Risk Regulation Model : What it is

The Risk Regulation Model: Enhancing Finance, Risk & Regulation Expertise

As individuals and businesses navigate the complex world of finance, risk management and regulation, it is crucial to stay informed and equipped with the necessary knowledge and expertise. In this article, we will explore the Risk Regulation Model, its significance, and how it can contribute to better financial risk management.

Understanding the Risk Regulation Model

The Risk Regulation Model is a comprehensive approach that encompasses various aspects of finance, risk, and regulation. It provides a framework to analyze, assess, and manage risks associated with financial activities and ensures compliance with regulatory requirements.

Benefits of Implementing the Risk Regulation Model

By adopting the Risk Regulation Model, organizations can enjoy numerous benefits:

- Improved risk identification and assessment: The model helps in identifying potential risks and provides a systematic approach to assess their impact and probability.

- Effective risk mitigation strategies: With a clear understanding of risks, organizations can develop robust risk management strategies to minimize their impact and prevent financial losses.

- Enhanced compliance: The Risk Regulation Model ensures that organizations comply with relevant regulations, preventing any potential legal or reputational risks.

- Accurate financial reporting: By leveraging the model, organizations can enhance the accuracy and reliability of their financial reports, providing stakeholders with a clear picture of the company's financial health.

Implementing the Risk Regulation Model: Key Steps

For successful implementation of the Risk Regulation Model, organizations need to follow these steps:

- Evaluate existing risk management practices: Assess the current risk management processes and identify gaps in terms of risk identification, assessment, and mitigation.

- Design a risk management framework: Develop a comprehensive risk management framework that aligns with the organization's objectives, regulatory requirements, and industry best practices.

- Integrate risk management systems: Implement robust risk management systems and technologies to streamline risk identification, assessment, and reporting processes.

- Train employees and promote a risk-aware culture: Conduct training programs to educate employees about the Risk Regulation Model and foster a culture that prioritizes risk identification and management.

- Monitor and review: Regularly monitor the effectiveness of the implemented risk management framework and make necessary adjustments to address emerging risks.

FAQs About the Risk Regulation Model

1. What is the role of technology in implementing the Risk Regulation Model?

Technology plays a vital role in supporting the implementation of the Risk Regulation Model. Advanced risk management systems, predictive analytics, and automated monitoring tools can aid in identifying potential risks, monitoring their impact, and ensuring timely risk mitigation measures.

2. How does the Risk Regulation Model help in preventing financial crimes?

The Risk Regulation Model enables organizations to establish robust compliance measures to prevent financial crimes. By implementing effective risk management practices and staying abreast of regulatory requirements, organizations can detect and mitigate potential financial crimes, such as money laundering and fraud.

3. Can small businesses benefit from implementing the Risk Regulation Model?

Absolutely! The Risk Regulation Model is not limited to large corporations. Small businesses can also benefit from implementing the model by enhancing their risk management capabilities, ensuring compliance, and safeguarding their financial interests. It provides a structured approach for small businesses to identify and address potential risks proactively.

Conclusion:

The Risk Regulation Model offers a holistic approach to finance, risk, and regulation, empowering organizations to navigate the intricate landscape of financial activities with confidence. By adopting this model, businesses can effectively manage risks, align with regulatory requirements, and safeguard their financial stability. Embracing the Risk Regulation Model helps organizations stay ahead in a rapidly evolving financial landscape.

Overview Of The Market Risk Regulation | Download Table

Image Source : www.researchgate.net

Image Source : www.researchgate.net Risk Regulation ‒ IRGC ‐ EPFL

Image Source : www.epfl.ch

Image Source : www.epfl.ch epfl irgc

Taming Covid-19 By Regulation: The European Journal Of Risk Regulation

Image Source : www.osservatorioair.it

Image Source : www.osservatorioair.it regulation risk european journal cambridge

Finance, Risk & Regulation

Image Source : www.monoclesolutions.com

Image Source : www.monoclesolutions.com How To Manage Risk, Regulation And Compliance Differently —and Better

Image Source : laptrinhx.com

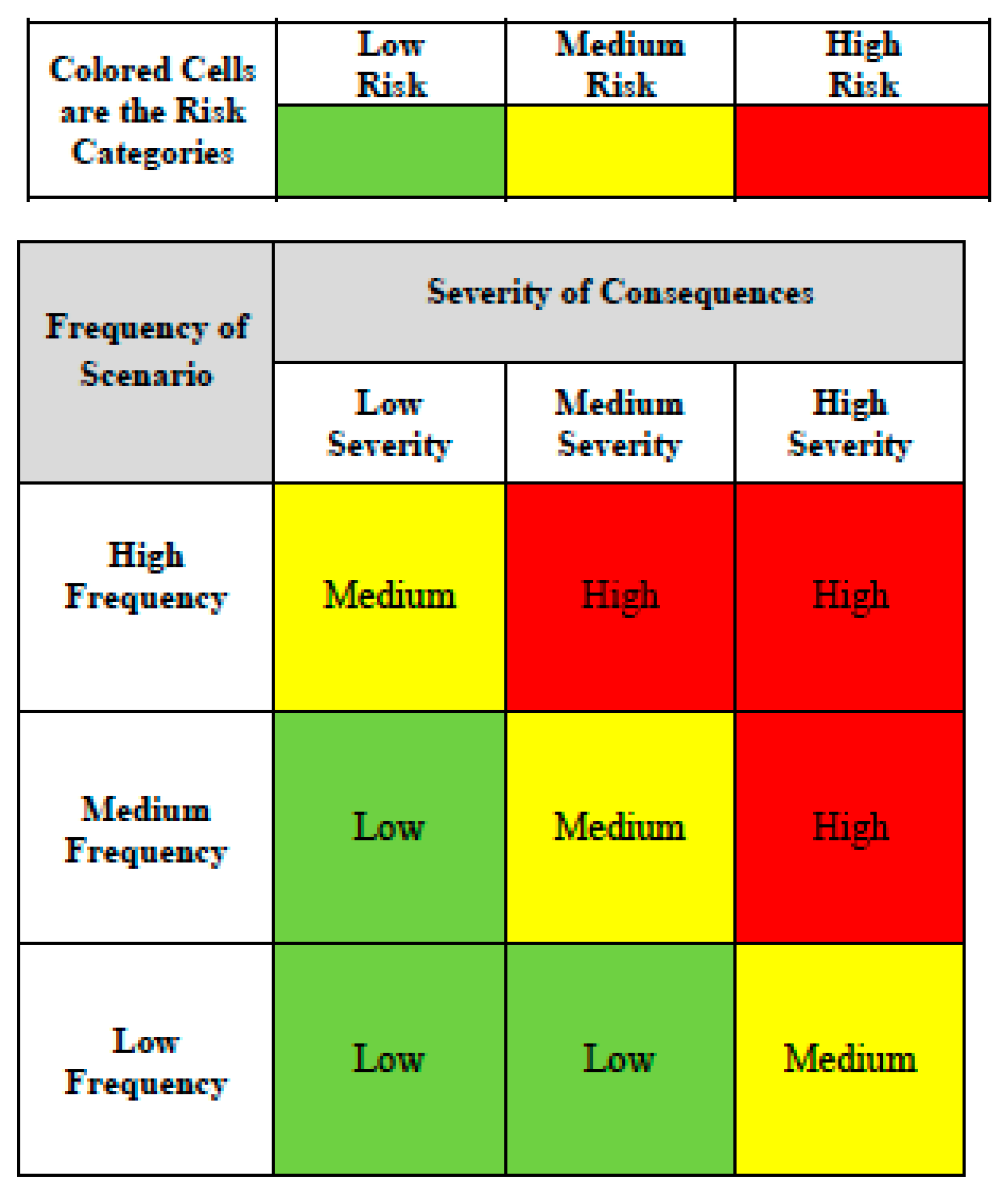

Image Source : laptrinhx.com Risk Scoring Matrix | Mobil Pribadi

Image Source : mobilpribadi.com

Image Source : mobilpribadi.com Risk, Regulation & Financial Crime | Definia

Image Source : www.definia.com

Image Source : www.definia.com The New Risks In Risk Regulation | World Finance

Image Source : www.worldfinance.com

Image Source : www.worldfinance.com regulation risk risks premium subscribe continue reading plans sign

Taming covid-19 by regulation: the european journal of risk regulation. Risk, regulation & financial crime. Regulation risk european journal cambridge. Finance, risk & regulation. The new risks in risk regulation