Financial Regulation History

Introduction

The history of financial regulation in the United States is a fascinating and complex topic that has shaped the modern banking and finance industry. Throughout the years, various laws and reforms have been implemented to ensure the stability and integrity of the financial system. In this article, we will explore the key milestones and developments in U.S. banking regulation, shedding light on the evolution of the industry.

1. The Early Days of Banking Regulation

In the early 1950s, U.S. banking regulation took its initial steps towards establishing a robust framework to govern the financial sector. At this time, the primary focus was on preventing abuses and protecting depositor funds. The establishment of the Federal Deposit Insurance Corporation (FDIC) in 1933 was a crucial development, offering deposit insurance to safeguard individuals' savings in case of bank failures. This move brought confidence and stability to the banking system, ensuring that customers' money was protected.

Another significant milestone during this period was the implementation of the Glass-Steagall Act in 1933. This legislation aimed to separate commercial banking activities from investment banking activities to prevent conflicts of interest and curb speculative practices. It established a clear line between banks that took deposits and made loans (commercial banks) and those that underwrote securities and engaged in other investment banking activities (investment banks).

The early days of banking regulation laid the foundation for a more secure and regulated financial system. However, as the years went by, new challenges emerged, calling for further reforms and adjustments to meet the evolving needs of the industry.

2. The Era of Deregulation

In the 1970s and early 1980s, the United States witnessed a wave of deregulation aimed at increasing competition and stimulating economic growth. This period was characterized by a relaxation of various banking regulations, giving financial institutions more flexibility in their operations.

One of the key events during this era was the passage of the Depository Institutions Deregulation and Monetary Control Act in 1980. This legislation aimed to enhance competition among financial institutions by removing interest rate controls on deposits, encouraging banks to offer higher deposit rates to attract customers. Additionally, this act granted regulatory relief to thrift institutions, allowing them to expand their lending activities beyond traditional home mortgages.

The subsequent years saw further deregulation efforts, culminating in the landmark reforms introduced through the Gramm-Leach-Bliley Act in 1999. This legislation repealed provisions of the Glass-Steagall Act, allowing commercial banks, investment banks, and insurance companies to engage in a more integrated and diverse range of activities. It marked a significant shift in the regulatory landscape and paved the way for greater consolidation and convergence within the financial industry.

:max_bytes(150000):strip_icc()/dotdash-brief-history-us-banking-regulation-v2-5c5ce164370b4818bf93f68a0a33396b.jpg)

3. The Aftermath of the Financial Crisis

The turn of the century marked a significant turning point in U.S. banking regulation. The 2008 financial crisis, triggered by the collapse of several major financial institutions and a subsequent economic downturn, exposed critical weaknesses in the regulatory framework.

In response to the crisis, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted in 2010. This comprehensive legislation aimed to address the issues that led to the financial crisis and prevent a similar situation from occurring in the future. It introduced a wide range of reforms, including increased capital requirements for banks, the creation of the Consumer Financial Protection Bureau (CFPB) to oversee consumer financial products, and measures to enhance transparency and accountability in the derivatives market.

The aftermath of the financial crisis brought about a renewed focus on financial regulation. Efforts were made to strengthen oversight and ensure the stability and resilience of the banking sector. The regulatory landscape became more stringent, with a greater emphasis on risk management, capital adequacy, and transparency.

Frequently Asked Questions (FAQ)

1. Why is financial regulation important?

Financial regulation is important as it helps maintain the stability and integrity of the financial system. It protects consumers and investors, promotes fair competition, and guards against fraudulent activities and market abuses. Additionally, financial regulation aims to prevent excessive risk-taking and ensure the overall health of the economy.

2. How does the FDIC protect depositor funds?

The FDIC protects depositor funds by providing deposit insurance. In case of a bank failure, the FDIC guarantees to reimburse depositors up to a certain amount, currently set at $250,000 per depositor, per insured bank. This ensures that individuals' savings are safeguarded even if a bank collapses.

3. What were the main objectives of the Dodd-Frank Act?

The Dodd-Frank Act aimed to address the issues that led to the 2008 financial crisis. Its main objectives were to enhance financial stability, promote fair and transparent markets, protect consumers from abusive practices, and reduce systemic risk. The act introduced various measures to achieve these goals, such as increased oversight and regulation of financial institutions, improved transparency in derivative markets, and the establishment of the Consumer Financial Protection Bureau.

Conclusion

The history of U.S. banking regulation reflects the ever-changing dynamics of the financial industry. From the early days of establishing deposit insurance and separating commercial and investment banking activities to the era of deregulation and the subsequent reforms post-financial crisis, the regulatory landscape continuously evolves to address the needs and challenges of the times. The implementation of prudent regulations is crucial for maintaining a stable and secure financial system, protecting consumers, and fostering economic growth.

Disclaimer: The information presented in this article is for informational purposes only and should not be considered as financial or legal advice.

Photos (1930s) | Photos | Virtual Museum And Archive Of The History Of

Image Source : www.pinterest.com

Image Source : www.pinterest.com Photos (Pre1930s) | Photos | Virtual Museum And Archive Of The History

Image Source : www.pinterest.com

Image Source : www.pinterest.com history regulation pierce

A History Of Financial Technology And Regulation

Image Source : www.cambridge.org

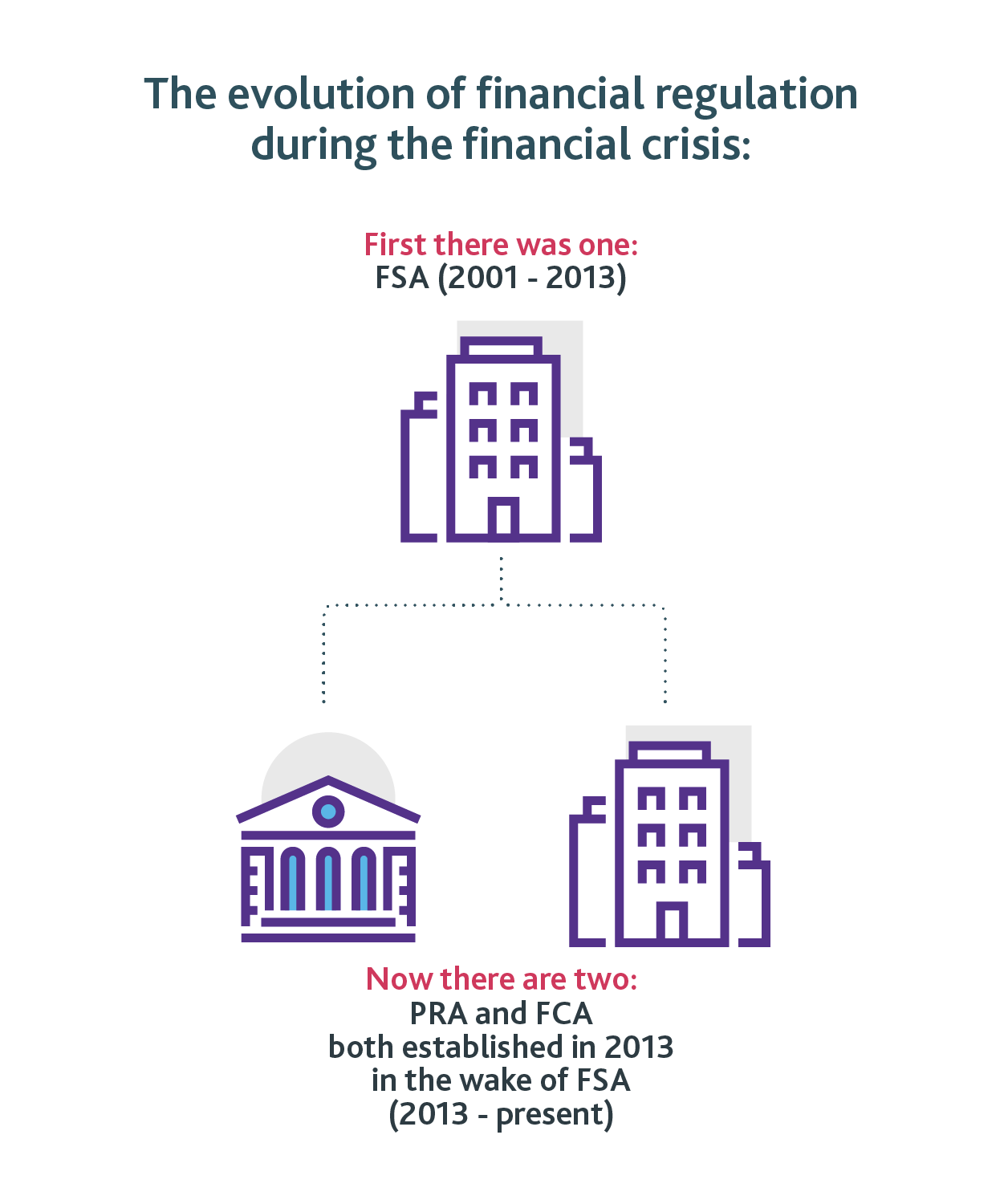

Image Source : www.cambridge.org What Is The Prudential Regulation Authority (PRA)? | Bank Of England

Image Source : www.bankofengland.co.uk

Image Source : www.bankofengland.co.uk Financial Innovation, Regulation And Crises In History

Image Source : www.cambridge.org

Image Source : www.cambridge.org Photos (1950s) | Photos | Virtual Museum And Archive Of The History Of

Image Source : www.pinterest.com

Image Source : www.pinterest.com history museum regulation 1950s securities commission exchange archive financial sec virtual

A Brief History Of U.S. Banking Regulation

:max_bytes(150000):strip_icc()/dotdash-brief-history-us-banking-regulation-v2-5c5ce164370b4818bf93f68a0a33396b.jpg) Image Source : www.investopedia.com

Image Source : www.investopedia.com A Brief History Of Credit Rating Agencies: How Financial Regulation

Image Source : www.mercatus.org

Image Source : www.mercatus.org mercatus history

History regulation pierce. A history of financial technology and regulation. What is the prudential regulation authority (pra)?. Photos (pre1930s). A brief history of u.s. banking regulation