Article 8 Of The Taxonomy Regulation

Article 8 Of The Taxonomy Regulation: A Complete Guide

The European Union (EU) has been taking significant steps towards a more sustainable and environmentally-friendly future. As part of this commitment, the EU introduced the Taxonomy Regulation, a framework that aims to establish a classification system for sustainable economic activities. Article 8 of the Taxonomy Regulation focuses on the promotion of environmental objectives and sets guidelines for investments in environmentally sustainable activities. In this article, we will explore the key aspects of Article 8 and its implications for various sectors.

What is Article 8 of the Taxonomy Regulation?

Article 8 of the Taxonomy Regulation lays down criteria for determining whether an economic activity contributes substantially to one or more environmental objectives. These environmental objectives include climate change mitigation, climate change adaptation, sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity and ecosystems.

Insight/2020/07.2020/07.13.2020_EU Taxonomy Regulation/eu_taxonomy_environmental_objectives.png?width=1164&name=eu_taxonomy_environmental_objectives.png)

As the concept of sustainability gains more prominence, investors and businesses are increasingly interested in aligning their activities with environmental objectives. Article 8 helps provide a clear framework for making informed investment decisions that contribute to the sustainable development goals set by the EU.

Implications for the Real Estate Sector

The real estate sector plays a significant role in achieving environmental objectives, particularly in terms of energy efficiency and reducing carbon emissions. Article 8 of the Taxonomy Regulation encourages investment in real estate assets that meet specific sustainability criteria.

Implications for Sustainable Finance

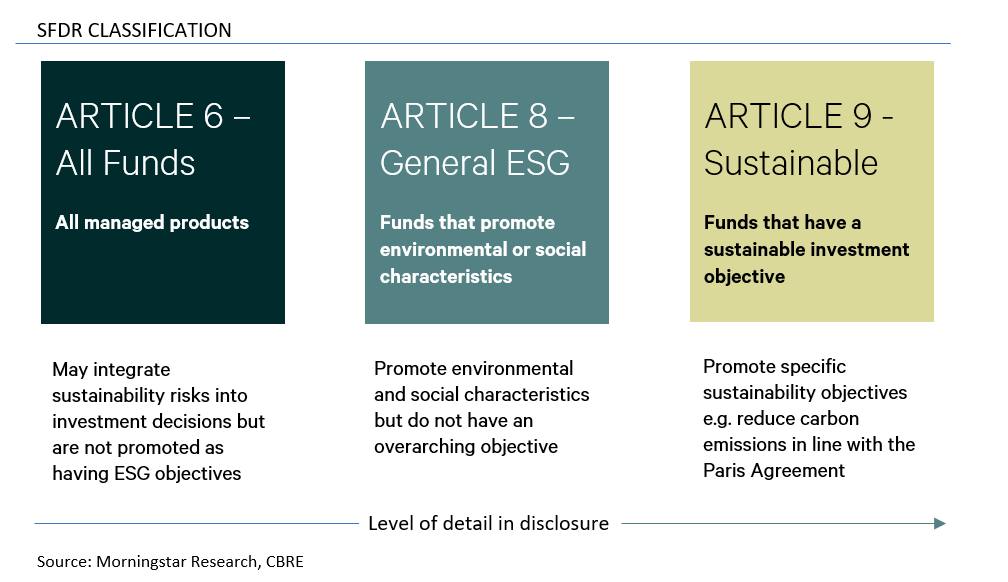

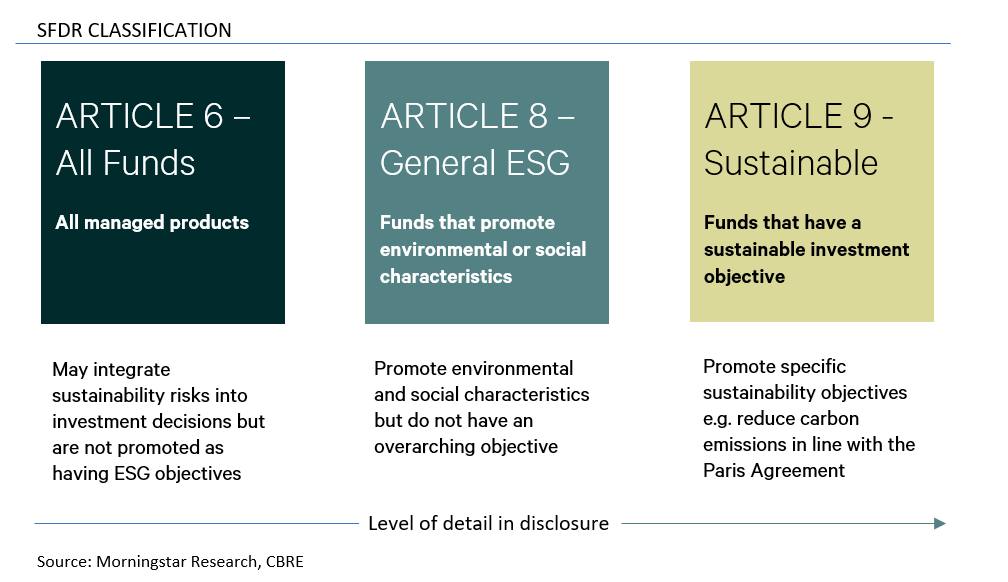

Sustainable finance refers to financial services that consider environmental, social, and governance (ESG) factors in investment decision-making. Article 8 of the Taxonomy Regulation enhances the transparency and disclosure requirements for financial market participants and issuers.

Financial institutions need to disclose how and to what extent they consider environmental factors in their investment decisions. This transparency enables investors to assess the environmental impact of their investments and make more informed choices.

Implications for Renewable Energy

Renewable energy is a key focus area for achieving climate change mitigation and transitioning to a low-carbon economy. Article 8 of the Taxonomy Regulation provides clear guidelines on what qualifies as an environmentally sustainable renewable energy activity.

Investing in renewable energy projects that meet the criteria set by Article 8 not only contributes to climate change mitigation but also supports the growth of the renewable energy sector.

Implications for Transportation

The transportation sector has a significant impact on emissions and air quality. Article 8 of the Taxonomy Regulation aims to promote environmentally sustainable transportation activities, such as electric mobility and public transport systems.

Investing in sustainable transportation projects can help reduce carbon emissions and improve air quality in urban areas. These investments contribute to the achievement of both climate change mitigation and sustainable use of resources objectives.

FAQs

1. How does Article 8 of the Taxonomy Regulation contribute to climate change mitigation?

Article 8 sets clear criteria for determining whether an economic activity contributes to climate change mitigation. By promoting investments in activities that reduce greenhouse gas emissions and support the transition to a low-carbon economy, Article 8 plays a crucial role in addressing climate change.

2. How can financial institutions comply with the transparency requirements of Article 8?

Financial institutions need to disclose how they consider environmental factors in their investment decisions. This includes information on the proportion of investments that are aligned with environmental objectives and the methodologies used for assessing environmental sustainability.

3. What are the benefits of investing in sustainable activities aligned with Article 8?

Investing in sustainable activities aligned with Article 8 not only helps address environmental challenges but also presents attractive investment opportunities. These investments contribute to the achievement of long-term environmental objectives and are likely to generate positive financial returns.

In conclusion, Article 8 of the Taxonomy Regulation sets the stage for a more sustainable future by promoting investments in environmentally sustainable activities. The regulation provides clarity and transparency for investors, businesses, and financial institutions, enabling them to align their activities with the EU's environmental objectives. By embracing the principles outlined in Article 8, we can accelerate the transition to a greener and more resilient economy.

Draft Commission Notice On The Interpretation Of Certain Legal

Image Source : barcelonacentrefinancer.cat

Image Source : barcelonacentrefinancer.cat ESMA FINAL REPORT ON ARTICLE 8 OF THE EU TAXONOMY REGULATION | Herbert

Image Source : www.herbertsmithfreehills.com

Image Source : www.herbertsmithfreehills.com The EU Taxonomy Regulation: An Overview

Insight/2020/07.2020/07.13.2020_EU Taxonomy Regulation/eu_taxonomy_environmental_objectives.png?width=1164&name=eu_taxonomy_environmental_objectives.png) Image Source : insight.factset.com

Image Source : insight.factset.com taxonomy regulation objectives overview insight

CEEP’s Views To The Consultation On Commission’s Draft Delegated

Image Source : www.ceep.be

Image Source : www.ceep.be ceep taxonomy delegated consultation commission jun

The EU Taxonomy Regulation: An Overview

Insight/2020/07.2020/07.13.2020_EU Taxonomy Regulation/eu_taxonomy_broader.png?width=1013&name=eu_taxonomy_broader.png) Image Source : insight.factset.com

Image Source : insight.factset.com taxonomy regulation esg scope regime broader economic basics insight

EFAMA´s Comments On Draft Delegated Acts Under Article 8 Of The

Image Source : www.efama.org

Image Source : www.efama.org Sustainable Finance Disclosure Regulation (SFDR) And Real Estate Assets

Image Source : www.nordicsrealestate.com

Image Source : www.nordicsrealestate.com Issuers: Phased-in Implementation Of Article 8 Of The EU Taxonomy

Image Source : www.cssf.lu

Image Source : www.cssf.lu Ceep’s views to the consultation on commission’s draft delegated. The eu taxonomy regulation: an overview. Taxonomy regulation esg scope regime broader economic basics insight. Sustainable finance disclosure regulation (sfdr) and real estate assets. Efama´s comments on draft delegated acts under article 8 of the