costs, and risks associated with the mortgage, ensuring borrowers have the necessary information to make informed decisions. Lenders must adhere to specific timelines for providing these disclosures, protecting borrowers from last-minute surprises. Subheading 3: Key Implications of Regulation X Mortgage Regulation X Mortgage has far-reaching implications for both borrowers and lenders. Let's take a closer look at some of the most important consequences of this regulation: 1. Enhanced Borrower Protection: By requiring lenders to provide comprehensive disclosures and adhere to specific timelines, Regulation X Mortgage empowers borrowers to make well-informed decisions. This contributes to a more transparent lending environment, reducing the likelihood of predatory practices. 2. Penalties for Non-Compliance: Lenders who fail to comply with Regulation X Mortgage may face severe penalties. These penalties can include monetary fines and the potential for legal action. This serves as a strong deterrent, encouraging lenders to prioritize compliance and uphold the rights of borrowers. 3. Streamlined Loan Modification and Loss Mitigation: Regulation X Mortgage also addresses loan modifications and loss mitigation options for borrowers facing financial difficulties. This ensures that lenders consider all available alternatives before proceeding with foreclosure, providing borrowers with opportunities to maintain homeownership. FAQ Section Q1: How does Regulation X Mortgage protect borrowers? A1: Regulation X Mortgage protects borrowers by requiring lenders to provide comprehensive disclosures and adhere to specific timelines, ensuring borrowers have accurate and timely information to make informed decisions. Q2: Does Regulation X Mortgage apply to all types of mortgage loans? A2: Regulation X Mortgage applies to most mortgage loans secured by residential real estate, including primary residences, second homes, and investment properties. Q3: What happens if a lender fails to comply with Regulation X Mortgage? A3: Lenders who fail to comply with Regulation X Mortgage may face penalties, including monetary fines and potential legal action. In conclusion, Regulation X Mortgage plays a critical role in safeguarding borrowers' interests and promoting transparency in the mortgage loan process. By requiring lenders to provide comprehensive disclosures and adhere to specific timelines, this regulation empowers borrowers to make informed decisions and protects them from unfair practices. Understanding the implications of Regulation X Mortgage is essential for anyone considering a mortgage loan.  Image Source : lenderscompliance.blogspot.com

Image Source : lenderscompliance.blogspot.com /GettyImages-160343527-6f8eb1f85c7b4e449571958bbc3efbe0.jpg) Image Source : www.investopedia.com

Image Source : www.investopedia.com  Image Source : www.mortgagenewsdigest.com

Image Source : www.mortgagenewsdigest.com  Image Source : dsnews.com

Image Source : dsnews.com  Image Source : www.answersdive.com

Image Source : www.answersdive.com  Image Source : privatemortgageannai.blogspot.com

Image Source : privatemortgageannai.blogspot.com  Image Source : blogs.claconnect.com

Image Source : blogs.claconnect.com  Image Source : www.americanas.com.br

Image Source : www.americanas.com.br

Lenders Compliance Group: CFPB’s Regulatory Agenda - 2013

Image Source : lenderscompliance.blogspot.com

Image Source : lenderscompliance.blogspot.com chart cfpb regulatory rules agenda rule provides final compliance certain promulgate changes overview quick will january selected stage

Regulation X Definition

/GettyImages-160343527-6f8eb1f85c7b4e449571958bbc3efbe0.jpg) Image Source : www.investopedia.com

Image Source : www.investopedia.com offshore accountants advise implications accounts banks rufford

Mortgage News Digest: July 2013

Image Source : www.mortgagenewsdigest.com

Image Source : www.mortgagenewsdigest.com Interpreting RESPA’s Regulation X - DSNews

Image Source : dsnews.com

Image Source : dsnews.com Solved: Instructions:1. You Are Expected To Read About Loa

Image Source : www.answersdive.com

Image Source : www.answersdive.com Private Mortgage: Private Mortgage Servicing Software

Image Source : privatemortgageannai.blogspot.com

Image Source : privatemortgageannai.blogspot.com mortgage servicing interim

Federal Reserve Issues New Examination Procedures For RESPA And TIL

Image Source : blogs.claconnect.com

Image Source : blogs.claconnect.com examination procedures federal respa regulation reserve til issues summary updates

Mechanisms Of Lymphocyte Activation And Immune Regulation X Em Promoção

Image Source : www.americanas.com.br

Image Source : www.americanas.com.br Offshore accountants advise implications accounts banks rufford. Private mortgage: private mortgage servicing software. Mechanisms of lymphocyte activation and immune regulation x em promoção. Mortgage news digest: july 2013. Federal reserve issues new examination procedures for respa and til