Csdr Regulation : What it is

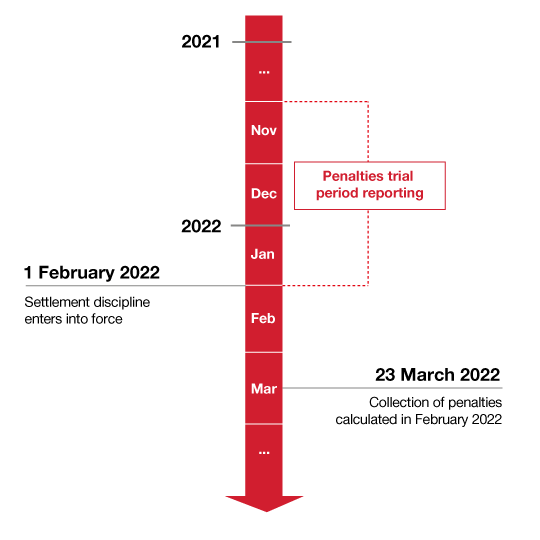

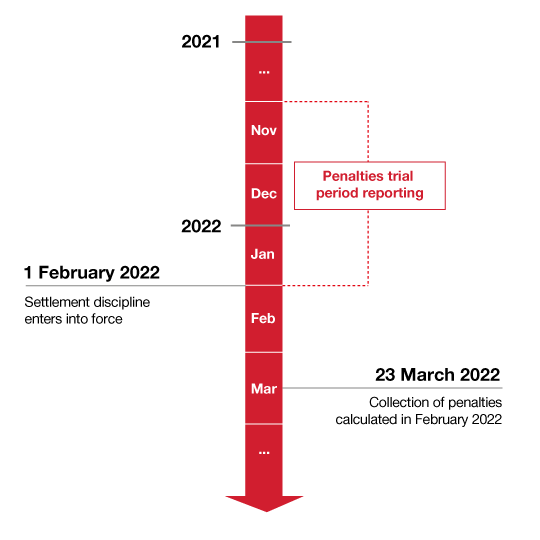

CSDR Regulation: What It Is and How It Impacts the Financial Industry Introduction: The Central Securities Depositories Regulation (CSDR) is a regulatory framework established by the European Union to govern central securities depositories (CSDs) and promote harmonization and standardization within the financial industry. This regulation aims to enhance the safety and efficiency of securities settlement and establish a more secure and transparent environment for investors. In this article, we will delve into the details of CSDR, its significance, and how it affects various stakeholders in the financial landscape. 1. Understanding CSDR: CSDR stands for Central Securities Depositories Regulation, which came into effect on 17th September 2014 as a part of a broader effort to create a more resilient financial system in the EU. It sets out rules and requirements for CSDs, which are entities responsible for facilitating the settlement, clearing, and safekeeping of financial transactions involving securities. The core objectives of CSDR include reducing systemic and operational risks, facilitating cross-border transactional activities, and ensuring a robust regulatory framework for CSDs. 2. Key Provisions and Impacts: 2.1 Modernization of CSD Infrastructure: One of the primary goals of CSDR is to modernize the infrastructure that supports the settlement and custody of securities. This entails implementing standardized and harmonized processes across CSDs in the EU, enabling seamless interoperability and enhancing risk mitigation measures. By introducing these reforms, CSDR aims to reduce fragmentation and strengthen the overall stability of the financial system. 2.2 Settlement Discipline Regime: CSDR introduces a settlement discipline regime intending to tackle late or failed settlements. Under this regime, financial penalties may be imposed on participants involved in the settlement process who fail to meet their obligations promptly. This measure aims to discourage settlement fails and enhance transparency by making settlement failures more visible within the market. 2.3 Securities Financing Transactions Regulation (SFTR): Alongside CSDR, the Securities Financing Transactions Regulation (SFTR) was introduced to address risks associated with securities financing transactions, such as repurchase agreements and securities lending. SFTR requires market participants to report these transactions to trade repositories and creates transparency and oversight for this sector. 3. How CSDR Impacts Various Stakeholders: 3.1 Investors: CSDR strengthens the protection of investor rights by promoting transparency and efficiency across the securities settlement process. Investors can expect increased harmonization and streamlined procedures, resulting in a safer and more predictable investment environment. 3.2 Central Securities Depositories (CSDs): CSDs are directly affected by CSDR as they are required to comply with various regulatory obligations. They must ensure robust risk management frameworks, meet capital requirements, and implement measures to mitigate settlement fails actively. Additionally, CSDs are encouraged to adopt innovative technologies to enhance the safety and efficiency of their operations. 3.3 Financial Institutions: Financial institutions, including banks and investment firms, play a crucial role in the settlement process. They are responsible for executing trades and ensuring timely settlement. With the introduction of the settlement discipline regime, financial institutions face stricter requirements and potential penalties for settlement failures. These institutions will need to strengthen their risk management systems and ensure compliance with the new regulations. FAQ: Q1: What is the timeline for the implementation of CSDR? A1: CSDR was first implemented on 17th September 2014. Certain provisions have already come into effect, while others are set to be implemented over a phased timeline until 2023. Q2: How does CSDR contribute to the stability of the financial system? A2: By introducing standardized processes and risk mitigation measures, CSDR reduces fragmentation and enhances the stability of the financial system. It also encourages cross-border activity while ensuring proper regulation and oversight. Q3: What are the penalties for settlement fails under the settlement discipline regime? A3: Financial penalties can be imposed on participants who fail to meet their settlement obligations, discouraging settlement fails and promoting transparency within the market. Conclusion: The Central Securities Depositories Regulation (CSDR) plays a pivotal role in promoting a secure and efficient securities settlement environment within the EU. Through its provisions, CSDR seeks to enhance the resilience of the financial system, protect investor rights, and mitigate settlement fails. By understanding the impacts of CSDR on various stakeholders and complying with the regulatory obligations, the financial industry can adapt to a more harmonized and transparent framework, leading to a stronger and more stable financial landscape.  Image Source : www.euroclear.com

Image Source : www.euroclear.com  Image Source : www.abbreviations.com

Image Source : www.abbreviations.com  Image Source : www.sc.com

Image Source : www.sc.com  Image Source : www.dtcc.com

Image Source : www.dtcc.com  Image Source : www.broadridge.com

Image Source : www.broadridge.com  Image Source : www.youtube.com

Image Source : www.youtube.com  Image Source : www.cva-services.eu

Image Source : www.cva-services.eu  Image Source : www.pershing.com

Image Source : www.pershing.com

CSDR Settlement Discipline - Euroclear

Image Source : www.euroclear.com

Image Source : www.euroclear.com CSDR - Central Securities Depositories Regulation

Image Source : www.abbreviations.com

Image Source : www.abbreviations.com csdr regulation embed

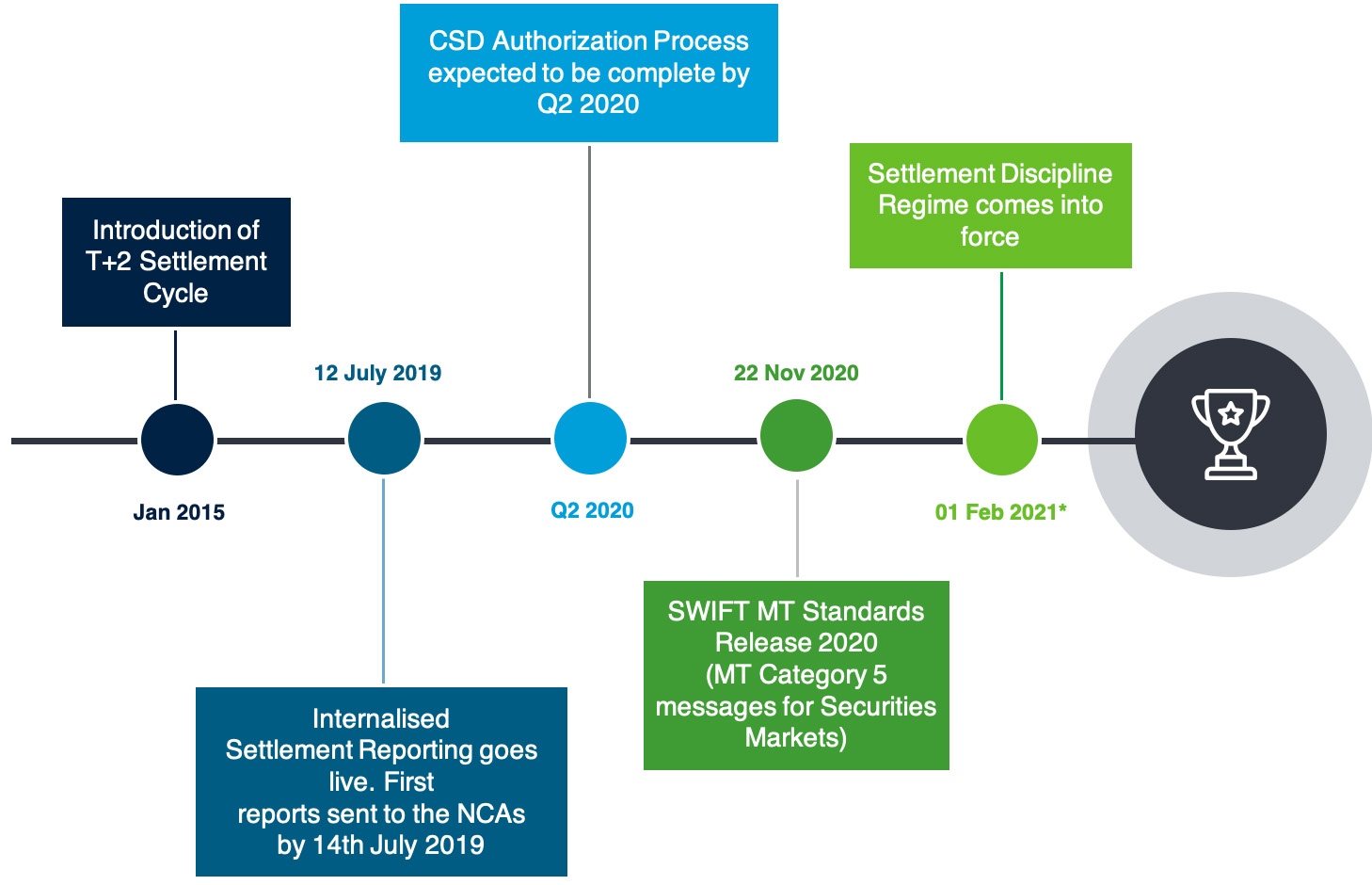

Central Securities Depositories Regulation | Standard Chartered

Image Source : www.sc.com

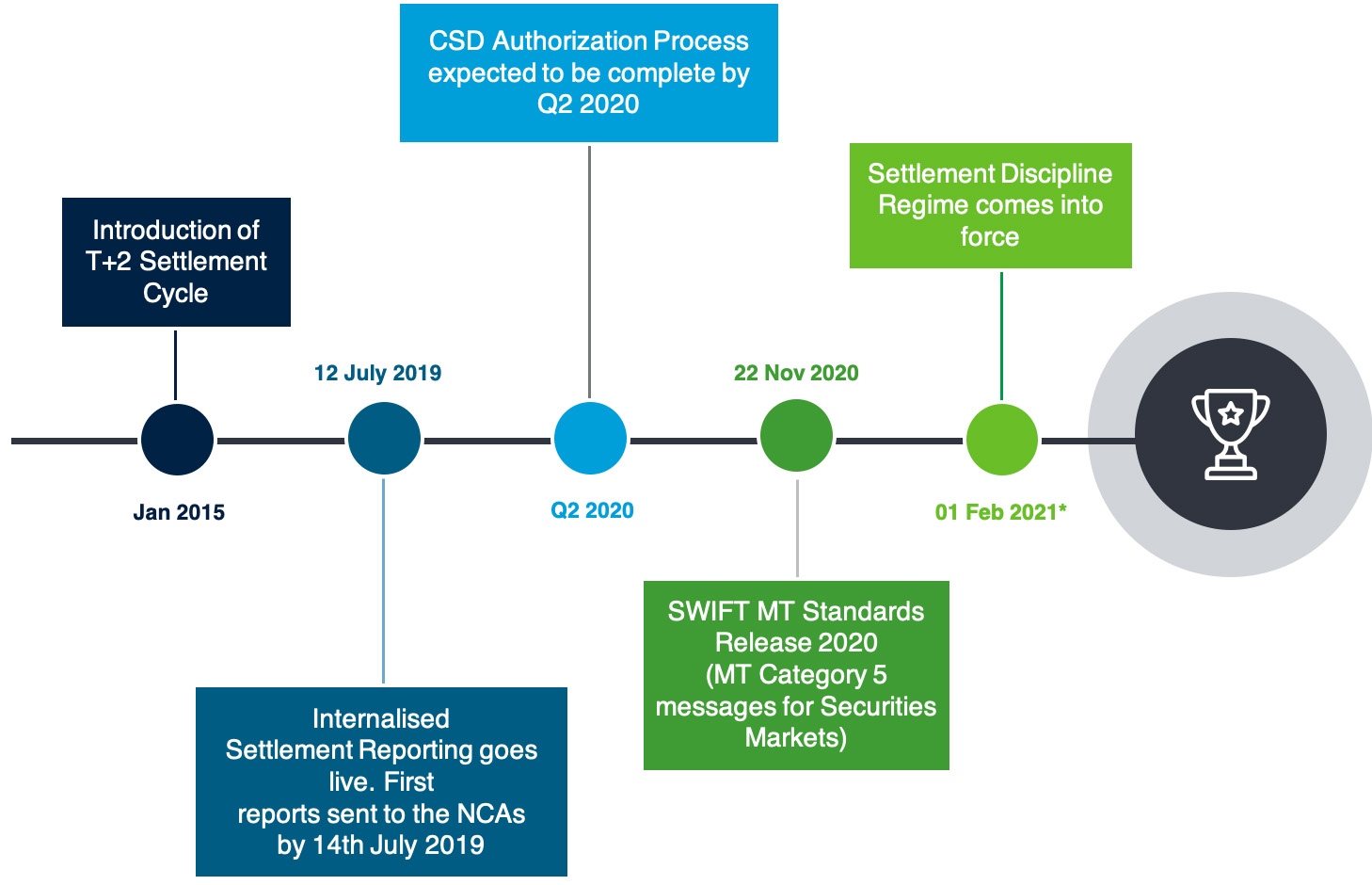

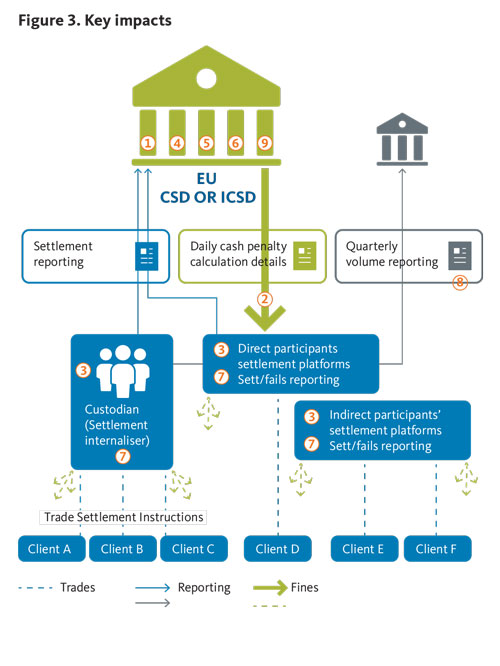

Image Source : www.sc.com csdr central regulation securities depositories timeline implementation regulatory discipline regime settlement

7 Things You Need To Know About CSDR | DTCC

csdr dtcc connection need know things

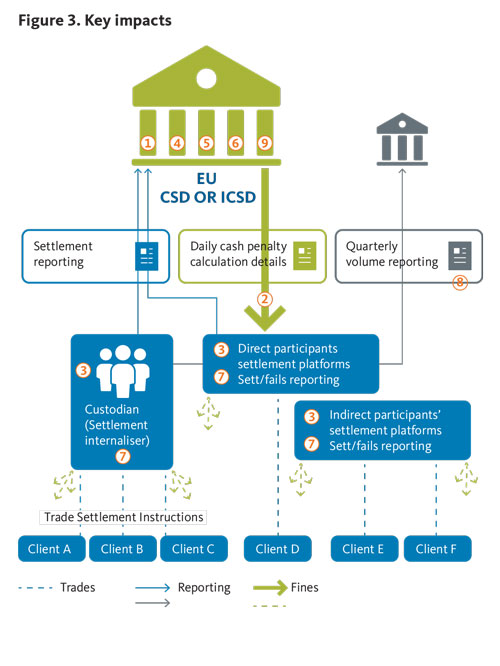

Central Securities Depository Regulation (CSDR) | Broadridge

Image Source : www.broadridge.com

Image Source : www.broadridge.com securities csdr regulation depository broadridge implications participants market

Central Securities Depositories Regulation (CSDR) Automation Solution

Image Source : www.youtube.com

Image Source : www.youtube.com csdr regulation

Was Ist CSDR? Central Securities Depositories Regulation - CVA Services

Image Source : www.cva-services.eu

Image Source : www.cva-services.eu Central Securities Depositories Regulation (CSDR) Overview

Image Source : www.pershing.com

Image Source : www.pershing.com csdr regulation securities central depositories pershing

7 things you need to know about csdr. Securities csdr regulation depository broadridge implications participants market. Csdr regulation securities central depositories pershing. Csdr regulation. Csdr settlement discipline