Section 32 Of Regulation Z

The Section 32 of Regulation Z has been instrumental in the financial landscape since its implementation. This regulation, issued by the Federal Reserve System, focuses on disclosure requirements for certain mortgage transactions. In this post, we will explore the key aspects of Section 32 and its implications for consumers and lenders.

Understanding Section 32 of Regulation Z

Section 32 of Regulation Z, also known as the Truth in Lending Act (TILA), was established to provide consumers with transparent information about mortgage transactions. It ensures that lenders provide accurate and complete details regarding various aspects of the mortgage, including interest rates, fees, and payment terms.

The aim of Section 32 is to prevent unfair and deceptive practices by lenders and promote fair lending practices. It enables borrowers to make well-informed decisions by understanding the costs and risks associated with a mortgage transaction.

Implications for Consumers

Section 32 offers several benefits and protections for consumers:

1. Enhanced Transparency

One of the primary goals of Section 32 is to ensure that consumers have access to clear and accurate information about the costs involved in their mortgage transactions. By mandating the disclosure of various fees, interest rates, and payment terms, borrowers can compare different loan offers and make informed decisions.

2. Protection Against Predatory Lending

Section 32 acts as a safeguard against predatory lending practices. It sets limits on certain loan terms and fees, protecting borrowers from excessive costs and unfair practices. This regulation works towards preventing situations where borrowers are pushed into loans they cannot afford.

3. Opportunities for Legal Recourse

Section 32 empowers borrowers with legal recourse in case of violations by lenders. If lenders fail to comply with the disclosure requirements or engage in deceptive practices, borrowers can take legal actions to seek remedies and hold lenders accountable.

FAQs About Section 32

Q: What is the purpose of Section 32?

A: The purpose of Section 32 is to promote transparency and protect consumers in mortgage transactions by requiring lenders to disclose all relevant information.

Q: What details are lenders required to disclose under Section 32?

A: Lenders must disclose information such as the annual percentage rate (APR), total loan costs, payment obligations, and potential penalties or variable interest rates.

Q: Does Section 32 apply to all mortgage transactions?

A: No, Section 32 applies to specific mortgage transactions, including closed-end loans secured by the borrower's dwelling, such as home purchase loans and refinances.

Q: How does Section 32 prevent predatory lending?

A: Section 32 sets limits on certain loan terms and fees, protecting borrowers from excessive costs and unfair practices. It helps prevent situations where borrowers are exploited by lenders.

Q: Can borrowers take legal action for Section 32 violations?

A: Yes, borrowers have the right to take legal action if lenders fail to comply with the disclosure requirements or engage in deceptive practices. They can seek remedies and hold lenders accountable.

Section 32 of Regulation Z has undoubtedly played a critical role in ensuring transparency and consumer protection in mortgage transactions. By adhering to the requirements set forth by this regulation, lenders contribute to a fairer lending environment and empower borrowers to make well-informed decisions.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute legal advice. Please consult with a qualified attorney for assistance with specific legal matters related to Section 32 of Regulation Z or any other financial regulations.

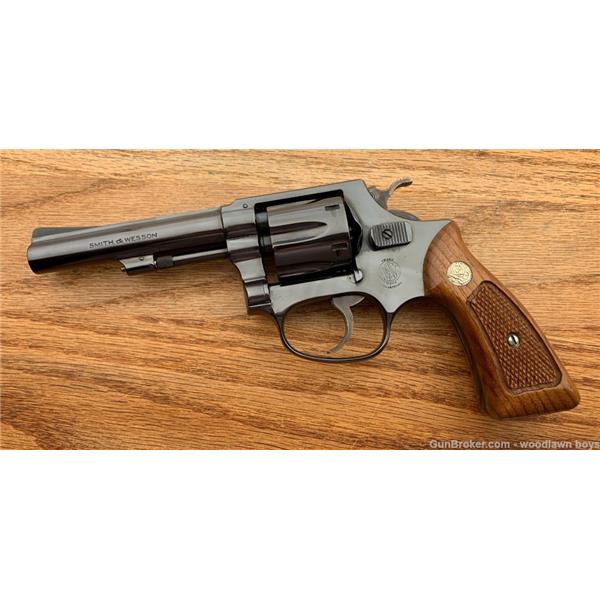

SMITH WESSON 32 REGULATION POLICE New And Used Price, Value, & Trends 2021

Image Source : truegunvalue.com

Image Source : truegunvalue.com regulation wesson pistol

S&W 32 Regulation Police | Smith And Wesson Forums

SMITH WESSON 32 REGULATION POLICE New And Used Price, Value, & Trends 2021

Image Source : truegunvalue.com

Image Source : truegunvalue.com regulation police wesson

Sold - Smith & Wesson .32 Regulation Police | Carolina Shooters Forum

New Dawn Law: December 2008

Image Source : newdawnlaw.blogspot.com

Image Source : newdawnlaw.blogspot.com reg chart 2008 regulation december mortgage compelling act important related also

Wells Signed Engraved/Inlaid S&W 32 Regulation Police Revolver | Rock

Image Source : www.rockislandauction.com

Image Source : www.rockislandauction.com Regulation Z Section 32 | Truth In Lending Act, Home Loans, Buying Your

Image Source : www.pinterest.com

Image Source : www.pinterest.com 31 REGULATION POLICE New And Used Price, Value, & Trends 2022

Image Source : truegunvalue.com

Image Source : truegunvalue.com Wells signed engraved/inlaid s&w 32 regulation police revolver. New dawn law: december 2008. Regulation wesson pistol. Smith wesson 32 regulation police new and used price, value, & trends 2021. Smith wesson 32 regulation police new and used price, value, & trends 2021