Article 11 Of Regulation S-X

Article 11 Of Regulation S-X: Enhancing Transparency and Accountability in Financial Reporting

Introduction:

The Securities and Exchange Commission (SEC) recently adopted amendments to Rules 3-10 and 3-16 of Regulation S-X, aiming to enhance transparency and provide investors with more meaningful financial information. These amendments are designed to facilitate better understanding of financial statements and promote consistency in reporting across different entities. In this article, we will explore the key changes introduced by Article 11, analyze their impact, and address frequently asked questions regarding Regulation S-X.

Key Amendments under Article 11 of Regulation S-X:

1. Enhanced Disclosure Requirements:

The amendments to Regulation S-X require enhanced disclosure in financial statements to provide investors with a clearer understanding of the financial health of entities. This includes the presentation of financial information with greater detail and accuracy, helping investors make informed decisions.

2. Strengthened Reporting Standards for Business Development Companies (BDCs):

The amendments also focus on improving reporting standards specifically applicable to BDCs. BDCs play a crucial role in providing financing to smaller and developing companies. With the enhanced reporting requirements, investors can gain a deeper understanding of the risks and opportunities associated with investing in BDCs.

3. Alignment with International Financial Reporting Standards:

Article 11 brings greater harmonization between U.S. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). This alignment allows for improved transparency and comparability, enabling investors to make better cross-border investment decisions.

FAQs:

Q1: What is Regulation S-X?

Regulation S-X prescribes the content and format requirements for financial statements, notes, and other financial disclosures submitted to the SEC. It ensures that companies provide accurate and complete financial information to investors, promoting confidence in the capital markets.

Q2: What are the main objectives of Article 11?

The main objectives of Article 11 are to enhance transparency, improve consistency in reporting, and provide investors with meaningful financial information. These objectives are achieved through enhanced disclosure requirements, strengthened reporting standards for BDCs, and alignment with international reporting standards.

Q3: How will the amendments benefit investors?

The amendments aim to benefit investors by providing them with clearer, more accurate, and detailed financial information. This enables investors to make well-informed investment decisions, understand the risks associated with their investments, and better assess the financial health of the entities they invest in.

Q4: How will the amendments impact the reporting obligations of BDCs?

The amendments strengthen the reporting obligations of BDCs, requiring them to disclose additional information about their financial position, investments, and risks. This enhanced reporting promotes investor confidence by providing them with greater insights into the operations and financials of BDCs.

Q5: What is the significance of aligning with International Financial Reporting Standards (IFRS)?

Aligning with IFRS improves the comparability and transparency of financial reporting across different jurisdictions. This allows investors to compare the financial performance of entities operating in different markets, facilitating cross-border investment decisions and expanding investment opportunities.

Conclusion

With the adoption of Article 11, the SEC has taken a significant step towards enhancing transparency and accountability in financial reporting. The amendments introduced in Regulation S-X provide investors with more meaningful financial information, improve reporting standards for BDCs, and align U.S. reporting standards with international best practices. By implementing these changes, regulators aim to foster investor confidence and promote informed decision-making in the capital markets.

Disclaimer: This article provides an overview of the amendments made in Article 11 of Regulation S-X. It does not constitute legal or financial advice.

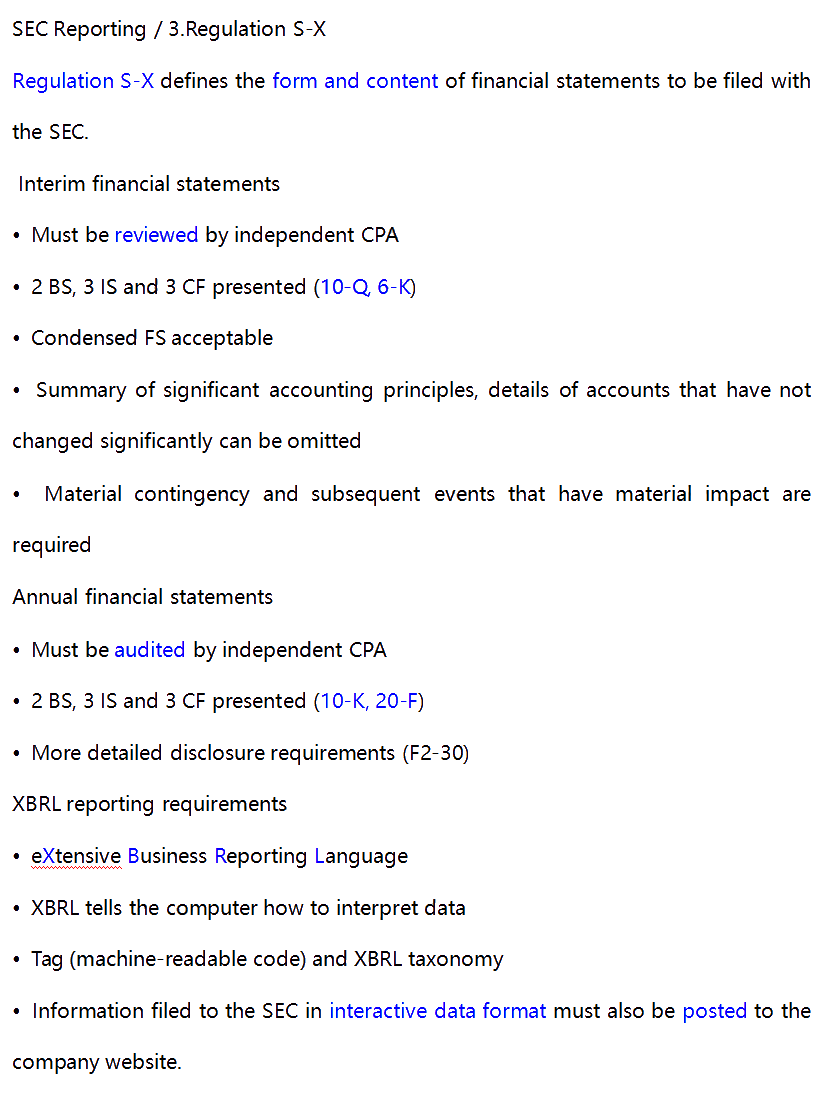

AICPA知识点:Regulation S-X_美国注册会计师-正保会计网校

Image Source : www.chinaacc.com

Image Source : www.chinaacc.com Teaching Kids Self-Regulation | WY Quality Counts In 2021 | Social

Image Source : www.pinterest.com

Image Source : www.pinterest.com emotional counseling informed counts psych mindfulness

Pro Forma Financial Information A Guide For Applying Amended Article 11

Image Source : docslib.org

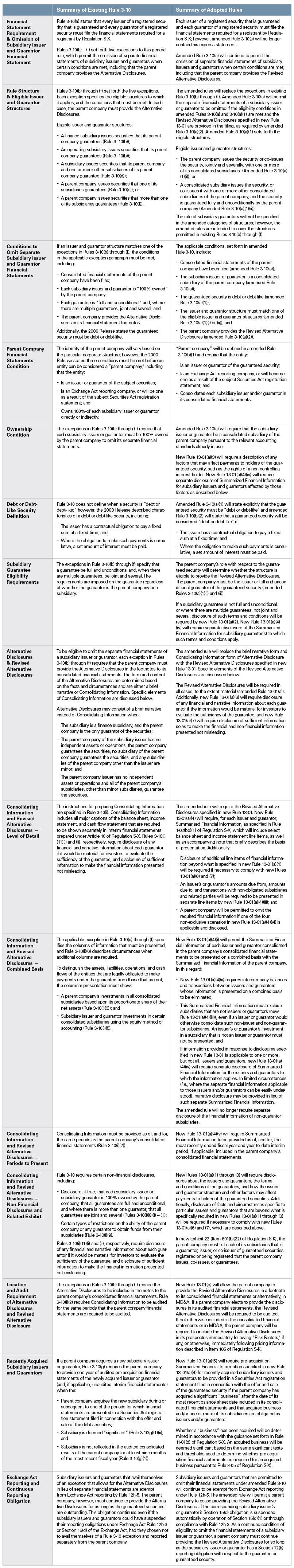

Image Source : docslib.org SEC Adopts Amendments To Regulation S-X Applicable To BDCs | Eversheds

Image Source : www.jdsupra.com

Image Source : www.jdsupra.com sec regulation adopts amendments jdsupra applicable bdcs schedules

SEC Adopts Amendments To Rules 3-10 And 3-16 Of Regulation S-X In

Image Source : www.skadden.com

Image Source : www.skadden.com amendments adopts regulation skadden offerings debt certain

Regulation S X SEC Reporting CPA Exam FAR - YouTube

Image Source : www.youtube.com

Image Source : www.youtube.com Adiato Balde Cosmetics Academy

Image Source : abcosmeticsacademy.com

Image Source : abcosmeticsacademy.com SEC Regulation S-X - YouTube

Image Source : www.youtube.com

Image Source : www.youtube.com regulation

Sec regulation adopts amendments jdsupra applicable bdcs schedules. Teaching kids self-regulation. Sec regulation s-x. Pro forma financial information a guide for applying amended article 11. Sec adopts amendments to rules 3-10 and 3-16 of regulation s-x in