Regulation Sci : What it is

Regulation SCI (Systems Compliance and Integrity) is a set of rules established by the U.S. Securities and Exchange Commission (SEC) to ensure the integrity and reliability of key market systems. These regulations aim to minimize technical glitches, errors, and other system failures that may have a significant impact on the securities markets.

The Significance of Regulation SCI

Regulation SCI was introduced in response to several high-profile system failures in the financial industry. These incidents highlighted the need for robust regulatory oversight to prevent disruptions, protect investor confidence, and maintain fairness within the markets.

With the increasing reliance on technology, markets have become highly automated and interconnected. This automation brings numerous benefits in terms of efficiency and speed, but it also creates vulnerabilities. Any system failure can have far-reaching consequences, leading to investor losses and erosion of market integrity.

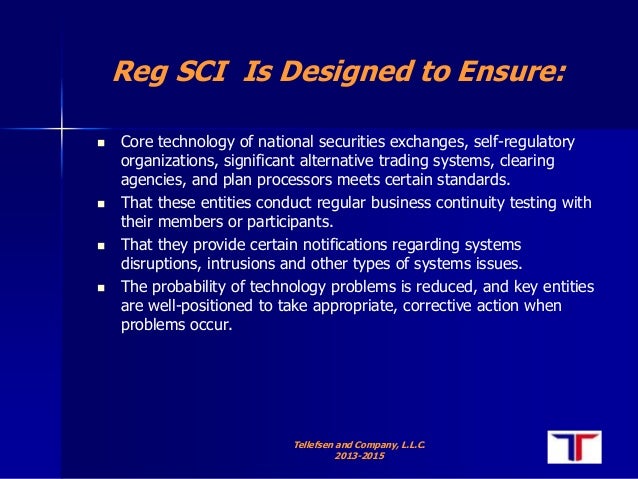

Regulation SCI sets requirements for the implementation and maintenance of comprehensive technology systems by key market participants. It aims to ensure that these participants have adequate controls and procedures in place to effectively manage their systems, prevent disruptions, and quickly respond to any incidents that may occur.

Key Provisions of Regulation SCI

Regulation SCI covers a wide range of market participants, including securities exchanges, alternative trading systems, clearing agencies, and certain trading venues. It focuses on the following key areas:

- Designation of SCI Entities: Regulation SCI requires certain entities to be designated as SCI entities. These entities are subject to enhanced oversight and must comply with specific requirements to maintain the integrity of their systems.

- Written Policies and Procedures: SCI entities are required to establish, document, and maintain written policies and procedures to ensure the proper functioning of their systems.

- Testing and Controls: SCI entities must conduct periodic testing of their systems to identify vulnerabilities, assess capacity, and evaluate the effectiveness of their controls.

- Coordination with Participants: SCI entities are required to coordinate with their participants, including service providers and users, to address potential vulnerabilities and adhere to certain standards.

- Resilience and Recovery: Regulation SCI emphasizes the importance of system resilience and recovery capabilities by requiring SCI entities to implement measures to minimize the impact of disruptions and quickly recover from incidents.

Benefits of Regulation SCI

Regulation SCI provides several benefits to market participants and investors:

- Enhanced Market Integrity: By implementing robust technology systems and adhering to the regulations, market participants contribute to maintaining the overall integrity and fairness of the markets.

- Reduced System Failures: Regulation SCI's requirements improve system reliability, minimize technical glitches, and reduce the chances of system failures that could disrupt trading activity.

- Protection for Investors: Investor confidence is crucial for the functioning of financial markets. Regulation SCI helps protect investors by minimizing the risks associated with system failures and ensuring prompt incident response.

- Standardization: The regulations provide a standardized framework for managing technology systems, allowing market participants to align their operations with industry best practices.

Frequently Asked Questions (FAQ)

Here are some common questions about Regulation SCI:

1. Which entities are subject to Regulation SCI?

Regulation SCI applies to securities exchanges, alternative trading systems, clearing agencies, and certain trading venues.

2. What are the consequences of non-compliance with Regulation SCI?

Non-compliance with Regulation SCI can result in penalties, fines, sanctions, and reputational damage for the entities involved. The SEC closely monitors compliance and takes enforcement actions as necessary.

3. How does Regulation SCI contribute to market stability?

By requiring market participants to implement robust technology systems, conduct regular testing, and establish recovery capabilities, Regulation SCI helps ensure the stability and resilience of the securities markets. This, in turn, promotes fair and orderly trading.

Conclusion

Regulation SCI plays a critical role in maintaining the integrity and reliability of key market systems. By implementing the requirements outlined in the regulations, market participants contribute to the stability and fairness of the securities markets. The standardization provided by Regulation SCI helps minimize system failures, protect investors, and enhance overall market integrity. As technology continues to evolve, ongoing compliance with Regulation SCI remains essential to prevent disruptions and maintain investor confidence.

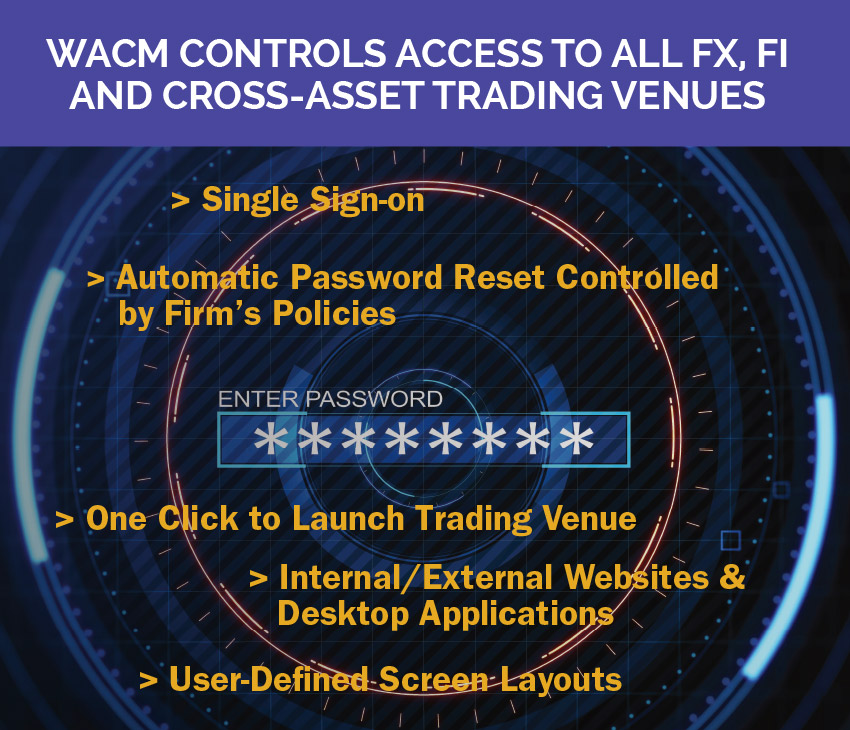

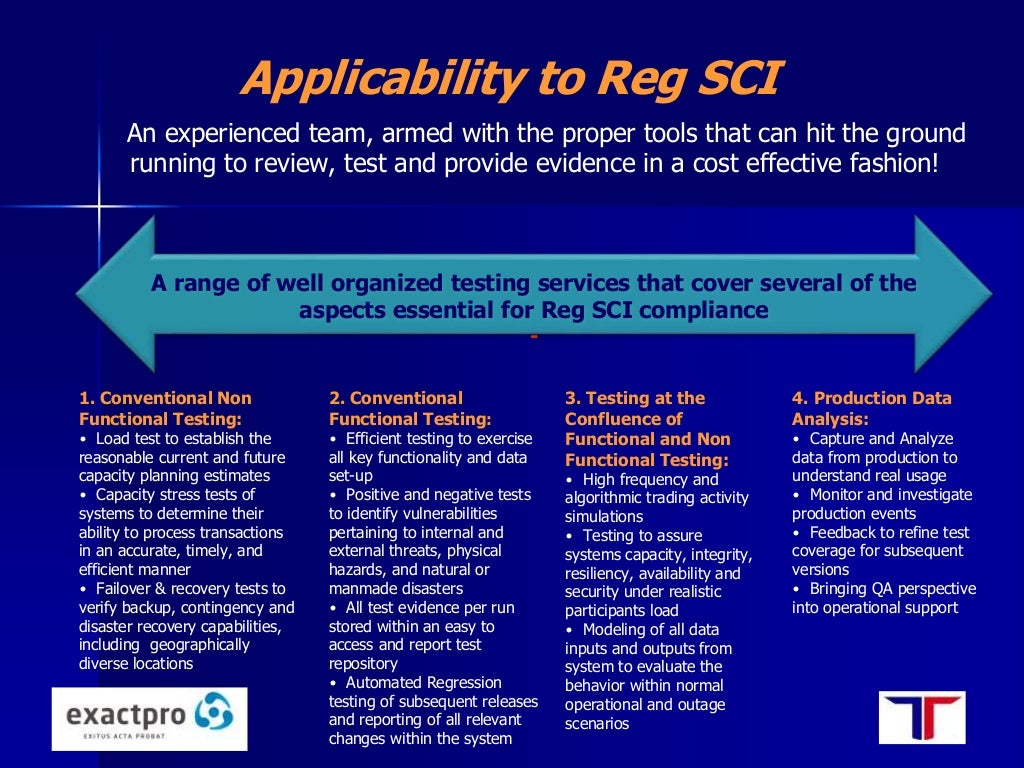

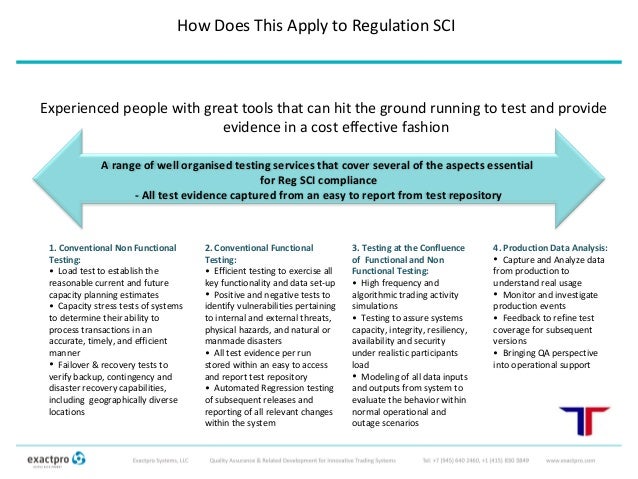

SEC Regulation SCI: Automation Review Compliance

Image Source : www.slideshare.net

Image Source : www.slideshare.net regulation compliance sec automation

CASE STUDYHelping A Global Bank Mitigate And Adhere To SEC Regulation

Image Source : www.westhighland.net

Image Source : www.westhighland.net SEC Regulation SCI: Automation Review Compliance

Image Source : www.slideshare.net

Image Source : www.slideshare.net regulation sec compliance automation

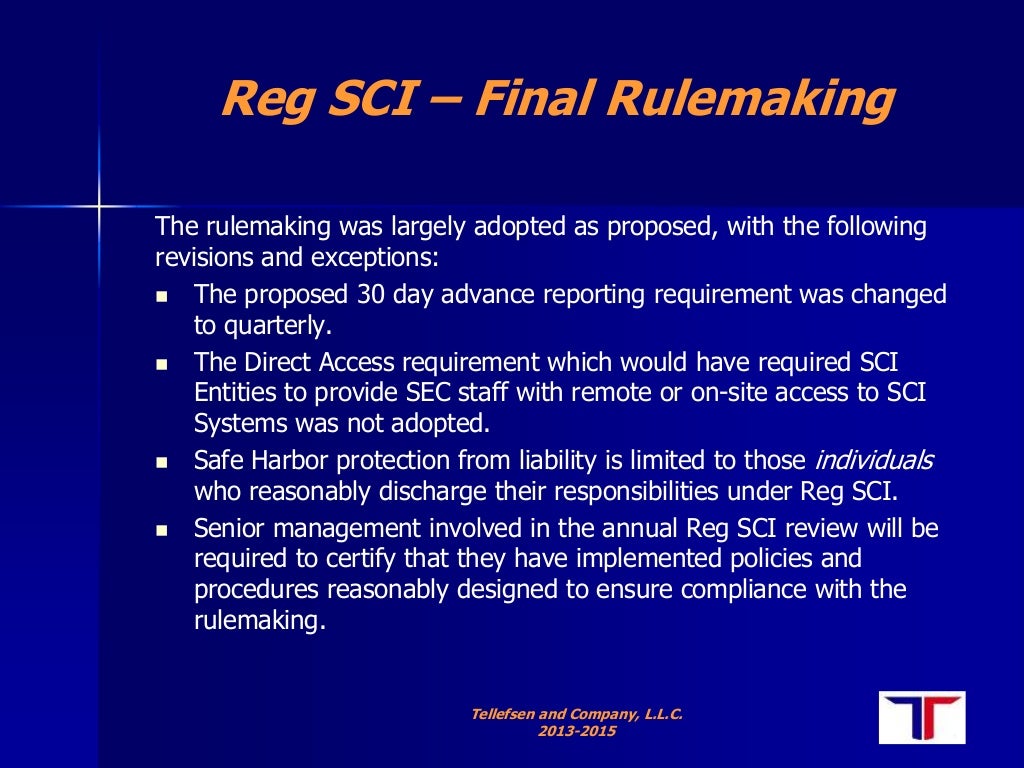

SEC Regulation SCI And ARP Compliance

Image Source : studylib.net

Image Source : studylib.net SEC.gov | Spotlight On Regulation SCI

Image Source : www.sec.gov

Image Source : www.sec.gov SEC Regulation SCI: Automation Review Compliance

Image Source : www.slideshare.net

Image Source : www.slideshare.net regulation compliance

SEC's Regulation SCI: A Visual Timeline

Image Source : searchcompliance.techtarget.com

Image Source : searchcompliance.techtarget.com regulation sci sec timeline visual infographic

SEC Regulation SCI Automation Review Compliance

Image Source : www.slideshare.net

Image Source : www.slideshare.net regulation compliance

Sec's regulation sci: a visual timeline. Regulation compliance. Regulation sec compliance automation. Sec regulation sci: automation review compliance. Regulation compliance sec automation