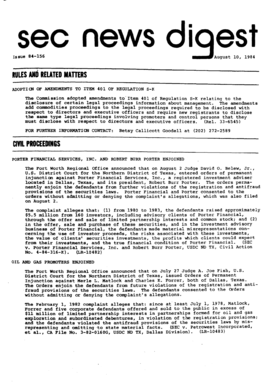

Item 401 Of Regulation S-K

Item 401 of Regulation S-K: A Comprehensive Guide

Regulation S-K, a set of rules prescribed by the U.S. Securities and Exchange Commission (SEC), governs the content and format of disclosure statements and reports filed by publicly traded companies in the United States. Item 401 of Regulation S-K focuses on the disclosure of the backgrounds and qualifications of directors, executive officers, and other key personnel of these companies. In this article, we will delve into the details of Item 401, its importance, and what it means for investors.

The Basics: Understanding Item 401

Item 401 of Regulation S-K requires companies to provide information about their directors, executive officers, and other key personnel in a clear and concise manner. This disclosure enables investors to make informed decisions based on the qualifications and experience of these individuals.

Companies must disclose the following information for each director and executive officer:

- Name and business address

- Position(s) held with the company

- Principal occupation(s) for at least the past five years

- The number of shares beneficially owned

Why is Item 401 Important?

The disclosure required by Item 401 serves several important purposes:

- Transparency: By providing information about key personnel, companies promote transparency and build trust with investors. Investors can assess the qualifications and experience of directors and executive officers, gaining confidence in the decision-making abilities of the leadership team.

- Accountability: Companies are accountable to their shareholders. Item 401 ensures that the background and qualifications of key personnel are readily accessible, allowing shareholders to evaluate the appropriateness of their roles and contributions to the company.

- Evaluation: Investors can use the information provided under Item 401 to evaluate the stability and continuity of the executive team. A strong leadership team with relevant expertise can enhance a company's prospects for success.

Subheading 1: Tips for Effective Disclosure

When disclosing information under Item 401, companies should consider the following tips to create effective and engaging content:

- Clarity: Ensure that the disclosure is clear, concise, and free from unnecessary jargon. Use language that is easy to understand for both seasoned investors and those who may be new to the financial world.

- Relevance: Highlight the qualifications and experience that are most relevant to the company's operations and strategic goals. Focus on how the individual's background aligns with the needs of the organization.

- Accuracy: Verify the accuracy of the information provided. Any discrepancies or inaccuracies can lead to loss of credibility and erode trust among investors.

- Timeliness: Keep the disclosure up to date, reflecting any changes in key personnel or their qualifications. Investors rely on accurate and current information to make informed decisions.

- Consistency: Maintain a consistent format for the disclosure across all key personnel. This facilitates easy comparison and evaluation by investors.

Subheading 2: Common Questions about Item 401

Here are some frequently asked questions about Item 401:

-

What types of companies need to comply with Item 401?

Item 401 applies to all publicly traded companies in the United States, regardless of their size or industry. It ensures transparency and accountability in the disclosure of key personnel information.

-

Are there any exemptions from disclosing under Item 401?

Yes, certain small reporting companies and non-accelerated filers are exempted from the detailed disclosure requirements of Item 401. However, they still need to provide basic information about their directors and executive officers.

-

How often should companies update their disclosure under Item 401?

Companies must update their disclosure under Item 401 whenever there are material changes in the background or qualifications of the individuals listed. It is important to keep the information current to avoid misleading investors.

Subheading 3: Best Practices for Investor Confidence

Companies aiming to build investor confidence through Item 401 disclosures should consider implementing the following best practices:

- Educational materials: Provide educational materials or guides to help investors understand the relevance of the disclosed information and how it can impact their investment decisions.

- Online accessibility: Make the disclosed information easily accessible on the company's website, ensuring it is organized and searchable. This allows investors to retrieve the information conveniently whenever needed.

- Collaboration with IR team: Collaborate with the Investor Relations (IR) team to ensure consistent messaging and alignment with the company's communication strategy. This fosters transparency and enhances investor trust.

Disclosure under Item 401 of Regulation S-K plays a crucial role in promoting transparency, accountability, and informed decision-making within publicly traded companies. By providing investors with a comprehensive understanding of the backgrounds and qualifications of key personnel, companies pave the way for increased investor confidence and long-term success.

Disclaimer: The content presented in this article is for informational purposes only and does not constitute legal or financial advice.

Fillable Online Streetsboro Athletic Department - Rocket Athletics Fax

Image Source : www.pdffiller.com

Image Source : www.pdffiller.com SEC Staff Issues Report With Recommendations To Numerous Regulation S-K

Image Source : www.marcumllp.com

Image Source : www.marcumllp.com requirements disclosure regulation numerous sec recommendations issues staff report lawrence montgomery assurance manager services

What Are Related Party Disclosures? - Going Public Lawyer

Image Source : www.securitieslawyer101.com

Image Source : www.securitieslawyer101.com related party disclosures lawyer sec securities

Cybersecurity Experience Disclosure | SEC Disclosure Requirement

Image Source : ocd-tech.com

Image Source : ocd-tech.com Regulation 1839 Pattern "Baby Size" Oval US Belt Plate For

Image Source : www.lelandlittle.com

Image Source : www.lelandlittle.com Regulation S-K Item 507 - Going Public Attorneys

Image Source : www.securitieslawyer101.com

Image Source : www.securitieslawyer101.com SEC Amends Regulation S-K Item 101, 103 And 105

Image Source : www.securitieslawyer101.com

Image Source : www.securitieslawyer101.com amends

Regulation S-K 1300: Disclosure Regime - YouTube

Image Source : www.youtube.com

Image Source : www.youtube.com Regulation 1839 pattern "baby size" oval us belt plate for. Regulation s-k 1300: disclosure regime. Sec amends regulation s-k item 101, 103 and 105. Fillable online streetsboro athletic department. Sec staff issues report with recommendations to numerous regulation s-k