Eu Merger Regulation : What it is

The EU Merger Regulation

The EU Merger Regulation is a key piece of legislation governing mergers and acquisitions within the European Union. It plays a critical role in ensuring fair competition and protecting consumers' interests. In this article, we will explore what the EU Merger Regulation entails and its significance in the business world.

What is the EU Merger Regulation?

The EU Merger Regulation, officially known as Regulation (EC) No 139/2004, is a law enacted by the European Union to control mergers and acquisitions that have a significant impact on economies across member states. The regulation applies to transactions that exceed certain turnover thresholds and aims to prevent the creation of dominant market positions that could stifle competition.

The regulation provides a harmonized framework for reviewing mergers in the EU, ensuring that they do not harm competition and ultimately benefit consumers. It grants the European Commission the power to assess deals and, when necessary, impose conditions or prohibit transactions that would significantly impede effective competition in the market.

Significance in the Business World

The EU Merger Regulation has several key implications for businesses operating within the European Union:

1. Promoting Fair Competition

The regulation's primary objective is to maintain fair competition by preventing mergers that would lead to the creation of dominant market players. By preserving a competitive business environment, the EU Merger Regulation fosters innovation, allows for fair pricing, and ensures that consumers have a wide choice of products and services.

2. Ensuring Consumer Protection

One of the main concerns addressed by the EU Merger Regulation is protecting the interests of consumers. The regulation aims to prevent situations where a dominant market position could allow a company to exploit its power by charging excessive prices or providing subpar products or services.

By carefully reviewing mergers and acquisitions, the European Commission can identify potential anti-competitive effects and take appropriate action to safeguard consumer welfare.

3. Facilitating Cross-Border Mergers

The EU Merger Regulation eliminates the need for companies to navigate different national merger control regimes within the EU, streamlining the process for cross-border mergers. This uniform approach reduces administrative burdens, promotes legal certainty, and encourages companies to pursue cross-border consolidation, leading to a more integrated European market.

FAQ

Q: Which mergers fall under the scope of the EU Merger Regulation?

A: The EU Merger Regulation applies to mergers and acquisitions where the combined worldwide turnover of the merging companies exceeds €5 billion, and the EU-wide turnover of each of the participating firms exceeds €250 million, unless each of the undertakings achieves more than two-thirds of its EU-wide turnover within one and the same member state.

Q: What is the role of the European Commission in the merger review process?

A: The European Commission acts as the central authority responsible for reviewing mergers and acquisitions within the EU. It is tasked with ensuring that proposed transactions comply with the EU Merger Regulation and do not significantly hinder competition in the market. The Commission has the power to assess, approve, impose conditions, or even prohibit mergers.

Q: How long does the merger review process usually take?

A: The initial review period is typically set at 25 working days. However, if the European Commission has concerns about the potential impact on competition, it may initiate an in-depth investigation that extends the review period to 90 working days. In complex cases, this timeframe can be further extended.

In conclusion, the EU Merger Regulation is a crucial legal framework that promotes fair competition, protects consumers, and facilitates cross-border mergers within the European Union. By ensuring that mergers do not harm competition, this regulation contributes to the growth and stability of the European market, benefiting businesses and consumers alike.

Sources:

GCR EMEA Antitrust Review 2023 – HSF’s EU Merger Control Update Now

Image Source : hsfnotes.com

Image Source : hsfnotes.com The European Commission Will Decide On The Proposed Acquisition Of

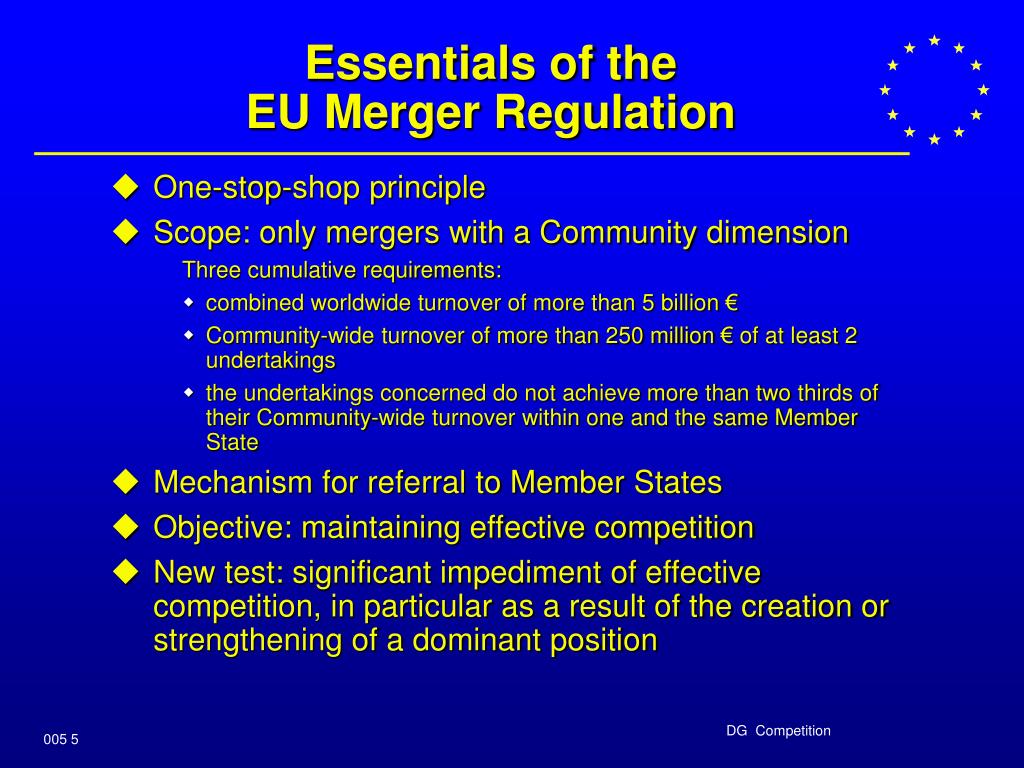

PPT - EU Merger Control In The Media Sector PowerPoint Presentation

Image Source : www.slideserve.com

Image Source : www.slideserve.com eu merger sector regulation control mergers ppt powerpoint presentation

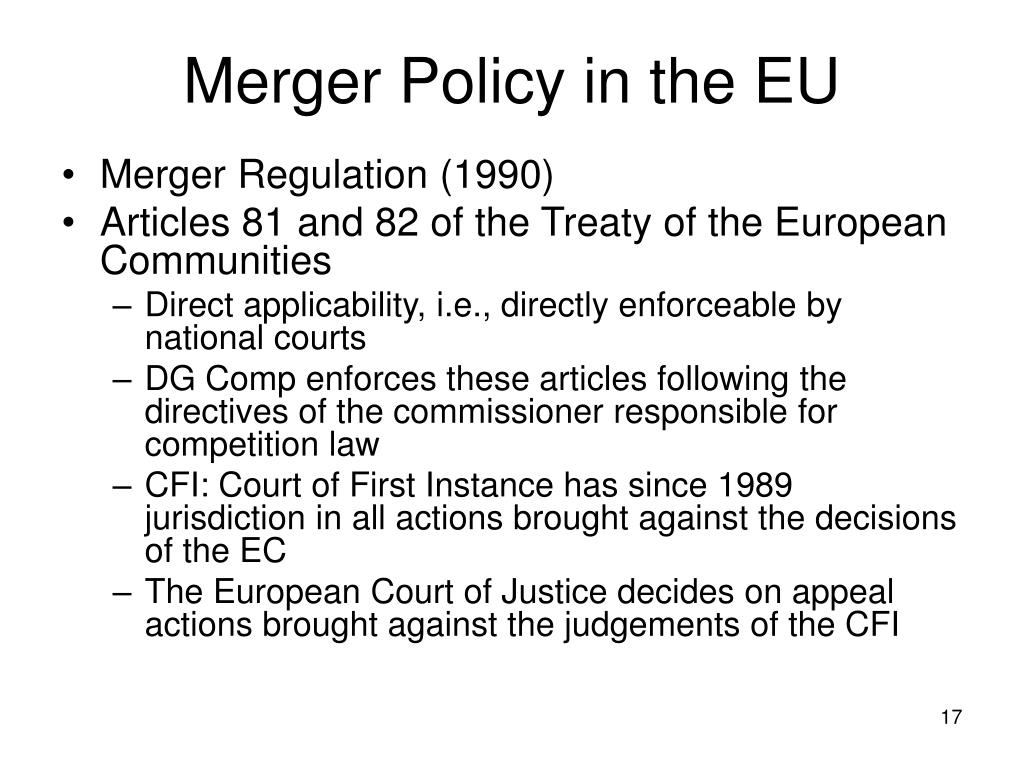

PPT - Competition Policy PowerPoint Presentation, Free Download - ID:442753

Image Source : www.slideserve.com

Image Source : www.slideserve.com policy merger competition eu ppt powerpoint presentation regulation

The EU Merger Regulation

Image Source : studylib.net

Image Source : studylib.net The EU Merger Regulation

Image Source : studylib.net

Image Source : studylib.net CJEU - Certain Joint Ventures Out Of The Scope Of EC Merger Regulation

Image Source : geciclaw.com

Image Source : geciclaw.com regulation merger cjeu justice court scope joint ventures certain ec

EU Ordinary Legislative Procedure Diagram | Quizlet

Image Source : quizlet.com

Image Source : quizlet.com The eu merger regulation. The eu merger regulation. The european commission will decide on the proposed acquisition of. Gcr emea antitrust review 2023 – hsf’s eu merger control update now. Policy merger competition eu ppt powerpoint presentation regulation