Canadian Securities Regulation

Canadian Securities Regulation: A Comprehensive Guide for Investors Introduction: If you have ever wondered about the rules and regulations governing securities in Canada, you have come to the right place! In this comprehensive guide, we will delve into the intricacies of Canadian securities regulation, helping you navigate this complex landscape with ease. Whether you are a seasoned investor or just starting your financial journey, understanding the Canadian securities market is crucial for making informed investment decisions. So, let's dive in! 1. What are Securities? Understanding the Basics: Before we explore the details of Canadian securities regulation, let's first understand what securities are. Securities refer to financial instruments that hold monetary value and represent an ownership stake in a company or a debt obligation. Examples of securities include stocks, bonds, options, and mutual funds. These instruments are traded in various markets, and their value fluctuates based on various factors such as market demand, economic conditions, and company performance. 2. Why is Securities Regulation Important? Securities regulation plays a vital role in safeguarding investors and maintaining the integrity of the financial markets. The regulatory framework ensures fair practices, transparency, and accountability within the industry. It aims to protect investors from fraudulent activities, manipulation, and insider trading, thus fostering investor confidence and facilitating a stable economic environment. 3. The Evolution of Canadian Securities Regulation: Canada has a unique regulatory structure, with both federal and provincial authorities having jurisdiction over securities regulation. Historically, each province had its own regulatory body, resulting in a fragmented approach. However, in recent years, there have been ongoing discussions to establish a pan-Canadian national securities regulator, aiming to streamline the regulatory process and create a more harmonized framework across the country. 4. Key Regulatory Authorities in Canada: a) Canadian Securities Administrators (CSA): The CSA is an umbrella organization comprising representatives from all provincial and territorial securities regulators in Canada. Its mandate is to develop and implement consistent securities regulation across jurisdictions, harmonizing the regulatory environment for investors and market participants. b) Ontario Securities Commission (OSC): As Canada's largest securities regulator, the OSC plays a pivotal role in enforcing securities law and protecting investors in Ontario. It administers and enforces the Securities Act and the Commodity Futures Act, overseeing the activities of market participants and ensuring compliance with regulatory requirements. 5. Important Securities Regulations in Canada: a) National Instrument 31-103 (Registration Requirements, Exemptions, and Ongoing Registrant Obligations): This regulatory instrument sets out the requirements for registration and ongoing obligations for dealers, advisers, and investment fund managers in Canada. It aims to ensure that market participants meet the necessary standards of professionalism, competence, and financial stability to protect investors' interests. b) National Instrument 45-106 (Prospectus Exemptions): This instrument provides exemptions from the requirement to file a prospectus, allowing issuers to raise capital through private placements or other alternative methods. It seeks to balance investor protection with the need to facilitate capital formation for businesses. 6. How Does Securities Regulation Impact Investors? Securities regulation impacts investors in several ways. Firstly, it provides investors with access to accurate and timely information about investment opportunities. Regulatory filings, such as prospectuses and continuous disclosure documents, allow investors to make informed decisions based on the financial health and performance of companies. Secondly, securities regulation aims to protect investors from fraudulent schemes and Ponzi schemes. By implementing stringent due diligence requirements and conducting audits, regulators work to identify and prevent fraudulent activities, safeguarding investors' funds. Lastly, securities regulations also address market manipulation and insider trading, ensuring fair and transparent trading practices that maintain market integrity. Restrictions on insider trading prevent individuals with privileged information from taking advantage of retail investors, promoting a level playing field for all market participants. FAQs (Frequently Asked Questions): Q1. How can I stay updated with the latest securities regulations in Canada? A1. The best way to stay informed about the latest regulations is by regularly visiting the websites of regulatory authorities such as the CSA and the OSC. These organizations publish regulatory updates, guidelines, and investor advisories to keep investors and market participants informed. Q2. Are there any risks associated with investing in securities? A2. Yes, investing in securities carries inherent risks. The value of securities can fluctuate, and investors may incur losses if their investments do not perform as expected. It is essential to conduct thorough research, seek professional advice, and diversify your investment portfolio to manage these risks effectively. Q3. How can I file a complaint against a fraudulent investment scheme? A3. If you suspect fraudulent activity or have fallen victim to an investment scam, you should report it to your provincial securities regulator or to the Royal Canadian Mounted Police (RCMP). They have dedicated resources to investigate such cases and take appropriate actions against the perpetrators. Conclusion: Navigating the world of Canadian securities regulation can be challenging, but armed with the right knowledge, you can make sound investment decisions and protect your hard-earned money. In this guide, we have explored the basics of securities regulation, the key regulatory authorities, and important regulations governing the Canadian securities market. Remember, investing is a journey that requires continuous learning and adaptation. By keeping yourself informed about the latest regulations, conducting thorough research, and seeking professional guidance when needed, you can confidently navigate the complex world of securities and work towards achieving your financial goals. Disclaimer: This guide provides general information and should not be considered as legal or investment advice. Always consult with qualified professionals before making any investment decisions.  Image Source : store.lexisnexis.ca

Image Source : store.lexisnexis.ca  Image Source : www.researchgate.net

Image Source : www.researchgate.net  Image Source : www.hosseinilaw.com

Image Source : www.hosseinilaw.com  Image Source : www.thecourt.ca

Image Source : www.thecourt.ca  Image Source : news.bitcoin.com

Image Source : news.bitcoin.com  Image Source : www.youtube.com

Image Source : www.youtube.com  Image Source : bluelinks.ca

Image Source : bluelinks.ca  Image Source : www.broadridge.com

Image Source : www.broadridge.com

Canadian Securities Regulation, 5th Edition | Boutique LexisNexis Canada

Image Source : store.lexisnexis.ca

Image Source : store.lexisnexis.ca securities regulation lexisnexis

(PDF) Canadian Securities Regulation: Issues And Challenges

Image Source : www.researchgate.net

Image Source : www.researchgate.net securities regulation challenges canadian issues

Canadian Securities Regulation | Hosseini Law Firm

canadian regulation securities law books canada

Pan-Canadian National Securities Regulation | TheCourt.ca

regulation securities pan canadian ca unified approach reference re

Canadian Securities Commission Keen To Support Cryptocurrencies And

Image Source : news.bitcoin.com

Image Source : news.bitcoin.com CSC Ch 1 - 1 Overview Of Canadian Securities Industry - YouTube

Image Source : www.youtube.com

Image Source : www.youtube.com securities industry canadian

Terence Corcoran: Canadian Securities Regulation —national And

Image Source : bluelinks.ca

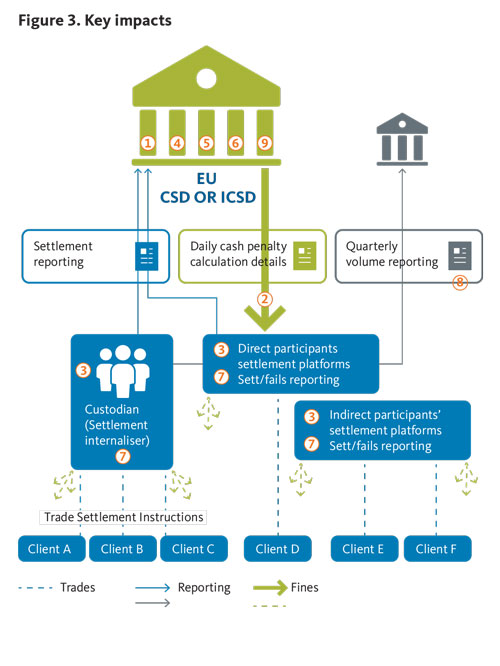

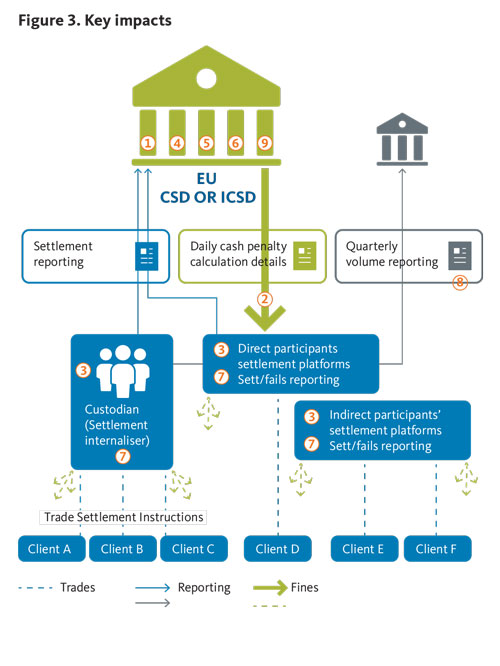

Image Source : bluelinks.ca Central Securities Depository Regulation (CSDR) | Broadridge

Image Source : www.broadridge.com

Image Source : www.broadridge.com securities csdr regulation depository broadridge implications participants market

Csc ch 1. Regulation securities pan canadian ca unified approach reference re. Securities regulation lexisnexis. Pan-canadian national securities regulation. Central securities depository regulation (csdr)