Eu Sustainable Finance Disclosure Regulation

A Guide to the EU Sustainable Finance Disclosure Regulation With the increasing concerns surrounding climate change and sustainability, the European Union has introduced the Sustainable Finance Disclosure Regulation (SFDR). This regulation aims to promote transparency and provide investors with the necessary information to make sustainable investment decisions. In this post, we will delve into the details of the SFDR and its implications for the financial industry. 1. Understanding the EU Sustainable Finance Disclosure Regulation The SFDR is a set of rules that require financial market participants and financial advisors to disclose information regarding the environmental, social, and governance (ESG) impacts of their investments. It aims to tackle greenwashing by ensuring that investors have access to reliable and accurate sustainability-related information. 2. Key Components of the SFDR The SFDR comprises several key components that financial market participants and advisors must adhere to. These include: a. Transparency Requirements: This includes disclosing the adverse sustainability impacts of investment decisions and considering principal adverse impacts on sustainability factors. b. Sustainability Risks: Financial market participants must identify and assess the potential adverse impacts of sustainability risks on their investments. c. Product Governance: This involves integrating sustainability risks into their investment decision-making processes and disclosing how those risks are taken into account. d. Sustainability Disclosures: Financial advisors must provide pre-contractual sustainability-related information to investors, including a description of their sustainability policies and how ESG factors are integrated into decision-making processes. 3. Implications for the Financial Industry The SFDR has significant implications for the financial industry, both in the EU and globally. Here are some of the key impacts: a. Increased Transparency: The regulation promotes greater transparency by requiring financial market participants to disclose sustainability information. This will enable investors to make informed decisions and promote sustainability-conscious investments. b. Standardization: The SFDR aims to create a common framework for disclosing sustainability-related information. This will facilitate the comparison of investment products and promote consistency in reporting. c. Shift towards Sustainable Investing: The regulation is expected to accelerate the shift towards sustainable investing. It will encourage financial institutions to align their investments with environmental and social objectives, driving more capital towards sustainable projects and solutions. 4. How Will SFDR Benefit Investors? The SFDR benefits investors in several ways: a. Improved Information: Investors will have access to more accurate and reliable sustainability-related information. This will enable them to assess the ESG risks and opportunities associated with their investments. b. Risk Mitigation: By considering sustainability risks, investors can mitigate potential financial losses associated with environmental and social factors. c. Alignment with Values: The SFDR empowers investors to align their investments with their personal values and contribute to a more sustainable future. 5. FAQ Section: Q1: Who is affected by the SFDR? A: The SFDR applies to financial market participants, including asset managers, investment firms, and insurance companies, as well as financial advisors providing advice on investment products. Q2: What are the penalties for non-compliance with SFDR? A: Non-compliance with the SFDR may result in penalties, including fines and reputational damage. Additionally, non-compliant financial products may lose access to certain investors or markets. Q3: Does the SFDR only apply to EU-based financial institutions? A: No, the SFDR applies to financial institutions that market their products or provide services within the EU, regardless of their location. In conclusion, the EU Sustainable Finance Disclosure Regulation (SFDR) is a significant step towards promoting sustainable investing and combating greenwashing. By requiring financial market participants and advisors to disclose sustainability-related information, the SFDR aims to provide investors with the necessary tools to make informed decisions. This regulation will not only increase transparency but also drive the transition towards a more sustainable financial industry. With the SFDR in place, investors can play a crucial role in shaping a more sustainable future through their investment choices.  Image Source : reportadviser.info

Image Source : reportadviser.info  Image Source : www.eurosif.org

Image Source : www.eurosif.org  Image Source : sphera.com

Image Source : sphera.com  Image Source : www.inreg.eu

Image Source : www.inreg.eu  Image Source : www.anthesisgroup.com

Image Source : www.anthesisgroup.com  Image Source : a-teaminsight.com

Image Source : a-teaminsight.com  Image Source : www.velaw.com

Image Source : www.velaw.com  Image Source : infra.global

Image Source : infra.global

Sustainable Finance Disclosure Regulation (SFDR): What To Expect

Image Source : reportadviser.info

Image Source : reportadviser.info sustainable disclosure regulation

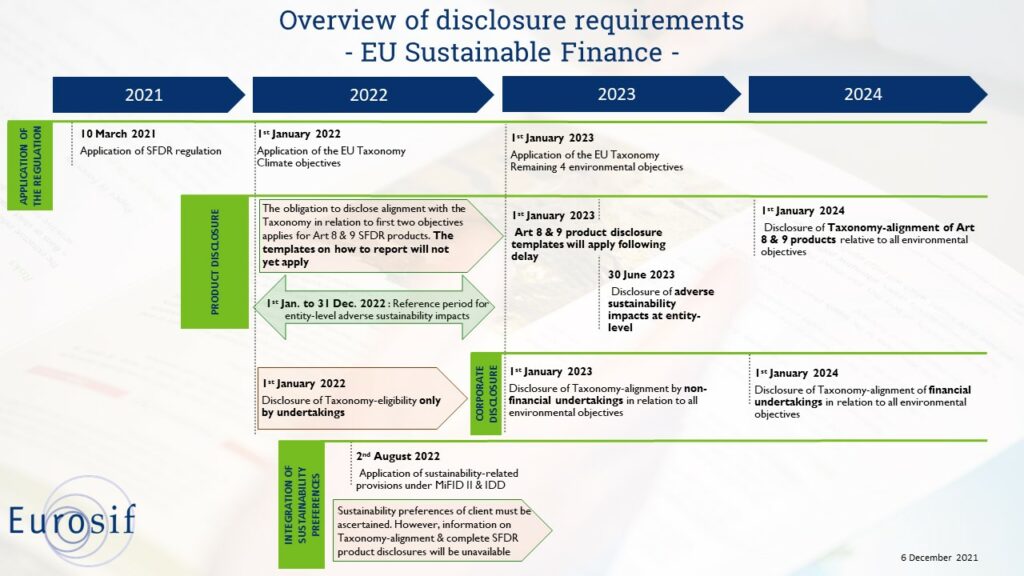

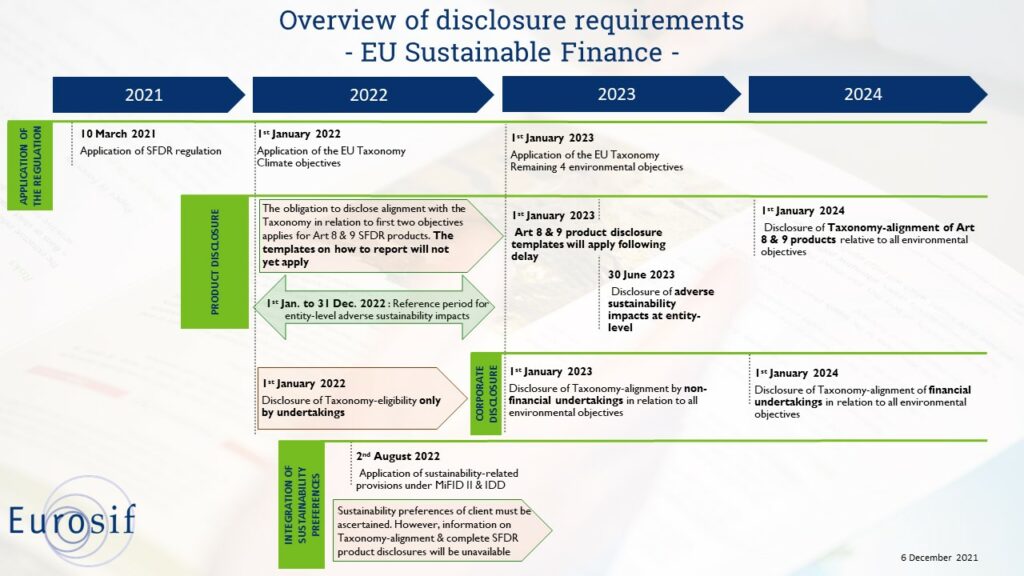

Infographic On Sustainable Finance Disclosure Requirements - EUROSIF

Image Source : www.eurosif.org

Image Source : www.eurosif.org Understanding The EU Sustainable Finance Disclosure Regulation | Sphera

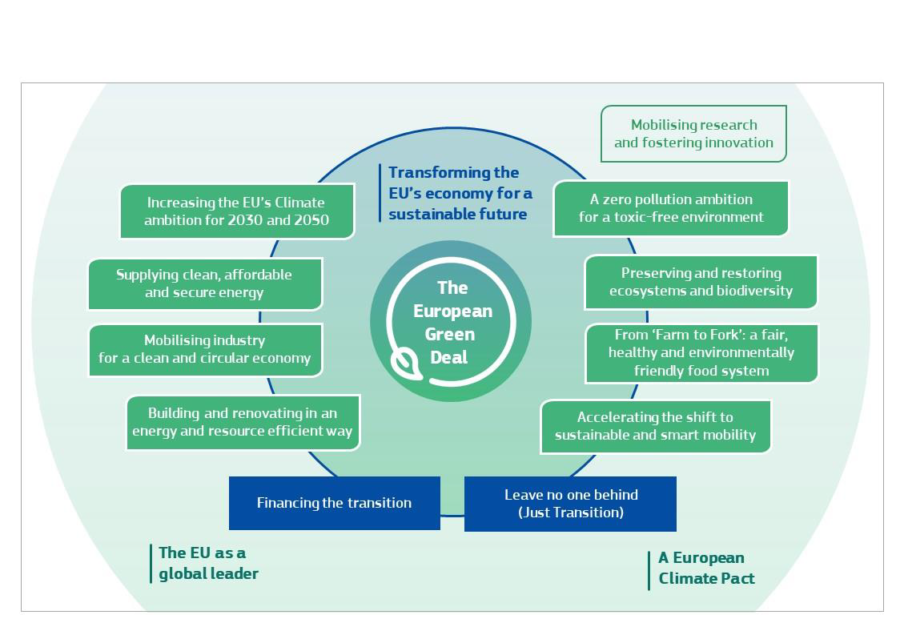

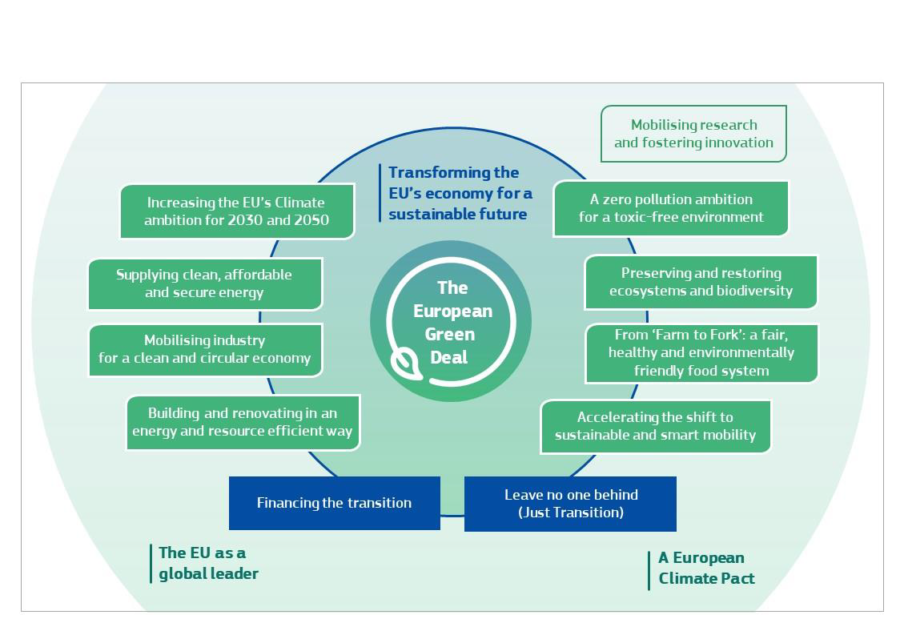

EU Green Deal – Review Of The Sustainable Finance Strategy – InReg

Image Source : www.inreg.eu

Image Source : www.inreg.eu sustainable regulatory

A Guide To The EU Sustainable Finance Disclosure Regulation - Anthesis

Image Source : www.anthesisgroup.com

Image Source : www.anthesisgroup.com eu

Meeting The Requirements Of The EU’s ESG Disclosure Regulation - A Team

Image Source : a-teaminsight.com

Image Source : a-teaminsight.com EU Sustainable Finance Disclosure Regulation: Another Step Towards An

Image Source : www.velaw.com

Image Source : www.velaw.com disclosure regulation sustainable driven esg

EU Sustainable Finance Disclosures Come Into Effect - Infrastructure Global

Image Source : infra.global

Image Source : infra.global disclosures into aim incentivise

Infographic on sustainable finance disclosure requirements. Eu green deal – review of the sustainable finance strategy – inreg. Sustainable disclosure regulation. Disclosure regulation sustainable driven esg. Meeting the requirements of the eu’s esg disclosure regulation